CMS Digital Transformation and the Health Tech Opportunity: Analyzing Dr. Oz's Vision and the 13th Scope of Work Business Implications

Disclaimer: The views and analysis presented in this essay are my own and do not reflect the positions, opinions, or policies of my employer or any organization with which I am affiliated.

Table of Contents

Abstract

The Digital Transformation Imperative at CMS

Administrator Oz's Vision for Healthcare Modernization

The Make America Healthy Again Movement and Quality Initiatives

CMS's 13th Scope of Work and Quality Improvement Organizations

Artificial Intelligence and Agentic Healthcare Systems

Interoperability and the Provider Directory Challenge

Fraud Prevention Through Technology Innovation

Business Model Opportunities for Health Tech Entrepreneurs

Investment Landscape and Market Dynamics

Implementation Challenges and Risk Mitigation

Conclusion: The Path Forward for Healthcare Innovation

Abstract

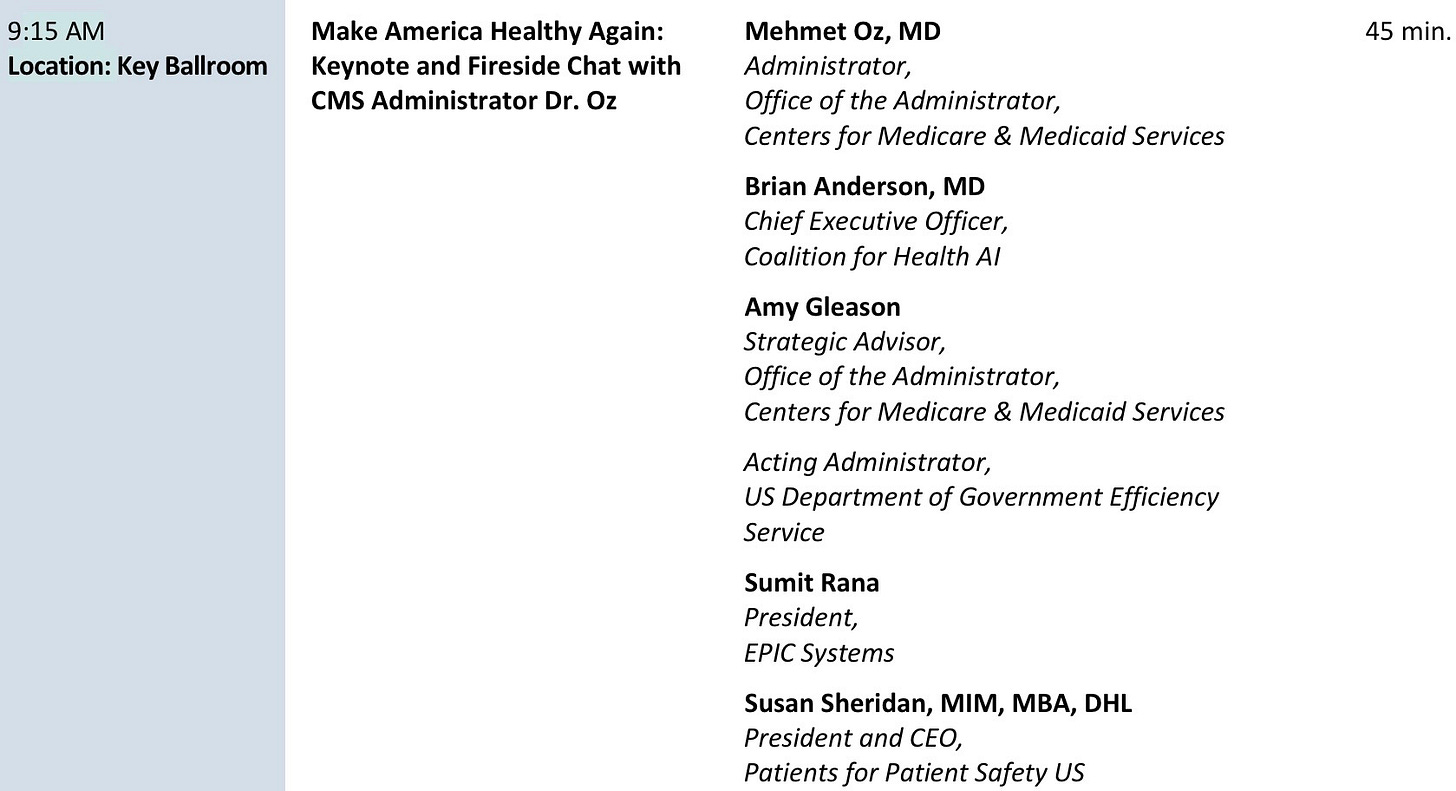

CMS Administrator Dr. Mehmet Oz outlined a comprehensive digital transformation agenda at the 2025 CMS Quality Conference, emphasizing patient empowerment, provider efficiency, and fraud prevention through technology

The Make America Healthy Again (MAHA) initiative represents a paradigm shift toward prevention-focused healthcare delivery models

CMS's 13th Scope of Work creates structured pathways for quality improvement organizations to collaborate with healthcare providers nationwide to improve outcomes for Medicare beneficiaries

Key technology priorities include agentic AI systems, comprehensive provider directories, and bidirectional patient communication platforms

Significant business opportunities exist for health tech entrepreneurs in areas including ambient AI documentation, interoperability solutions, fraud detection systems, and patient engagement platforms

The $1.7 trillion CMS budget and 161 million covered lives create unprecedented market opportunities for scalable health technology solutions

Digital identity infrastructure and API-first approaches will enable new ecosystem business models

Regulatory clarity around AI implementation and value-based care models provides favorable conditions for health tech innovation

The Digital Transformation Imperative at CMS

The Centers for Medicare and Medicaid Services stands at a critical inflection point in American healthcare history. With responsibility for 161 million covered lives representing one in two Americans, CMS wields unprecedented influence over healthcare delivery models and technology adoption patterns throughout the industry. The agency's annual budget of $1.7 trillion positions it as the single largest healthcare payer globally, creating ripple effects that extend far beyond government programs into commercial healthcare markets.

Administrator Dr. Mehmet Oz's keynote address at the 2025 CMS Quality Conference revealed a fundamental reimagining of how the federal government approaches healthcare technology integration. Rather than building monolithic government systems, the new CMS strategy centers on creating foundational infrastructure that enables private sector innovation while maintaining regulatory oversight and quality standards. This approach represents a departure from traditional government technology procurement models and signals significant opportunities for health technology entrepreneurs willing to navigate the complexities of federal healthcare markets.

The urgency driving this transformation stems from stark performance metrics that Administrator Oz presented to the conference audience. Medical errors currently represent the third leading cause of death in the United States, while American life expectancy has fallen five years behind European countries since the 1990s. Perhaps most concerning for CMS's financial sustainability, Medicare fee-for-service expenditures grew nine percent in the previous year, with Medicaid spending doubling over the past five years. These trends have compressed the Medicare Trust Fund's projected solvency timeline from ten years to seven years, with worst-case scenarios predicting bankruptcy by 2029.

The technological infrastructure challenges at CMS reflect broader systemic issues within American healthcare delivery. The agency employs only thirteen engineers to manage technology systems serving 161 million beneficiaries, highlighting the resource constraints that have historically limited innovation within government healthcare programs. This staffing limitation has created dependency relationships with external contractors and vendors, often resulting in inflexible legacy systems that struggle to adapt to evolving healthcare delivery models.

Administrator Oz's Vision for Healthcare Modernization

Dr. Oz's background as a cardiothoracic surgeon and television personality brings a unique perspective to healthcare administration that combines clinical expertise with mass communication experience. His keynote presentation outlined five strategic objectives organized around the concept of making CMS the "best payer in the country and the world." These objectives encompass human capital development, beneficiary empowerment, provider support, fraud prevention, and quality improvement through technology integration.

The administrator's emphasis on objectives and key results (OKRs) methodology borrowed from technology companies represents a significant cultural shift within federal healthcare administration. This approach prioritizes measurable outcomes over process compliance, creating clearer pathways for health technology companies to demonstrate value propositions that align with CMS priorities. The adoption of private sector management methodologies also suggests greater receptivity to innovative partnership structures and risk-sharing arrangements.

Central to Dr. Oz's vision is the development of a minimum viable product for patient communication within twelve months. This timeline reflects both the urgency of addressing current system deficiencies and the recognition that incremental improvements can generate significant benefits for both beneficiaries and providers. The commitment to smartphone-based communication acknowledges that 91% of Medicaid beneficiaries and an even higher percentage of Medicare beneficiaries own smartphones, creating universal access potential for digital health interventions.

The administrator's candid discussion of current system failures provides important context for understanding CMS's openness to disruptive innovation. His acknowledgment that prior authorization represents the "single biggest complaint" received by CMS, combined with the revelation that 49% of physicians still respond to prior authorization requests using paper-based processes, illustrates the massive efficiency gaps that technology solutions could address. These inefficiencies create direct business opportunities for companies capable of streamlining administrative workflows while maintaining clinical quality standards.

The Make America Healthy Again Movement and Quality Initiatives

Secretary Robert F. Kennedy Jr.'s video message to the conference audience articulated the philosophical foundation underlying CMS's transformation initiatives. The Make America Healthy Again movement represents a fundamental shift from treatment-focused healthcare delivery toward prevention-oriented population health management. This transition has profound implications for health technology companies, as it expands the total addressable market beyond traditional clinical care into areas including nutrition counseling, physical activity monitoring, environmental health tracking, and behavioral health interventions.

The movement's emphasis on childhood health metrics provides particularly compelling business development opportunities. Kennedy's observation that 70% of American children cannot qualify for military service due to health problems highlights the scope of preventable conditions that technology-enabled interventions could address. The contrast he drew between current chronic disease management costs (representing 70% of total healthcare expenditures) and the zero dollars spent on chronic disease when President John F. Kennedy was in office illustrates the magnitude of market opportunity for prevention-focused solutions.

The integration of MAHA principles into CMS quality initiatives creates regulatory pathways for innovative approaches to population health management. The agency's 27 quality reporting and value-based payment programs provide multiple entry points for technology companies developing solutions that demonstrate measurable improvements in health outcomes. These programs span the continuum from birth to end-of-life care across all healthcare settings, creating opportunities for comprehensive platform approaches rather than point solutions.

The emphasis on addressing social determinants of health within the MAHA framework opens new categories of reimbursable services that technology companies can target. Amy Gleason's observation during the panel discussion that the two strongest predictors of healthcare costs and quality outcomes are social isolation and health literacy creates specific opportunities for digital therapeutic companies, remote monitoring platforms, and patient education systems.

CMS's 13th Scope of Work and Quality Improvement Organizations

The launch of CMS's 13th Scope of Work for Quality Improvement Organizations (QIOs) represents a structured approach to implementing technology-enabled quality improvements across healthcare provider networks. This initiative builds upon decades of quality improvement experience while incorporating modern data analytics capabilities and digital health tools. The scope of work runs from January 2025 through May 2030, providing predictable funding cycles and outcome metrics that enable health technology companies to develop sustainable business models around quality improvement services.

Quality Improvement Organizations serve as intermediaries between CMS and healthcare provider communities, creating partnership opportunities for technology companies that might otherwise struggle to navigate complex federal procurement processes. QIOs are groups of health quality experts, clinicians, and consumers organized to improve the care delivered to people with Medicare. The QIO network's established relationships with hospitals, physician practices, and long-term care facilities provide distribution channels for innovative solutions that demonstrate measurable quality improvements. This infrastructure reduces market entry barriers for emerging health technology companies while providing established validation mechanisms for their solutions.

The 13th Scope of Work's focus areas include disease prevention, quality and patient safety, chronic conditions management, behavioral health, emergency preparedness, care coordination, and workforce challenges. This emphasis creates opportunities for companies developing culturally appropriate interfaces, multilingual support systems, and low-bandwidth solutions that function effectively in underserved communities. The scope of work's attention to rural healthcare delivery challenges also creates specific market opportunities for telemedicine platforms, remote monitoring systems, and AI-enabled clinical decision support tools.

The integration of patient safety initiatives within the QIO framework provides additional business development pathways for health technology companies. The Opioid Prescriber Safety & Support (OPSS) initiative provides national outreach and education to eligible providers to promote safe opioid prescribing practices and to spread knowledge of non-opioid pain management therapies. These specialized initiatives create targeted opportunities for companies developing addiction treatment technologies, pain management platforms, and clinical decision support systems.

Artificial Intelligence and Agentic Healthcare Systems

The conference's extensive discussion of artificial intelligence applications revealed CMS's sophisticated understanding of AI's transformative potential across healthcare delivery systems. Brian Anderson from the Coalition for Health AI (CHI) articulated a vision for "agentic AI" systems that operate semi-autonomously as members of healthcare teams rather than simple diagnostic tools. This conceptual framework has significant implications for health technology companies developing AI-powered solutions, as it suggests regulatory pathways for more sophisticated automation than traditional clinical decision support systems.

Epic Systems President Sumit Rana's presentation of real-world AI implementation results provided concrete evidence of technology's impact on provider efficiency and satisfaction. The 86% reduction in documentation time at Reid Health in Indiana and the 44% decrease in provider turnover at John Muir in California demonstrate measurable outcomes that justify investment in AI-enabled healthcare technologies. These metrics provide benchmarks that health technology companies can use to validate their own solutions and communicate value propositions to potential customers.

The discussion of ambient AI documentation systems highlighted the potential for technology to address one of healthcare providers' most significant pain points. Dr. Oz's observation that "none of us went to medical school to chart" resonates with widespread provider frustration about administrative burden that reduces time available for patient care. The description of physician visits transformed from traditional computer-mediated interactions to face-to-face conversations enabled by AI-powered documentation represents a paradigm shift that could drive rapid adoption of ambient AI solutions.

Amy Gleason's personal example of using AI to analyze her daughter's medical records and identify potential clinical trial eligibility illustrates the power of patient-controlled health data combined with AI analytics. This use case demonstrates opportunities for health technology companies developing consumer-facing AI applications that enable patients to extract insights from their medical records, identify treatment options, and participate more actively in healthcare decision-making processes.

Interoperability and the Provider Directory Challenge

The conference's emphasis on provider directory development as foundational infrastructure reveals both the complexity and the business opportunity inherent in healthcare data interoperability challenges. Sumit Rana's disclosure that payers and providers collectively spend $4.8 billion annually managing provider directory information illustrates the magnitude of inefficiencies that comprehensive interoperability solutions could address. The downstream effects of inaccurate provider data on prior authorization processes and claims adjudication create additional cost burdens that technology solutions could eliminate.

CMS's commitment to developing a comprehensive provider directory with "federated inputs from different stakeholders" but maintaining "an unambiguous source of truth for each data element" describes a technical architecture that balances distributed data management with centralized quality control. This approach creates opportunities for companies developing data integration platforms, identity verification systems, and real-time data synchronization technologies. The requirement for machine-to-machine communication capabilities also suggests opportunities for API management platforms and workflow automation tools.

The provider directory initiative's integration with digital identity standards represents a significant step toward creating "TSA pre-check for healthcare" that could streamline provider credentialing, patient identification, and care coordination processes. This infrastructure development creates platform opportunities for companies capable of providing identity verification services, credentialing management systems, and secure data sharing protocols that meet federal security requirements while enabling seamless provider and patient experiences.

The discussion of TEFCA (Trusted Exchange Framework and Common Agreement) implementation revealed CMS's strategy for creating minimum connectivity standards across healthcare systems. The existing use cases for provider-to-provider interoperability and individual access services provide proven frameworks that health technology companies can build upon to develop more sophisticated data sharing capabilities.

Fraud Prevention Through Technology Innovation

The Department of Justice's announcement of the largest healthcare fraud action in American history, involving $15 billion in attempted theft primarily by foreign operatives, provides stark context for understanding CMS's emphasis on technology-enabled fraud prevention. The fact that CMS recovered approximately $3 billion of the $15 billion attempted theft illustrates both the agency's vulnerability to sophisticated fraud schemes and its capability to detect and prevent fraudulent activities when equipped with appropriate technology tools.

Dr. Oz's revelation that 50% of CMS's fraud recovery comes from whistleblower tips suggests significant opportunities for technology companies developing fraud reporting platforms, anomaly detection systems, and predictive analytics tools that can identify suspicious patterns before fraudulent claims are processed. The administrator's banking industry analogy highlighting AI's superior fraud detection capabilities compared to traditional human-based approaches provides a clear roadmap for health technology companies developing similar solutions for healthcare applications.

The specific fraud examples presented during the conference, including a cardiologist billing for services in two states simultaneously and a psychiatric clinic billing millions for skin grafts performed by anesthesiologists, illustrate the types of logical inconsistencies that rule-based systems and machine learning algorithms could readily identify. These examples suggest opportunities for companies developing real-time claims monitoring systems, provider behavior analytics platforms, and automated fraud scoring tools.

Sue Sheridan's reframing of fraud prevention as a patient safety issue creates additional business justification for technology investments in this area. Her observation that "charging Medicare for care that caused harm is fraud" and that only 5% of patient harm events are currently reported suggests massive underreporting of adverse events that technology solutions could help identify and prevent. This patient safety perspective expands the total addressable market for fraud prevention technologies beyond financial protection to include clinical quality improvement applications.

Business Model Opportunities for Health Tech Entrepreneurs

The transformation initiatives outlined at the CMS Quality Conference create multiple categories of business opportunities for health technology entrepreneurs willing to navigate the complexities of federal healthcare markets. The agency's ecosystem approach, using Dr. Oz's metaphor of building "the racetrack" while allowing private companies to serve as "the racehorses," suggests platform-based business models that leverage CMS infrastructure investments to deliver services to providers, patients, and other healthcare stakeholders.

Patient engagement platforms represent perhaps the most immediate opportunity, given CMS's commitment to deploying smartphone-based communication tools within twelve months. The agency's vision for an "app store" integrated with Medicare.gov creates marketplace opportunities for companies developing diabetes management apps, medication adherence tools, care coordination platforms, and health education resources. The requirement for bidirectional communication between CMS and beneficiaries suggests opportunities for companies developing secure messaging systems, alert management platforms, and patient feedback collection tools.

Provider efficiency solutions constitute another major opportunity category, particularly in areas addressing administrative burden reduction. The 49% of physicians who still use paper-based prior authorization processes represent a substantial market for companies developing digital prior authorization platforms, clinical workflow automation tools, and provider-payer communication systems. The insurance industry's voluntary commitment to revamp prior authorization by the end of 2025 creates a defined timeline for technology companies to develop and deploy solutions that meet industry requirements.

AI-powered clinical decision support systems represent a rapidly expanding opportunity area, particularly for companies developing ambient documentation tools, diagnostic assistance platforms, and treatment recommendation engines. The 80% adoption rate of AI tools across Epic's customer base demonstrates strong provider demand for solutions that demonstrably improve efficiency and clinical outcomes. The pipeline of over 100 AI tools mentioned by Sumit Rana suggests sustained demand for innovative AI applications across diverse clinical specialties and care settings.

Interoperability and data management solutions offer platform-level opportunities for companies capable of addressing the complex technical challenges involved in healthcare data integration. The provider directory initiative alone represents a multi-billion-dollar market opportunity, while broader interoperability requirements create demand for API management platforms, data normalization tools, and real-time synchronization systems.

Investment Landscape and Market Dynamics

The market dynamics created by CMS's transformation initiatives present both opportunities and challenges for health technology investors and entrepreneurs. The agency's $1.7 trillion annual budget and influence over healthcare industry practices create the potential for massive scale, but federal procurement processes and regulatory requirements add complexity that many technology companies struggle to navigate effectively. The key to success in this market lies in understanding the intersection between technology capabilities, clinical outcomes, and federal compliance requirements.

The shift toward value-based care models creates alignment between CMS payment incentives and technology solutions that demonstrate measurable improvements in health outcomes or cost efficiency. The growth in physicians participating in advanced payment models from 125,000 to 750,000 over the past decade illustrates the momentum behind value-based care adoption. This trend creates opportunities for companies developing population health management platforms, risk adjustment tools, and outcome measurement systems that help providers succeed in value-based contracts.

The emphasis on prevention and upstream interventions within the MAHA framework expands the total addressable market beyond traditional clinical care into areas that have historically received limited reimbursement. Technology companies developing nutrition counseling platforms, physical activity monitoring systems, mental health screening tools, and environmental health tracking capabilities may find new reimbursement pathways through CMS innovation models and quality improvement initiatives.

The accelerated adoption of AI technologies across healthcare delivery systems creates opportunities for companies at various stages of development, from early-stage startups developing novel AI applications to established companies expanding their AI capabilities. The key differentiator for success will be the ability to demonstrate clinical efficacy, provider adoption, and measurable outcomes that align with CMS quality metrics and value-based care requirements.

The fraud prevention market represents a specialized but potentially lucrative opportunity for companies developing sophisticated analytics capabilities and real-time monitoring systems. The $15 billion attempted fraud highlighted at the conference represents only the detected portion of total fraudulent activity, suggesting a much larger market opportunity for effective prevention technologies. Companies with experience in financial services fraud detection may find their capabilities highly applicable to healthcare fraud prevention applications.

Implementation Challenges and Risk Mitigation

Despite the significant opportunities created by CMS's transformation initiatives, health technology entrepreneurs must navigate substantial implementation challenges to succeed in this market. Federal procurement processes often involve lengthy sales cycles, complex compliance requirements, and extensive validation procedures that can strain the resources of emerging technology companies. The need to demonstrate clinical efficacy, data security, and regulatory compliance creates higher barriers to entry than many commercial healthcare markets.

The interoperability requirements embedded in CMS's digital transformation strategy create both opportunities and technical challenges for health technology companies. While standardized data formats and API requirements provide clearer technical specifications, the complexity of integrating with legacy healthcare systems and meeting evolving security requirements demands significant engineering resources and ongoing maintenance commitments. Companies must balance the benefits of CMS market access against the costs of maintaining compliance with federal standards.

The regulatory landscape surrounding AI applications in healthcare continues to evolve, creating uncertainty for companies developing innovative AI-powered solutions. While the conference discussions demonstrated CMS's openness to AI adoption, the requirements for "rigorous studies to ensure patients are not guinea pigs" suggest that AI companies will need to invest significantly in clinical validation and safety demonstration. This regulatory caution is appropriate for patient safety but may slow the deployment of beneficial technologies.

The competitive dynamics within healthcare technology markets create additional challenges for companies seeking to establish sustainable business models around CMS initiatives. The presence of established electronic health record vendors, major technology companies, and specialized healthcare technology firms creates intense competition for market share and technical talent. Success in this environment requires clear differentiation, strong execution capabilities, and the ability to demonstrate superior outcomes compared to alternative solutions.

The sustainability of political support for current transformation initiatives represents a potential risk factor for companies making significant investments in CMS-aligned solutions. While the bipartisan nature of healthcare quality improvement and fraud prevention provides some protection against political changes, the specific priorities and implementation approaches outlined by the current administration may evolve with future political transitions. Companies must balance the opportunities presented by current initiatives against the risk of policy changes that could affect their market positioning.

Conclusion: The Path Forward for Healthcare Innovation

The 2025 CMS Quality Conference marked a pivotal moment in the evolution of American healthcare technology adoption, with Administrator Oz's presentation outlining a comprehensive vision for digital transformation that creates unprecedented opportunities for health technology entrepreneurs. The convergence of urgent healthcare performance challenges, substantial financial resources, and political will for innovation has created conditions that favor bold approaches to healthcare delivery improvement.

The key insight from the conference is that CMS has moved beyond viewing technology as a procurement challenge to embracing it as an ecosystem enablement strategy. This philosophical shift creates opportunities for health technology companies to participate in healthcare transformation as partners rather than vendors, with the potential for sustained business relationships based on shared risk and outcome accountability. The emphasis on measurement and data-driven decision-making aligns with the capabilities that technology companies can bring to healthcare delivery challenges.

For health technology entrepreneurs, the path forward requires careful attention to the intersection between technological capability, clinical evidence, and regulatory compliance. Companies that can demonstrate measurable improvements in patient outcomes, provider efficiency, or cost effectiveness while meeting federal security and privacy requirements will find substantial opportunities within the CMS ecosystem. The agency's commitment to transparency and collaboration suggests that companies willing to engage constructively with federal stakeholders can influence policy development and implementation approaches.

The transformation initiatives outlined at the conference extend beyond CMS to influence healthcare industry practices more broadly. The agency's role as a market leader means that successful technology implementations within CMS programs often drive adoption across commercial healthcare markets, creating platform opportunities for companies capable of scaling their solutions beyond federal programs. This multiplier effect amplifies the business potential for companies that achieve success within the CMS ecosystem.

The ultimate success of these transformation initiatives will depend on the ability of technology companies, healthcare providers, and government agencies to collaborate effectively in pursuing shared goals of improved patient outcomes, enhanced provider satisfaction, and sustainable healthcare costs. The 2025 CMS Quality Conference provided a roadmap for this collaboration, with clear opportunities for health technology entrepreneurs who are prepared to invest in solutions that address the complex challenges facing American healthcare delivery systems.

The window of opportunity created by current CMS initiatives is significant but time-limited, given the accelerated implementation timelines outlined by Administrator Oz and the urgent challenges facing Medicare's financial sustainability. Health technology companies that move quickly to develop solutions aligned with CMS priorities while maintaining focus on clinical outcomes and regulatory compliance will be best positioned to benefit from this transformational moment in American healthcare policy and practice.