RUNNING DILIGENCE FOR A HEALTHCARE ANGEL SYNDICATE: A PRACTICAL GUIDE FROM THE TRENCHES

DISCLAIMER: The views and opinions expressed in this essay are solely my own and do not reflect the views, opinions, or positions of my employer, Datavant, or any of its affiliates.

If you are interested in joining my generalist healthcare angel syndicate, reach out to trey@onhealthcare.tech or send me a DM. Accredited investors only.

ABSTRACT

This essay provides a comprehensive framework for conducting diligence as an angel syndicate investing in healthcare technology, medical devices, and biotechnology. Drawing from experience managing 50-60 seed investments, it covers the unique challenges of healthcare due diligence including regulatory complexity, reimbursement pathways, clinical validation requirements, and extended timelines. Key topics include structuring diligence workflows, dividing responsibilities among syndicate members, evaluating technical risk in different healthcare subsectors, assessing market timing and adoption curves, and developing frameworks for go/no-go decisions within compressed angel timelines. The essay emphasizes practical shortcuts and heuristics that enable angel investors to punch above their weight when competing with institutional capital while maintaining sufficient rigor to avoid catastrophic misses.

TABLE OF CONTENTS

Why Healthcare Diligence Is Different and Why That Matters

Building Your Diligence Machine: Structure and Workflow

The Core Pillars: What Actually Matters in Healthcare Deals

Technical Diligence Across Healthcare Subsectors

The Reimbursement Question: Following the Money

Regulatory Risk: Separating Real from Imaginary

Clinical Validation and Evidence Standards

Team Assessment in Healthcare: Domain Expertise vs Execution

Market Timing and Adoption Curves

Red Flags and Deal Killers

Making the Call: Decision Frameworks and Speed

Post-Investment: Setting Up for Success

Why Healthcare Diligence Is Different and Why That Matters

Let me start with the uncomfortable truth that took me way too long to internalize. Healthcare diligence is fundamentally different from software diligence and if you try to run the same playbook you’re going to miss critical risks or pass on great deals for the wrong reasons. I’ve watched smart software investors with incredible track records get absolutely destroyed in healthcare because they didn’t respect the complexity. I’ve also watched healthcare operators who understand the nuances pass on deals that returned 50x because they overweighted regulatory risk or didn’t believe in product-market fit signals that looked different from traditional healthcare buying patterns.

The core difference is that healthcare has multiple overlapping complexity layers that all need to work simultaneously. You’ve got the product itself, sure, but then you’ve got regulatory pathways, reimbursement mechanisms, clinical validation requirements, provider adoption curves, and often a multi-year sales cycle with a dozen stakeholders involved in purchase decisions. In consumer software you can launch fast, iterate based on user feedback, and pivot if something isn’t working. In healthcare you might need FDA clearance before you can even talk to customers, and if your clinical evidence package isn’t bulletproof you’re dead regardless of how elegant your technology is.

This creates a unique challenge for angel syndicates because we’re operating with compressed timelines, limited resources, and usually less domain expertise than institutional investors who have full-time healthcare-focused partners. A top-tier VC firm might spend 60 days on diligence with three partners, two analysts, and a network of expert consultants. We’ve got maybe two weeks, a handful of syndicate members with day jobs, and we’re trying to compete for allocation in the same rounds. The only way this works is by being smart about what actually matters, developing efficient frameworks, and knowing when to trust pattern recognition versus when to dig deep.

The good news is that healthcare angel investing has some structural advantages if you know how to leverage them. The long development timelines mean that founders need multiple rounds of capital, creating more entry points than in software where companies might raise a seed round and then jump straight to Series B. The complexity creates information asymmetry that favors investors who’ve done their homework. And the technical nature of healthcare means that syndicate members with clinical, regulatory, or payer backgrounds can add genuine value that founders actually care about, making it easier to get allocation in competitive rounds.

Building Your Diligence Machine: Structure and Workflow

The first thing you need to get right is the structure. Running diligence as a one-person show is a recipe for either taking forever or missing critical issues. You need a repeatable process that can scale across multiple deals simultaneously without burning out your syndicate members or producing garbage analysis.

I structure diligence around three phases with different people leading each phase. Phase one is the quick screen which happens in 48 hours or less. Someone on the team reviews the deck, watches the demo if available, and does basic research on the market and team. The goal isn’t deep analysis but rather identifying obvious deal killers or misalignment with our thesis. Maybe the company is pre-product in a space that requires multi-year clinical trials and millions in capital to get to revenue. Maybe the founders have no relevant domain expertise and are building something that requires deep regulatory knowledge. Maybe the addressable market is too small or the business model doesn’t make sense. This phase filters out probably 70 percent of inbound deals and takes less than two hours per company.

Phase two is where real diligence starts and this typically takes one to two weeks depending on the subsector and complexity. I assign a lead investor from the syndicate who has relevant expertise and then pull in 2-3 other members to cover different angles. For a digital health company selling to providers we might have someone with health system experience lead with support from someone who understands interoperability and someone who knows payer reimbursement. For a medical device we might lead with a clinician in the relevant specialty, supported by someone who understands FDA pathways and someone who has device commercialization experience.

The lead investor owns the relationship with the founders, coordinates the workstream, and ultimately makes the recommendation to the syndicate. But the supporting members are doing real work, not just rubber-stamping. Each person has specific deliverables tied to their area of expertise. The health system person is talking to potential customers and validating the value proposition. The interoperability person is reviewing the technical architecture and integration approach. The payer person is modeling out reimbursement scenarios and talking to their contacts about coverage policies.

This division of labor is critical because it lets you punch way above your weight in terms of diligence depth while keeping the time commitment reasonable for any individual syndicate member. If I asked someone to do comprehensive diligence on a complex healthtech deal by themselves it might take 40 hours. If I ask them to spend 6 hours on their specific area of expertise while others cover different angles, we get better analysis with less burnout.

Phase three is the decision process which I’ll cover in more detail later but the key structural element is having a clear framework for aggregating inputs and making the final call. You can’t do diligence by committee where everyone has veto power because you’ll never invest in anything. But you also can’t ignore red flags that domain experts are raising. I use a lead investor model where the person who ran diligence makes the final recommendation but has to explicitly address concerns raised by other syndicate members.

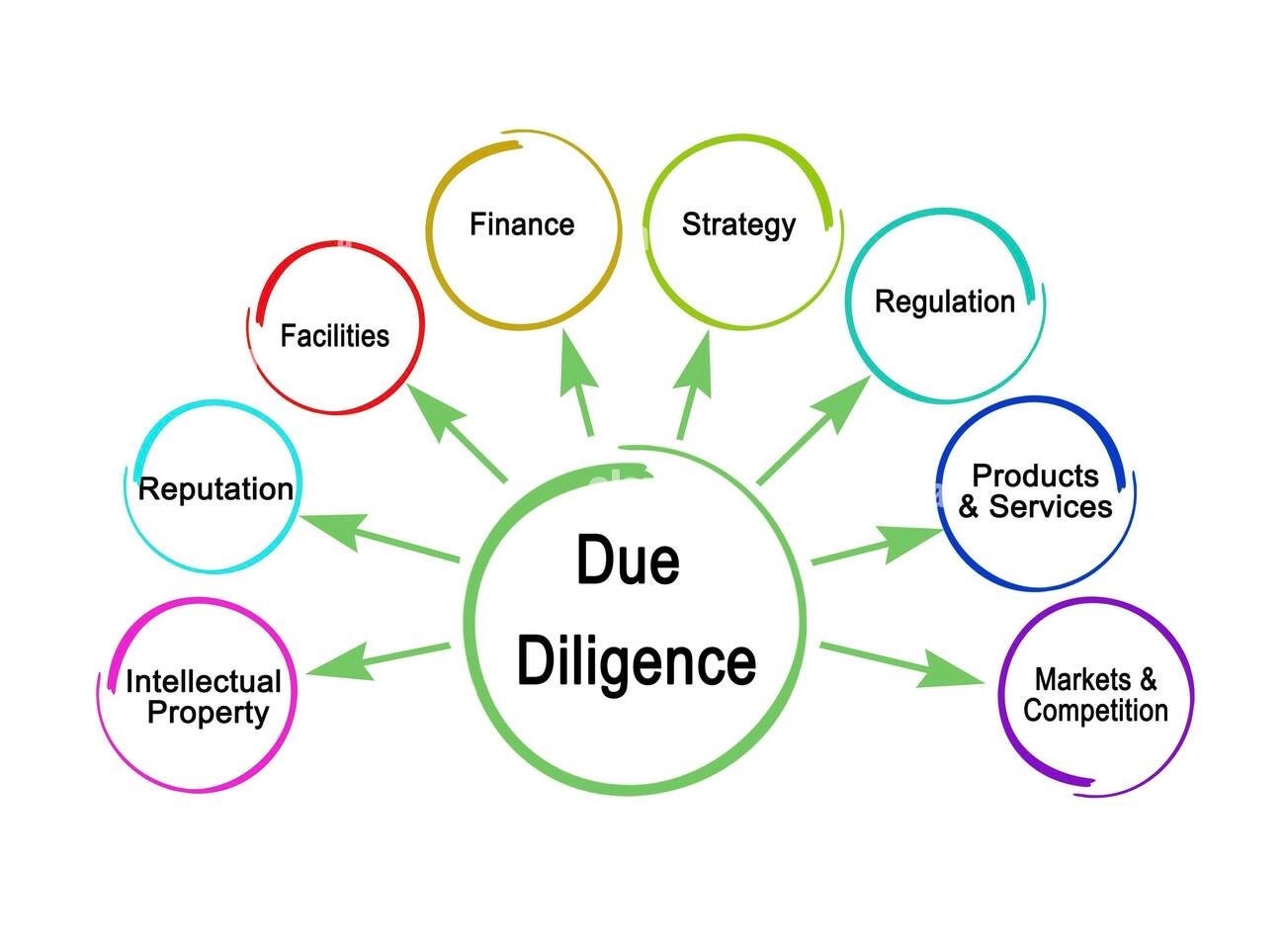

The Core Pillars: What Actually Matters in Healthcare Deals

Before diving into subsector specifics it’s worth stepping back and thinking about what actually predicts success in healthcare investing. I’ve looked at my portfolio and talked to enough other angel investors to have some conviction about what separates winners from losers at the seed stage.

The single most important factor is having a clear path to recurring revenue with reasonable unit economics. This sounds obvious but you’d be amazed how many healthcare startups raise money without any coherent story about how they’ll actually make money. Digital health is particularly bad about this with companies that have beautiful products solving real problems but no sustainable business model. They’ll say something vague about “data monetization” or “we’ll figure out the business model once we have users” and angels invest because the mission feels good and the product looks slick. Then the company spends two years trying to find product-market fit for a revenue model, runs out of cash, and dies.

I need to see a specific customer segment, a clear value proposition that maps to how that customer thinks about ROI, and a credible path to getting paid that doesn’t require convincing the entire healthcare system to change how they operate. If the business model requires novel reimbursement codes, complex multi-party revenue shares, or convincing self-insured employers to pay for something they’ve never paid for before, that’s not necessarily a deal killer but it needs to be sized appropriately from a risk perspective.

The second pillar is technical feasibility and defensibility. Healthcare has this interesting dynamic where the technical risk varies enormously by subsector. A digital therapeutics app for behavioral health might have basically zero technical risk because the core product is just mobile software with some clinical protocols built in. A novel drug delivery device might have massive technical risk because you’re trying to miniaturize complex hardware that interfaces with human biology. A diagnostic AI tool sits somewhere in between because the core ML models might be straightforward but clinical validation and regulatory approval create real execution risk.

You need to calibrate your diligence intensity to the actual technical risk of what’s being built. For pure software plays I’m spending maybe 20 percent of my diligence time on technical feasibility and 80 percent on market and business model. For medical devices or biotech that ratio might flip. And technical defensibility matters more in healthcare than consumer software because the sales cycles are so long. If you’re selling into hospitals with 18-month implementation timelines you need something that prevents a competitor from swooping in mid-process and stealing the deal.

The third pillar is team composition and domain expertise. Healthcare is unforgiving of founders who don’t know what they’re doing. You can get away with a lot in consumer software if you’re a great product thinker who’s willing to iterate quickly. In healthcare if you don’t understand regulatory pathways, reimbursement mechanics, and clinical workflows you’re going to waste years and millions of dollars going down dead ends. The best healthcare founders have this combination of deep domain expertise and enough disrespect for how things currently work that they’re willing to try something new.

I’m looking for teams where at least one founder has 5-plus years of direct experience in the problem space, ideally in a role where they felt the pain personally. A physician who practiced for years and got frustrated with a specific workflow problem. An operator at a health plan who saw billions being wasted on preventable complications. A medical device engineer who worked on legacy products and saw an opportunity to do it better. That domain expertise gives them credibility with customers, helps them navigate regulatory and reimbursement landmines, and makes it easier to recruit the right talent as they scale.

Technical Diligence Across Healthcare Subsectors

The mechanics of technical diligence vary enormously depending on what subsector you’re investing in. Let me walk through how I approach each major category.

For digital health software plays the technical diligence is often the easiest part. These are usually just well-architected web or mobile applications with some healthcare-specific features. I’m looking at whether they’ve made good technology choices for scalability, whether their data architecture makes sense for healthcare, and whether they understand security and compliance requirements. If they’re building interoperability features I want to understand their integration strategy and whether they’ve actually gotten HL7 or FHIR interfaces working with real EMR systems. But this is usually not where deals die because any decent engineering team can build solid healthcare software if they understand the domain.

The bigger question for digital health is whether the product actually solves the workflow problem in the way clinicians or administrators actually work. I’ve seen gorgeous patient engagement apps that fail because they require patients to do five different things and patients just won’t. I’ve seen provider tools that look amazing in demos but completely break down when you try to fit them into existing clinical workflows. The best technical diligence for digital health involves watching real users try to use the product in realistic scenarios and seeing where they get stuck.

Medical devices are a completely different beast. If you’re looking at a physical product that interfaces with human biology you need to understand the core technology, the engineering risk, the manufacturing approach, and the regulatory pathway all at once. I’m not a device engineer so I can’t personally evaluate whether their servo motor design will work at scale or whether their biocompatible materials will pass ISO testing. What I can do is find syndicate members or advisors who have relevant technical expertise and ask them targeted questions.

The key things I’m digging into are whether they have working prototypes, what their testing data looks like, whether they’ve identified manufacturing partners, and what the path to FDA clearance looks like. For Class II devices going through 510k clearance I want to understand what predicate devices they’re comparing to and whether that comparison is defensible. For Class III devices or PMA pathways I need to understand the clinical trial requirements and whether they have the capital and timeline to get through it.

Diagnostics and AI tools require a different flavor of technical diligence because the core question is whether the underlying science or algorithm actually works. For diagnostic tests I’m looking at sensitivity, specificity, and whether the clinical validation data is robust enough to support the claims they’re making. You see a lot of diagnostic companies present pilot data from 50 patients and claim they’ve validated their approach. That might be enough for a seed round but I want to understand how much more data they need to collect, whether there are edge cases they haven’t tested, and whether the test performance holds up across different populations and clinical settings.

For AI and machine learning applications the technical diligence is about understanding the training data, the model architecture, and whether performance metrics translate to clinical utility. I’ve seen too many healthcare AI companies present impressive AUC scores that don’t actually matter because the clinical workflow doesn’t support acting on the model’s predictions. Or they’ve trained on datasets that don’t represent the real-world patient population they’ll encounter in deployment. The best AI diligence involves getting someone technical to review their model cards, understanding their approach to bias mitigation, and pressure-testing whether their performance claims will hold up when deployed broadly.

Biotech and therapeutics are where angel diligence gets really hard because you need deep scientific expertise to evaluate the core technology. I’m generally more cautious about seed-stage biotech because the timelines to exit are measured in decades and the technical risk is massive. When I do invest in this space I’m relying heavily on syndicate members with relevant PhD-level expertise to evaluate the science. But even with expert support I’m mostly making bets on team and market rather than trying to outsmart the biology because I know I don’t have the expertise to really evaluate whether the mechanism of action is sound.

The Reimbursement Question: Following the Money

This is where angels often screw up healthcare deals. They get excited about elegant technology or compelling clinical outcomes and forget to ask whether anyone will actually pay for it. Healthcare is weirdly disconnected between who benefits from a solution and who pays for it. Patients benefit but usually don’t pay directly. Clinicians benefit from workflow improvements but aren’t the budget holder. Payers benefit from reduced costs but are skeptical of new vendors making ROI claims.

The first question is who is the payer of record and why will they pay. For things sold to providers the answer is usually the provider’s capital or operational budget and the value prop needs to tie to either revenue generation or cost reduction. Provider tools that promise quality improvements or better patient experience are hard sells unless you can tie it directly to reimbursement or cost. Tools that reduce labor costs, increase throughput, or enable billing for new services are much easier.

For things sold to payers the question is whether the intervention reduces total cost of care enough to justify the spend. Payers are incredibly ROI-focused and will beat you up on your health economics assumptions. They want to see published evidence, not just your internal pilot data. And they move slowly because implementing new solutions requires clinical policy changes and operational integration. If your business model depends on payer reimbursement I want to see that you understand the J-code or CPT code pathway, you’ve talked to payer medical directors about coverage, and you have a realistic timeline for getting on formularies or covered benefits lists.

Direct-to-consumer healthcare is a different animal where you’re asking patients to pay out of pocket. This works for things patients really want and see clear value in like fertility, mental health, or aesthetic applications. It’s brutal for things that feel like healthcare chores even if they’re clinically important. Weight loss works because patients are highly motivated. Medication adherence tools struggle because taking your pills correctly is not something people want to pay for even though it matters for their health.

The second-order question is whether the reimbursement model is stable or at risk of changing. You see this with digital health companies that built business models around remote patient monitoring codes and then CMS changed the reimbursement rules and their unit economics fell apart. Or diagnostic companies that assumed commercial payers would reimburse at certain rates and then payers started negotiating much more aggressively once the market got crowded. I want to understand whether the reimbursement pathway depends on current policy that could change or whether it’s tied to fundamental value delivery that will be durable.

Regulatory Risk: Separating Real from Imaginary

Angels tend to either overweight or underweight regulatory risk and both mistakes are costly. Overweighting means you pass on good deals because you’re scared of FDA or you assume everything requires a years-long approval process. Underweighting means you invest in companies that blow through their seed capital trying to figure out regulatory pathways and die before getting to market.

The key is understanding which regulatory questions are truly risky and which are knowable with diligence. If a company is building a Class I medical device or something that qualifies for enforcement discretion, the regulatory path is straightforward and well-trodden. If they’re pursuing 510k clearance with a clear predicate device, it’s more work but the path is known. If they’re going for de novo classification or PMA approval, that’s real risk that needs to be sized appropriately.

The diligence process is about getting clear answers to specific questions. Have they engaged with FDA through pre-submission meetings? Do they have a regulatory consultant who knows what they’re doing? Have they mapped out the full regulatory strategy including quality systems, design controls, and post-market surveillance? For software-as-a-medical-device I want to understand whether they actually need FDA oversight or whether they’re in the enforcement discretion bucket. A shocking number of digital health founders have no idea which category they fall into.

For diagnostics the regulatory question is tied up with evidence generation. What does the FDA want to see for validation? What’s the timeline and cost to generate that data? Have they talked to FDA about the evidence package? For laboratory-developed tests there’s this whole separate regulatory mess around CLIA certification and state-by-state validation that you need to understand.

International regulatory is a whole other layer. If the company plans to commercialize outside the US they need CE marking for Europe, PMDA approval for Japan, and so on. Sometimes the smart play is to launch outside the US first if the regulatory path is easier, but that requires understanding those markets and whether the company has the capability to execute internationally.

Clinical Validation and Evidence Standards

Healthcare buyers want evidence and the standards for what counts as sufficient evidence vary enormously by customer type and clinical domain. Academic medical centers want peer-reviewed publications. Community hospitals might accept white papers or case studies. Payers want health economics data from real-world deployment. Each of these evidence types takes time and money to generate.

I’m looking for companies that have a clear evidence generation roadmap tied to their commercialization strategy. For early-stage companies that might mean pilot data from a handful of customers that you can turn into case studies. For later-stage companies you need published studies or at least studies submitted for publication. The timeline and cost to generate evidence needs to fit within the company’s funding plan because if you need three years and five million dollars to generate the evidence you need for sales and you’ve only raised two million at seed you’re in trouble.

The evidence question is particularly important for AI and machine learning applications where you need to show that the algorithm performs well on real-world data, generalizes across different settings, and doesn’t introduce bias. I want to understand their clinical validation strategy, whether they have academic partnerships to run studies, and whether the evidence they’re generating will be accepted by their target customers.

There’s also this dynamic where healthcare has different evidence standards for different claims. If you’re making a clinical effectiveness claim you need clinical studies. If you’re making an ROI claim you need health economics data. If you’re claiming that your tool improves workflow efficiency you need time-motion studies or qualitative feedback from users. The companies that do well are thoughtful about what claims matter for their sales motion and focus their evidence generation there rather than trying to boil the ocean.

Team Assessment in Healthcare: Domain Expertise vs Execution

I hinted at this earlier but it’s worth going deeper on how to evaluate founding teams in healthcare because the dynamics are different from software. The ideal team has deep domain expertise in the problem space combined with strong execution chops and enough technical firepower to build the product. Finding all three in one founding team is rare which is why you often see healthcare companies with large founding teams or very specific hiring plans to fill gaps.

Domain expertise means the founders have lived the problem personally and understand the nuances of clinical workflows, regulatory requirements, reimbursement mechanics, or whatever else matters for their specific business. A physician founder who practiced in the specialty they’re targeting. A payer executive who ran utilization management. A hospital CIO who dealt with interoperability challenges for years. This expertise gives them credibility with customers, helps them avoid rookie mistakes, and accelerates time to market.

But domain expertise alone is not enough because healthcare is littered with smart clinicians or operators who had good ideas but couldn’t execute. You also need founders who can recruit and build teams, who understand product development and go-to-market strategy, who can raise capital and manage investors. These execution skills are more generic but they’re often missing in healthcare founders who spent their careers in clinical or operational roles.

The other factor is coachability and growth mindset. Healthcare is changing fast and founders who are stuck in old mental models about how healthcare works will miss opportunities. I’m looking for people who respect the complexity of healthcare but aren’t paralyzed by it. Who understand regulatory requirements but are willing to find creative paths forward. Who know that traditional sales cycles are 18 months but are experimenting with product-led growth or alternative distribution channels.

Red flags on teams include founders who’ve been in the space for six months and think they understand it better than people who’ve been there for decades. Or domain experts who are so sure they know what customers need that they won’t do any customer discovery or validation. Or technical founders building healthcare products who have no healthcare experience and no plans to bring in domain expertise. The best teams have this blend of confidence and humility where they trust their insight on the problem but are constantly learning.

Market Timing and Adoption Curves

Healthcare is notoriously slow to adopt new technology which creates this interesting dynamic where you can be too early or too late but the window for being right on time is kind of wide. If you invest in something that requires fundamental changes to clinical workflows or reimbursement models you might be 5 years too early and the company runs out of capital before the market is ready. If you wait until adoption is obvious you’ve missed the best returns.

I think about market timing across a few dimensions. First is whether the underlying technology is ready. AI-powered clinical decision support tools are viable today in ways they weren’t five years ago because the models actually work now. Virtual care companies took off during COVID because video infrastructure became ubiquitous and both patients and providers learned how to use it. Sometimes the technology needs to cross a threshold before the business model makes sense.

Second is whether the regulatory environment is favorable. You saw this with digital therapeutics where FDA created pathways for software-based treatments and suddenly it became feasible to build prescription digital health products. Or with remote patient monitoring where CMS created reimbursement codes and the whole sector exploded. Policy changes can create or destroy markets overnight.

Third is whether customers are ready. This is about both capability and willingness. Do health systems have the IT infrastructure to integrate your product? Are clinicians comfortable with the workflow changes required? Are patients ready to engage with digital tools? COVID accelerated healthcare’s digital transformation by probably five years which made all kinds of companies viable that would have struggled pre-pandemic.

The diligence question is whether the company has timed the market correctly or whether they’re going to spend years evangelizing before they can sell. I want to see evidence that customers understand the problem, recognize it as painful enough to fix, and are actively looking for solutions. If the company is mostly doing education rather than selling that’s a red flag. The best time to invest is when the problem is widely recognized but the solution set is still nascent.

Red Flags and Deal Killers

Let me run through some patterns I’ve seen that usually predict bad outcomes. These aren’t automatic passes but they require serious scrutiny and usually I end up walking away.

First is companies that have been around for 3-plus years and still don’t have clear product-market fit or revenue traction. In healthcare you expect slower progress than software but if a company has raised multiple rounds and still hasn’t figured out who will pay them there’s usually something fundamentally broken. Either the problem isn’t as painful as they thought, the solution doesn’t actually work in practice, or the team can’t execute.

Second is companies with super complex business models that require coordinating multiple stakeholders or novel payment arrangements. I’m talking about things like requiring providers, payers, pharma, and patients to all participate in some multi-sided platform. Or needing to negotiate risk-based contracts where you take on outcomes-based payment before you’ve proven your product works. These models sound great in theory but execution risk is massive and you need way more capital and time than anyone expects.

Third is companies where the founders don’t have skin in the game or seem checked out. If they’re not fully committed or they’re hedging by keeping other jobs or projects going that’s a bad sign. Healthcare is too hard to do as a side hustle and if the founders aren’t all-in they’ll fail.

Fourth is companies that are dependent on a single customer or partnership for their entire strategy. I get that early-stage companies often start with one or two lighthouse customers but if the entire business model requires winning a specific health system or payer contract and there’s no plan B that’s way too much concentration risk. Things fall through in healthcare all the time and you need optionality.

Fifth is companies with unrealistic timelines or capital plans. If they think they can get to FDA clearance and revenue in 12 months with one million dollars of seed capital and it’s obvious that will take 24 months and three million dollars, either they don’t understand the business or they’re being dishonest. I’d rather see realistic projections that acknowledge the difficulty than fantasy hockey stick projections that won’t survive first contact with reality.

Sixth is teams with obvious gaps they’re not addressing. If you have two technical founders and no one with healthcare experience and no plans to hire domain experts that’s a problem. If you have clinical founders with no one who can build product or sell that’s equally bad. The best founders are self-aware about their gaps and have specific plans to fill them.

Making the Call: Decision Frameworks and Speed

After all this diligence you still need to make a yes or no decision and you need to do it fast enough that you don’t miss allocation in competitive rounds. I use a framework that balances rigor with speed and forces explicit tradeoffs rather than trying to optimize everything at once.

The first question is whether this is a qualified opportunity meaning it passes our basic criteria around stage, sector, ticket size, and syndicate fit. If not we pass quickly and don’t waste time. The second question is whether we believe the company can be venture-scale. Healthcare has this challenge where lots of businesses can be nice cash-flowing companies that never return venture returns because the markets are too small or growth is too slow. We need to believe there’s a path to 100 million in revenue at attractive margins because otherwise the math doesn’t work.

The third question is whether we believe in the team’s ability to execute. This is partly qualitative assessment of the founders and partly looking at what they’ve accomplished relative to their stage and resources. Have they made good decisions? Are they moving quickly? Do they learn from mistakes? Can they recruit and retain talent?

The fourth question is whether the core risks are addressable with the capital they’re raising. If they need to prove clinical efficacy and get FDA clearance and build a sales team and they’re raising two million dollars for 18 months runway, the math probably doesn’t work. But if they’re raising enough to hit clear milestones that reduce risk and set them up for a strong A round, that’s different.

I use a scoring framework where each of these questions gets a rating and then we aggregate. But the scoring is really about forcing explicit discussion of tradeoffs rather than generating some objective truth. If we have concerns about team but the market opportunity is massive and the traction is strong we might still invest. If the team is incredible but the regulatory path is unclear we might pass. The framework helps us articulate what we’re betting on and what risks we’re accepting.

Speed matters because in competitive deals you need to move fast. I try to give founders clear signals quickly so they can plan accordingly. If we’re excited we move to deep diligence immediately and aim to get to a decision within 10 business days. If we’re passing we tell them right away with specific feedback on why. Stringing founders along while you slowly work through diligence is both disrespectful and a good way to miss out on deals.

Post-Investment: Setting Up for Success

Diligence doesn’t end when you wire the money. The best angel investors stay engaged and help portfolio companies succeed. For healthcare deals this often means making specific connections that leverage your network. Introducing them to potential customers. Connecting them with regulatory consultants. Making talent intros for key hires. Helping them think through strategic decisions where your domain expertise is relevant.

I try to establish clear communication rhythms with founders so I stay informed without being burdensome. Monthly updates via email plus quarterly calls work well. I ask founders to be explicit about how syndicate members can help and I try to be responsive when they reach out. Healthcare is a small world and your reputation as a helpful investor matters for getting access to future deals.

The other post-investment task is tracking progress against the diligence assumptions we made. If we invested because we thought they could get FDA clearance in 12 months and it’s been 18 months with no progress, we need to understand why. If we thought they’d have 10 customers by now and they have two, what’s the blocker? This tracking helps us make better investment decisions in follow-on rounds and also makes us better diligence investors over time because we learn what actually predicts success.

Healthcare angel investing is a long game with extended timelines and meaningful capital requirements as companies scale. The companies I invested in three or four years ago are just now getting to their Series A or B rounds. Some of them have died. Some are stalled. Some are crushing it. The ones that are working tend to be the ones where our core diligence thesis was correct and the team executed well. The ones that failed usually had obvious red flags in retrospect that we either missed or chose to overlook. The goal is to get better at pattern matching over time while staying humble about how much we don’t know.

Running diligence for a healthcare angel syndicate is about building systems and frameworks that let you move fast while maintaining sufficient rigor to avoid catastrophic mistakes. You can’t match the resources or expertise of top-tier institutional investors but you can punch above your weight by being smart about division of labor, focusing on what actually matters, and leveraging the collective knowledge of your syndicate members. The key is respecting the complexity of healthcare while not being paralyzed by it, trusting your pattern recognition while staying open to being wrong, and maintaining enough humility to know that even great diligence won’t catch everything.