MimicMed AI: Building a Business on the Foundations of MIMIC-IV

Disclaimer: The thoughts and opinions expressed in this essay are my own and do not reflect the views of my employer or any affiliated organizations.

Table of Contents

Abstract

Executive Summary

Market Opportunity

Technical Overview

Business Model

I. Introduction: The Convergence of Data and Clinical Intelligence

II. Understanding MIMIC-IV: Anatomy of a Gold Standard Dataset

III. Market Analysis: The Macro Landscape of Clinical Intelligence

IV. Product Strategy: Defining Three Minimum Viable Products

V. Technical Architecture: Building for Reliability, Interoperability, and Scale

VI. Commercial Strategy: Navigating Academic Validation, Regulation, and Enterprise Adoption

VII. Financial Projections and Investor Thesis

VIII. Risks and Mitigation Strategies

IX. Conclusion: Capturing the Clinical Intelligence Opportunity

Abstract

The MIMIC-IV dataset is the largest and most comprehensive open-access critical care dataset in the world, containing over 431,000 hospital stays and 73,000 ICU admissions between 2008 and 2019, sourced from Beth Israel Deaconess Medical Center and processed by MIT’s Laboratory for Computational Physiology . It integrates structured hospital data, high-resolution ICU data, and deidentified clinical notes, complemented by external systems such as ICD-9/10, DRG, and Massachusetts vital statistics. This essay lays out a business plan for MimicMed AI, a company that builds commercial applications from MIMIC-IV, focusing on clinical decision support, population health analytics, and clinical research acceleration. It outlines the market opportunity in the $50B healthcare analytics sector, proposes detailed technical architectures leveraging FHIR APIs and MLOps, and presents go-to-market strategies emphasizing academic validation, regulatory clearance, and enterprise integration. Conservative projections suggest $50M ARR by year five with gross margins above 85%.

I. Introduction: The Convergence of Data and Clinical Intelligence

The digitization of healthcare has produced a paradox. Never before has so much patient data been collected, yet much of it remains locked in silos, optimized for billing and storage rather than for analysis and clinical insight. Electronic health records, despite their promise, are often seen as administrative burdens rather than engines of clinical innovation. Into this paradox enters MIMIC-IV, a dataset that rewrites the rules. It is not a synthetic dataset or a narrow registry, but a living archive of real-world hospital and ICU encounters spanning more than a decade. For entrepreneurs, this dataset represents more than just numbers on servers; it is raw material for building a new generation of clinical intelligence companies.

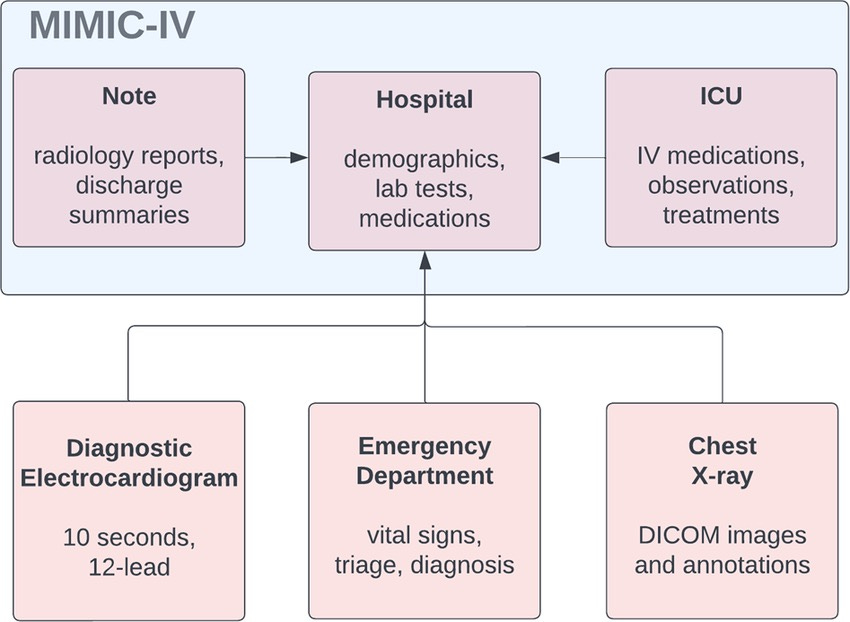

What differentiates MIMIC-IV from the average EHR dump is not just its size but its structure, completeness, and clinical richness. It is modular, divided into hospital, ICU, and notes data, each linked through unique patient identifiers and designed to support cross-domain analytics . It includes granular medication administration records via barcode-based eMAR systems, minute-level vital sign tracking in the ICU, and radiology and discharge notes that capture the reasoning processes of physicians. It even links to out-of-hospital mortality through state registries, enabling longitudinal survival analyses. In short, MIMIC-IV is not just a dataset; it is a microcosm of modern hospital operations, spanning the journey from emergency admission to discharge and beyond.

II. Understanding MIMIC-IV: Anatomy of a Gold Standard Dataset

The foundation of any successful healthcare AI venture lies in the data, and MIMIC-IV offers unmatched advantages. The dataset contains over 431,231 hospital admissions, representing 180,733 patients, with ICU data on 73,181 admissions from 50,920 patients . Demographics reveal that ICU patients have a mean age of 64.7 years, with 44.2% female representation, and one-year mortality approaching 39%—highlighting the acuity and prognostic richness of the data. Each ICU admission is annotated with medications, labs, microbiology, procedures, and free-text notes.

From a technical standpoint, the relational design supports complex joins across modules. The hosp module provides data on billing codes, medications, labs, and transfers; the icu module captures high-resolution data streams; and the note module records discharge summaries and radiology reports. The inclusion of external ontologies such as ICD and DRG codes makes it commercially viable, as these coding systems underpin reimbursement and healthcare operations. Importantly, the data is rigorously deidentified under HIPAA Safe Harbor rules, with dates shifted and PHI scrubbed from notes . This allows startups to prototype and validate algorithms on realistic datasets without patient privacy risks, while preparing for production deployment with live health system data.

III. Market Analysis: The Macro Landscape of Clinical Intelligence

The healthcare analytics market, valued at $50.5 billion and growing nearly 20% annually, represents the broader opportunity space . Within it, three segments align particularly well with MIMIC-IV. First, the clinical decision support (CDS) segment, worth $12 billion, is hungry for predictive models that can anticipate deterioration, optimize therapy, and reduce preventable deaths. Second, the population health and value-based care segment, worth $8.2 billion, demands predictive tools that stratify risk and reduce costly readmissions. Third, the clinical research optimization market, valued at $2.1 billion, provides an immediate opportunity to sell evidence-generation services to pharmaceutical and life sciences companies.

Competitively, most current CDS products are narrow—sepsis alerts, drug-drug interaction checkers, or readmission calculators. They lack the longitudinal, multimodal data that MIMIC-IV uniquely enables. The competitive moat for a startup lies not only in better accuracy but in breadth: building models that generalize across disease areas and capture systemic patient trajectories. Furthermore, regulatory tailwinds—FDA’s Software as a Medical Device (SaMD) framework and CMS’s push toward value-based care—create fertile conditions for commercialization.

IV. Product Strategy: Defining Three Minimum Viable Products

The first MVP is an ICU early warning system, trained on the rich time-series data of MIMIC-IV’s icu module. This product predicts sepsis onset, cardiac arrest, or respiratory failure hours before current systems, using multimodal inputs including labs, vital signs, and clinical notes. The target buyers are ICU directors and CMOs of large health systems, with pricing aligned per-bed per-month SaaS licenses.

The second MVP is a population health risk engine, leveraging MIMIC-IV’s longitudinal hospital module and one-year mortality data. This product scores patients for readmission risk and chronic disease complications, helping ACOs and payers succeed in value-based contracts. Pricing aligns to per-member-per-month models, with ROI proven through reduced readmission penalties.

The third MVP is a research acceleration platform for pharma and CROs. By pre-training models on MIMIC-IV and offering cohort-building and synthetic control arms, it reduces trial costs and timelines. This generates high-margin project revenue and builds credibility with regulators by leveraging real-world evidence.

Each of these MVPs is not a silo but a stepping stone toward an integrated clinical intelligence platform. The ICU system proves real-time integration; the population health engine validates longitudinal analytics; the research platform builds credibility and regulatory fluency.

V. Technical Architecture: Building for Reliability, Interoperability, and Scale

From a CTO’s perspective, the architecture must satisfy three imperatives: performance, compliance, and interoperability. The data backbone should be a cloud-native lakehouse supporting both batch and streaming ingestion. For structured EHR data, FHIR-compliant APIs are essential, allowing seamless integration with Epic, Cerner, and Meditech. For unstructured notes, transformer-based NLP models fine-tuned on MIMIC-IV discharge summaries and radiology reports provide contextual embeddings.

The MLOps layer supports continuous deployment with model versioning, drift monitoring, and audit trails, ensuring FDA SaMD compliance. Real-time ICU prediction requires a streaming pipeline—Kafka or Pub/Sub feeding Spark Streaming or Flink. Security architecture follows HIPAA and HITRUST CSF, with encryption in transit and at rest, role-based access, and comprehensive logging. Deployment should support hybrid models, given that many hospitals demand on-premise or private cloud solutions.

VI. Commercial Strategy: Navigating Academic Validation, Regulation, and Enterprise Adoption

From a Chief Commercial Officer’s perspective, the path to market requires building credibility before scaling revenue. The initial target should be academic medical centers, which already use MIMIC-IV for research and are open to piloting AI tools. These pilots generate clinical validation studies and peer-reviewed publications, forming the evidence base for FDA submissions. Early adopters also serve as reference customers.

For scaling, partnerships with EHR vendors and system integrators are crucial. Embedding APIs into Epic’s App Orchard or Cerner’s HealtheIntent marketplace accelerates adoption. The sales motion is consultative: selling outcomes rather than features. ROI is demonstrated through reduced ICU mortality, lower readmission penalties, or faster trial recruitment. Pricing strategies should align with value delivered—per-bed SaaS for ICU tools, per-member pricing for population health, and project-based fees for research solutions.

VII. Financial Projections and Investor Thesis

Conservative modeling suggests $2.5M revenue in year one, driven by academic pilots and pharma projects. By year three, scaling ICU SaaS and population health products could drive $20M ARR, with gross margins at 80%. By year five, with multi-market penetration, ARR could surpass $50M, supporting a valuation in the $400M range on an 8x revenue multiple. Investors are attracted not only to financial upside but also to the defensibility created by regulatory barriers, clinical evidence, and network effects.

VIII. Risks and Mitigation Strategies

Regulatory uncertainty, model generalizability, and healthcare’s slow procurement cycles are major risks. These can be mitigated by proactive FDA engagement, multi-site validation studies, and flexible contracting models. Competition risk from big tech entrants is real but countered by deep clinical specialization and domain expertise. Talent scarcity in clinical AI is another constraint, requiring partnerships with academic centers to build pipelines of data scientists and clinicians.

IX. Conclusion: Capturing the Clinical Intelligence Opportunity

MIMIC-IV is more than an academic dataset. It is the scaffolding for building commercially viable, clinically validated, and societally impactful AI platforms. The convergence of data availability, technical maturity, and regulatory clarity creates a fleeting but powerful opportunity. Entrepreneurs who move now—balancing technical rigor with commercial pragmatism—stand to define the next generation of clinical intelligence. MimicMed AI is not just a company concept; it is a thesis on how open data, carefully harnessed, can transform the economics and outcomes of modern healthcare.