The Clinical AI Battle: DeepEvidentia vs OpenEvidence and the Real Challenge of Building Healthcare Intelligence Companies

The emergence of DeepEvidentia as a challenger to established clinical AI platforms like OpenEvidence represents more than a technical competition—it illuminates fundamental questions about artificial intelligence architecture, business model sustainability, and the complex realities of building successful healthcare technology companies. This analysis examines both platforms from first principles, evaluating their technical approaches, reasoning capabilities, scalability potential, and capital efficiency. Through a comprehensive assessment of dual-layer O3 reasoning versus traditional information retrieval systems, we explore which technical architecture is superior for clinical decision support. However, the deeper question emerges: while technical excellence in LLM capabilities may be necessary, is it sufficient for building a defensible, profitable healthcare AI business? Drawing from OpenEvidence's remarkable growth trajectory, $1 billion valuation, and complex monetization challenges, this essay argues that the true competitive moats in healthcare AI lie not in LLM superiority alone, but in the intricate orchestration of user acquisition, content partnerships, regulatory navigation, workflow integration, and sustainable revenue generation. The analysis concludes that while DeepEvidentia may possess technical advantages in reasoning architecture, the winner in this space will be determined by execution across multiple business dimensions that extend far beyond the underlying AI model.

Table of Contents

The $4,000 Challenge to a $1 Billion Giant

Technical Architecture Deep Dive: Reasoning vs. Retrieval

The O3 Reasoning Advantage: First Principles Analysis

Scalability and Capital Efficiency: The David vs. Goliath Economics

The OpenEvidence Phenomenon: Success Beyond the Algorithm

Business Model Complexity in Healthcare AI

The Multi-Dimensional Challenge of Healthcare AI Success

Market Dynamics and Competitive Moats

The Execution Gap: From LLM to Healthcare Business

Strategic Assessment: Which Approach Will Prevail?

Conclusion: The Real Battle Ahead

---

The $4,000 Challenge to a $1 Billion Giant

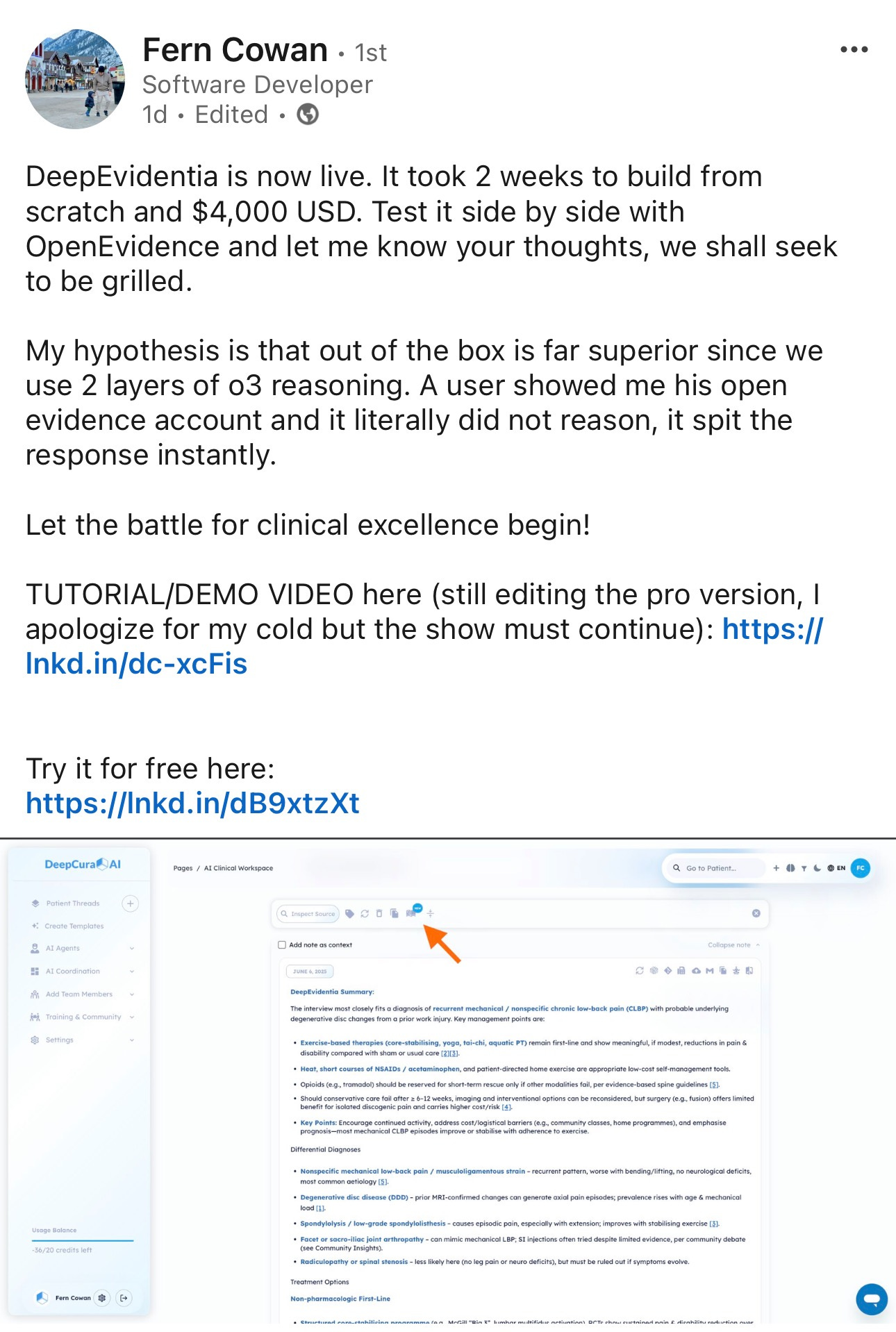

Fern Cowan's bold proclamation on LinkedIn represents a pivotal moment in the clinical AI landscape: "DeepEvidentia is now live. It took 2 weeks to build from scratch and $4,000 USD. Test it side by side with OpenEvidence and let me know your thoughts, we shall seek to be grilled." This direct challenge to OpenEvidence—a platform that has achieved a $1 billion valuation, raised over $100 million, and captured 440,000+ verified physician users—encapsulates one of the most fascinating dynamics in modern healthcare technology.

The audacity of this challenge is remarkable. On one side stands OpenEvidence, the darling of Sequoia Capital, boasting partnerships with The New England Journal of Medicine, presence in 10,000+ healthcare centers, and adding 40,000 new doctors monthly. On the other stands DeepEvidentia, built in two weeks by what appears to be a small team, claiming technical superiority through "2 layers of o3 reasoning" against a system that "literally did not reason, it spit the response instantly."

This confrontation forces us to confront fundamental questions about the nature of innovation in healthcare AI. Is technical superiority in reasoning architecture the determining factor for success? Can a lean, technically-focused startup disrupt an incumbent that has achieved massive scale and user adoption? Most importantly, what does it actually take to build a successful clinical AI business beyond having the best large language model?

From a technical standpoint, I believe Cowan's hypothesis about reasoning superiority has merit. The distinction between instant information retrieval and thoughtful clinical reasoning represents a fundamental architectural divide that may determine the next generation of clinical decision support tools. However, my analysis of OpenEvidence's business model and market position reveals that the challenge facing any clinical AI startup extends far beyond technical capabilities into complex territory involving user acquisition, content partnerships, regulatory compliance, workflow integration, and sustainable monetization.

The $4,000 versus $100 million development cost comparison is striking, but potentially misleading. While DeepEvidentia may have achieved technical parity or superiority at a fraction of the cost, the true test lies not in initial development efficiency but in the ability to scale, monetize, and sustain a healthcare AI business in an industry characterized by conservative adoption patterns, complex stakeholder dynamics, and stringent regulatory requirements.

This essay examines both platforms through multiple lenses: technical architecture, reasoning capabilities, scalability potential, capital efficiency, business model viability, and market positioning. My conclusion is that while DeepEvidentia may possess genuine technical advantages, the ultimate winner in clinical AI will be determined by execution across dimensions that extend far beyond the sophistication of the underlying language model.

Technical Architecture Deep Dive: Reasoning vs. Retrieval

The core technical claim underlying DeepEvidentia's challenge centers on the distinction between reasoning-based and retrieval-based architectures for clinical decision support. This difference represents more than a technical detail—it reflects fundamentally different philosophies about how artificial intelligence should approach clinical decision-making.

OpenEvidence, despite its sophisticated user interface and impressive adoption metrics, appears to operate primarily as an advanced information retrieval system. When a clinician poses a query, the system rapidly searches through its curated medical knowledge base, identifies relevant sources, and presents synthesized information with appropriate citations. The emphasis is on speed, comprehensiveness, and source attribution. This approach has clear advantages: responses are generated quickly, the information is traceable to authoritative sources, and the system can handle a wide variety of clinical queries with consistent performance.

However, this retrieval-based approach has fundamental limitations when applied to complex clinical scenarios. Real clinical decision-making rarely involves simple information lookup. Instead, it requires synthesis of multiple factors, consideration of patient-specific variables, evaluation of conflicting evidence, and application of clinical reasoning principles that go beyond what any individual study or guideline explicitly addresses. A system that "spits out responses instantly" may provide useful information, but it cannot engage in the type of deliberative reasoning that characterizes expert clinical judgment.

DeepEvidentia's dual-layer O3 reasoning architecture represents a fundamentally different approach. The first reasoning layer appears focused on evidence comprehension and initial synthesis, analyzing individual studies and guidelines to extract key findings, assess methodological quality, and identify relevant clinical contexts. This layer functions as an intelligent research assistant, capable of understanding not just what studies say, but how they should be interpreted within broader clinical contexts.

The second reasoning layer engages in higher-order clinical reasoning, taking the processed evidence from the first layer and applying clinical reasoning principles to develop actionable insights. This layer considers factors such as patient population characteristics, clinical context, potential contraindications, and the hierarchical nature of medical evidence. It attempts to reconcile conflicting findings across studies, weigh the relative strength of different types of evidence, and provide recommendations that account for the inherent uncertainty present in much medical research.

From a first principles perspective, this dual-layer reasoning approach is superior for clinical decision support. Clinical reasoning is not simply a matter of information retrieval; it requires synthesis, analysis, and the application of clinical judgment to complex, often ambiguous scenarios. A system capable of engaging in this type of reasoning should theoretically provide more valuable insights than one focused primarily on rapid information access.

The technical architecture also has implications for how these systems handle edge cases and novel scenarios. Retrieval-based systems are fundamentally limited by their training data and knowledge base. When confronted with unusual clinical scenarios or emerging medical knowledge, they can only provide information that has been explicitly included in their databases. Reasoning-based systems, by contrast, may be able to extrapolate from existing knowledge to provide insights into novel situations, applying general clinical reasoning principles even when specific information is not available.

However, the reasoning approach also introduces new challenges. The computational requirements are likely higher, resulting in slower response times. The complexity of the reasoning process may make it more difficult to ensure consistency and reliability across different queries. Most critically, the reasoning process may be less transparent than simple information retrieval, making it harder for clinicians to understand how the system arrived at its recommendations.

The O3 Reasoning Advantage: First Principles Analysis

The technical superiority of O3 reasoning over traditional retrieval systems becomes apparent when we examine how expert clinicians actually approach complex clinical decisions. Expert clinical reasoning involves multiple cognitive processes that operate in sequence and in parallel: pattern recognition, hypothesis generation, evidence evaluation, uncertainty management, and decision synthesis. DeepEvidentia's dual-layer O3 architecture appears designed to mirror these cognitive processes in ways that simple retrieval systems cannot.

Consider a complex clinical scenario: a 65-year-old diabetic patient with chronic kidney disease presenting with chest pain, elevated troponins, and a history of both coronary artery disease and pulmonary embolism. An expert clinician approaching this case would not simply look up information about chest pain, troponins, or each individual comorbidity. Instead, they would engage in sophisticated reasoning about the interaction between these factors, the differential diagnosis given the specific combination of patient characteristics, and the appropriate diagnostic and therapeutic approaches given the patient's unique risk profile.

A retrieval-based system would likely provide information about each component of this scenario—chest pain workup protocols, troponin interpretation guidelines, management of acute coronary syndromes in diabetic patients with kidney disease. While useful, this information would require the clinician to perform the complex synthesis work of integrating these disparate pieces of knowledge into a coherent clinical approach.

DeepEvidentia's O3 reasoning architecture should theoretically be capable of performing this synthesis work. The first reasoning layer would process the available evidence about each component of the clinical scenario, understanding not just what the literature says but how different studies apply to patients with specific characteristics. The second layer would then engage in the type of integrative reasoning that expert clinicians perform, considering how the combination of factors influences diagnosis and treatment decisions.

This reasoning capability becomes particularly valuable when dealing with clinical uncertainty, conflicting evidence, or novel scenarios not explicitly addressed in medical literature. Expert clinicians routinely encounter situations where guidelines provide conflicting recommendations, where patient characteristics fall outside the populations studied in clinical trials, or where emerging evidence challenges established practices. In these situations, clinical reasoning—rather than simple information retrieval—becomes essential.

The O3 reasoning architecture also offers potential advantages in handling the temporal and contextual aspects of clinical decision-making. Medical decisions are not made in isolation but within the context of ongoing patient relationships, previous treatment responses, and evolving clinical pictures. A reasoning-based system should be better equipped to integrate this contextual information into its recommendations, providing more personalized and clinically relevant guidance.

From a scientific design perspective, the dual-layer approach appears well-architected for the complexity of medical knowledge. Medical evidence exists at multiple levels—from basic science mechanisms to population-level outcomes—and effective clinical reasoning requires integration across these levels. The two-layer structure provides a framework for this integration that is conceptually superior to flat retrieval systems.

However, the effectiveness of O3 reasoning depends critically on implementation quality. Reasoning systems are inherently more complex than retrieval systems, with more potential points of failure and greater requirements for validation. The quality of the reasoning depends not just on the underlying language model capabilities but on how well the reasoning frameworks are designed to mirror expert clinical judgment.

Scalability and Capital Efficiency: The David vs. Goliath Economics

The economic comparison between DeepEvidentia and OpenEvidence reveals profound insights about the changing dynamics of healthcare AI development. The ability to build a sophisticated clinical reasoning system for $4,000 in two weeks represents a dramatic shift in the economics of healthcare technology innovation, with implications that extend far beyond the specific comparison between these two platforms.

Traditional healthcare AI development has been characterized by substantial capital requirements, extended development timelines, and large multidisciplinary teams. OpenEvidence's fundraising of over $100 million reflects this traditional model—significant investment in team building, content partnerships, infrastructure development, regulatory preparation, and market development. This approach has clear advantages: it enables comprehensive solution development, substantial marketing capabilities, and the ability to navigate complex healthcare industry relationships.

However, DeepEvidentia's development model suggests that the democratization of AI capabilities has reached a tipping point where small teams can achieve technical parity or superiority at dramatically lower costs. This shift has several important implications for the competitive landscape in clinical AI.

First, it lowers barriers to entry for innovative solutions. If sophisticated clinical reasoning systems can be built for thousands rather than millions of dollars, it becomes feasible for smaller teams, academic researchers, and specialized consultants to develop competing solutions. This could lead to increased innovation and specialization, with different teams focusing on specific clinical domains or reasoning approaches.

Second, it enables rapid iteration and experimentation. The traditional venture capital model for healthcare AI involves raising substantial funding, building large teams, and committing to specific technical approaches for extended periods. DeepEvidentia's model enables rapid prototyping, testing, and refinement of different approaches with minimal financial commitment. This could accelerate innovation by allowing more experimental approaches to be tested and validated.

Third, it changes the risk-reward dynamics for investors and entrepreneurs. Rather than making large bets on unproven technologies, investors could support multiple smaller experiments, backing the most promising approaches as they demonstrate market traction. Entrepreneurs could test ideas quickly and cheaply before committing to larger-scale development efforts.

However, the capital efficiency comparison may be misleading when considering the full scope of building a successful healthcare AI business. DeepEvidentia's $4,000 development cost covers the core technical platform, but successful healthcare AI companies require substantial additional investments in areas that extend far beyond the underlying technology.

Content partnerships represent a significant ongoing cost that may not be reflected in initial development expenses. OpenEvidence's partnership with The New England Journal of Medicine likely involves substantial licensing fees and revenue sharing arrangements. These partnerships are essential for credibility and clinical utility but require ongoing financial commitments that can dwarf initial development costs.

User acquisition in healthcare represents another substantial cost category. Healthcare professionals are conservative adopters of new technologies, requiring extensive validation, peer endorsement, and integration support before adoption. OpenEvidence's growth to 440,000+ users likely required substantial investment in marketing, medical professional outreach, and user support that is not reflected in DeepEvidentia's development budget.

Regulatory compliance and quality assurance represent ongoing cost categories that become more significant as clinical AI systems scale. While early-stage platforms may operate with minimal regulatory oversight, successful clinical AI companies must invest substantially in compliance, quality control, and risk management systems.

Infrastructure scaling presents another cost consideration. DeepEvidentia's current architecture may be optimized for demonstration and early testing, but scaling to serve hundreds of thousands of users with sub-second response times likely requires substantial infrastructure investment. OpenEvidence's ability to serve 440,000+ users with high availability and performance represents a significant engineering and operational achievement that requires ongoing investment.

The OpenEvidence Phenomenon: Success Beyond the Algorithm

OpenEvidence's remarkable growth trajectory provides crucial insights into the factors that drive success in clinical AI beyond technical capabilities. The platform's achievement of 440,000+ verified physician users, presence in 10,000+ healthcare centers, and $1 billion valuation represents one of the most successful market penetration efforts in healthcare technology history. Understanding how OpenEvidence achieved this success illuminates the complex challenges that any clinical AI platform must navigate.

The user acquisition achievement is particularly impressive given the conservative nature of healthcare professional technology adoption. Physicians are notoriously skeptical of new technologies, requiring extensive validation and peer endorsement before incorporating new tools into clinical workflows. OpenEvidence's ability to achieve viral adoption—adding 40,000 new doctors monthly through word-of-mouth referrals—suggests that the platform provides genuine clinical value that translates into user enthusiasm and advocacy.

This viral adoption pattern is rare in healthcare technology and indicates that OpenEvidence has achieved something that goes beyond technical capabilities: genuine workflow integration and clinical utility. The platform's reported usage pattern—75% of users utilizing it during office hours for clinical decision support—suggests that it has successfully integrated into actual clinical practice rather than remaining a peripheral tool used occasionally for reference.

The content partnership strategy represents another crucial success factor. OpenEvidence's collaboration with The New England Journal of Medicine provides not just access to high-quality medical content but, more importantly, credibility and clinical validation. In healthcare, the source and quality of information are as important as the technology used to access it. NEJM's association with OpenEvidence serves as a powerful endorsement that helps overcome physician skepticism about AI-based clinical tools.

The partnership strategy also demonstrates understanding of the healthcare industry's complex stakeholder dynamics. Rather than attempting to create all medical content internally, OpenEvidence has strategically aligned with established, trusted medical authorities. This approach leverages existing credibility rather than attempting to build it from scratch, significantly accelerating market acceptance.

The platform's positioning as "free and unlimited for verified healthcare practitioners" represents a sophisticated go-to-market strategy that addresses the unique characteristics of healthcare markets. Healthcare decisions are often made by users (physicians) who are not the direct purchasers of technology solutions. By making the platform free for individual users while monetizing through enterprise contracts and partnerships, OpenEvidence has aligned its revenue model with healthcare purchasing dynamics.

The verification requirement for healthcare practitioners serves multiple strategic purposes. It creates a barrier that ensures the user base consists primarily of legitimate healthcare professionals, which is essential for maintaining clinical credibility. It also creates a valuable user database that can be leveraged for business development and partnership opportunities. Most importantly, it enables OpenEvidence to make credible claims about physician adoption and usage patterns, which are crucial for enterprise sales and investor relations.

OpenEvidence's funding success also reflects sophisticated understanding of venture capital dynamics in healthcare. The platform's $1 billion valuation, while substantial for a company offering a free product, is justified by metrics that demonstrate massive user adoption, high engagement, and clear monetization pathways. Sequoia Capital's investment reflects not just current traction but confidence in OpenEvidence's ability to execute on complex business model challenges.

The enterprise sales strategy represents perhaps the most crucial element of OpenEvidence's business model. While individual physicians use the platform for free, healthcare institutions require enterprise licensing for comprehensive integration, compliance, and administrative oversight. This B2B2C model enables rapid user adoption while creating substantial revenue opportunities through institutional sales.

However, OpenEvidence's success also highlights the challenges inherent in building sustainable clinical AI businesses. Despite impressive user adoption and substantial funding, the platform faces complex monetization challenges that extend far beyond technical capabilities. The need to balance free individual access with profitable enterprise sales, maintain clinical credibility while pursuing revenue opportunities, and scale operations while ensuring quality and compliance represents a multidimensional execution challenge that few healthcare technology companies have successfully navigated.

Business Model Complexity in Healthcare AI

The monetization challenges facing clinical AI platforms reveal the fundamental complexity of building sustainable businesses in healthcare technology. OpenEvidence's business model analysis illustrates that technical excellence, while necessary, is insufficient for creating profitable, scalable healthcare AI companies. The path from clinical utility to business success requires navigation of complex stakeholder dynamics, regulatory requirements, and industry-specific constraints that extend far beyond the capabilities of the underlying AI technology.

Healthcare technology markets are characterized by unique purchasing dynamics that complicate traditional software business models. The users of clinical AI tools (physicians and other healthcare professionals) are typically not the direct purchasers of technology solutions. Healthcare institutions, insurance companies, and government agencies control technology purchasing decisions, often with priorities that differ significantly from individual user preferences. This creates a complex environment where clinical utility must be translated into institutional value propositions that justify significant technology investments.

The regulatory environment in healthcare adds another layer of complexity to business model development. While clinical AI platforms may initially operate with minimal regulatory oversight, successful scaling often requires navigation of FDA guidelines, HIPAA compliance requirements, and institutional review board approvals. These regulatory requirements create ongoing compliance costs and operational constraints that must be incorporated into business model planning from early stages.

Healthcare institutions also have unique integration requirements that affect business model viability. Unlike consumer software markets where individual adoption can drive business success, healthcare AI platforms must integrate with existing electronic health record systems, clinical workflows, and institutional governance structures. This integration complexity requires substantial customer success resources and often necessitates custom development work that affects scalability and profit margins.

The content licensing landscape in healthcare presents both opportunities and challenges for clinical AI platforms. Access to high-quality medical content is essential for clinical credibility, but licensing agreements with medical publishers, professional societies, and research institutions can be expensive and complex to negotiate. OpenEvidence's partnership with NEJM represents a significant strategic achievement, but it likely involves substantial ongoing costs that must be factored into long-term business model viability.

Healthcare data privacy and security requirements create additional operational costs and compliance challenges. Clinical AI platforms must implement enterprise-grade security measures, undergo regular audits, and maintain comprehensive data governance frameworks. These requirements are essential for healthcare market credibility but represent ongoing cost centers that affect business model economics.

The competitive landscape in healthcare AI is also evolving rapidly, with large technology companies, established healthcare technology vendors, and venture-backed startups all competing for market share. This competitive pressure affects both customer acquisition costs and the pricing power of clinical AI platforms, requiring careful business model calibration to achieve sustainable unit economics.

Professional liability and clinical responsibility represent unique challenges for healthcare AI business models. Unlike consumer software applications where user errors primarily affect individual users, clinical AI tools influence medical decisions that directly impact patient safety. This creates potential liability exposure that must be managed through insurance, legal frameworks, and careful product positioning that affects both costs and market positioning.

The international expansion challenges facing healthcare AI platforms are also more complex than typical software markets. Healthcare regulations, professional licensing requirements, medical content licensing, and cultural practice patterns vary significantly across different countries and regions. This complexity affects both the cost and timeline for international scaling, requiring careful market-by-market analysis and customization.

The Multi-Dimensional Challenge of Healthcare AI Success

The comparison between DeepEvidentia and OpenEvidence illuminates the multi-dimensional nature of success in healthcare AI. While technical capabilities form the foundation of any clinical AI platform, sustainable success requires execution across multiple domains that extend far beyond the sophistication of the underlying language model or reasoning architecture.

User acquisition in healthcare requires a fundamentally different approach than typical software markets. Healthcare professionals are conservative technology adopters who require extensive validation before incorporating new tools into clinical practice. They value peer endorsement, clinical evidence, and integration with existing workflows more than cutting-edge technical features. Successful healthcare AI platforms must invest substantially in medical professional outreach, clinical validation studies, and workflow integration support.

The challenge of achieving viral adoption in healthcare cannot be overstated. OpenEvidence's success in reaching 440,000+ physician users represents an extraordinary achievement that required more than technical excellence. It required understanding of healthcare professional communication patterns, strategic timing of product launches, and careful cultivation of clinical opinion leaders who could drive peer adoption.

Content strategy represents another crucial dimension of healthcare AI success. The quality, credibility, and comprehensiveness of medical information are as important as the technology used to access it. Successful platforms must either develop substantial internal medical content capabilities or establish strategic partnerships with trusted medical authorities. This content strategy affects both initial credibility and ongoing operational costs.

Workflow integration presents technical and strategic challenges that extend beyond the core AI capabilities. Healthcare professionals work within complex, established workflows that have evolved over decades to ensure patient safety and regulatory compliance. Clinical AI platforms must integrate seamlessly into these workflows without creating additional administrative burden or disrupting established safety protocols.

The enterprise sales challenge in healthcare is particularly complex. Healthcare institutions make technology purchasing decisions through committees involving clinical leadership, information technology departments, procurement teams, and executive management. Each stakeholder group has different priorities and evaluation criteria, requiring sophisticated sales approaches that address clinical utility, technical requirements, cost-effectiveness, and strategic alignment.

Regulatory navigation represents an ongoing challenge that affects both product development and business operations. Healthcare AI platforms must anticipate evolving FDA guidelines, maintain HIPAA compliance, and adapt to changing institutional requirements. This regulatory complexity requires dedicated compliance resources and legal expertise that represent significant ongoing costs.

Quality assurance and clinical validation present unique challenges for healthcare AI platforms. Unlike consumer applications where user feedback can drive iterative improvement, clinical AI tools require rigorous validation to ensure patient safety and clinical utility. This validation process requires clinical expertise, statistical analysis capabilities, and often formal research partnerships with academic medical centers.

International expansion in healthcare faces regulatory, cultural, and content challenges that are more complex than typical software markets. Medical practice patterns, regulatory requirements, and professional standards vary significantly across different countries. Successful international expansion requires substantial localization efforts and often requires separate content partnerships and regulatory approvals for each target market.

The monetization challenge requires balancing clinical accessibility with business sustainability. Healthcare professionals expect access to high-quality clinical information, but sustainable business models require revenue generation. This tension requires sophisticated pricing strategies that align user value with willingness and ability to pay, often requiring different approaches for individual users, institutions, and international markets.

Market Dynamics and Competitive Moats

The competitive landscape in clinical AI reveals that sustainable competitive advantages extend far beyond technical capabilities to encompass network effects, content partnerships, regulatory positioning, and workflow integration. Understanding these competitive dynamics is essential for evaluating the long-term prospects of both DeepEvidentia and OpenEvidence.

Network effects in healthcare AI operate differently than in typical software markets. Rather than direct user-to-user value creation, healthcare AI platforms benefit from indirect network effects through data aggregation, clinical pattern recognition, and peer validation. As more physicians use a platform, the aggregated usage patterns provide insights that improve the system's capabilities for all users. OpenEvidence's large user base creates these network effects that become increasingly difficult for competitors to replicate.

Content partnerships represent another source of competitive advantage that is difficult to replicate. OpenEvidence's relationship with NEJM provides not just access to high-quality content but exclusive positioning in partnership negotiations with other medical publishers. These partnerships often involve exclusive or semi-exclusive arrangements that create barriers for potential competitors.

The first-mover advantage in healthcare AI is particularly significant due to the conservative nature of healthcare professional technology adoption. Once physicians become comfortable with a particular platform and integrate it into their clinical workflows, switching costs are substantial. This switching cost includes not just learning new interfaces but also re-establishing trust in clinical recommendations and adapting established practice patterns.

Regulatory positioning creates another competitive moat that becomes more significant over time. Platforms that establish early relationships with regulatory authorities, develop compliance frameworks, and demonstrate safety and efficacy through clinical studies create advantages that are difficult for later entrants to replicate. The regulatory approval process in healthcare is time-consuming and expensive, creating natural barriers to entry.

Integration partnerships with electronic health record vendors represent a crucial competitive consideration. Healthcare institutions are increasingly seeking integrated technology solutions rather than standalone applications. Platforms that achieve deep integration with major EHR systems gain substantial competitive advantages through workflow integration and reduced implementation complexity.

The enterprise sales channel in healthcare requires specialized expertise and established relationships that take years to develop. Healthcare technology sales involve complex stakeholder management, extensive validation processes, and often require clinical champions within target institutions. Companies that build successful healthcare sales organizations create competitive advantages that are difficult for new entrants to replicate quickly.

However, the rapid pace of AI technology development also creates opportunities for disruptive entry. If DeepEvidentia's technical approach proves superior in clinical utility, it could potentially overcome some traditional competitive advantages through superior user experience and clinical outcomes. The healthcare industry has shown willingness to adopt superior technologies when the clinical benefits are clear and substantial.

The venture capital dynamics in healthcare AI also affect competitive positioning. Well-funded platforms like OpenEvidence can invest aggressively in user acquisition, content partnerships, and market development. However, this advantage is balanced by the capital efficiency demonstrated by platforms like DeepEvidentia, which can achieve technical parity at dramatically lower costs.

The international market dynamics create additional competitive considerations. Different regions have varying regulatory requirements, content needs, and competitive landscapes. Success in the U.S. market does not guarantee international success, creating opportunities for regional competitors or platforms that better address local market needs.

The Execution Gap: From LLM to Healthcare Business

The transition from technical demonstration to sustainable healthcare business represents one of the most challenging execution gaps in technology entrepreneurship. DeepEvidentia's technical achievements, while impressive, represent only the beginning of the journey toward building a successful clinical AI company. Understanding this execution gap is crucial for evaluating the competitive dynamics between technical innovation and business execution.

The scaling challenge in healthcare AI extends far beyond technical infrastructure to encompass clinical validation, regulatory compliance, and operational excellence. While DeepEvidentia may have achieved technical superiority in reasoning capabilities, scaling to serve hundreds of thousands of users while maintaining clinical accuracy and system reliability requires sophisticated engineering and operational capabilities that extend far beyond the core AI functionality.

Clinical validation represents a particular challenge for healthcare AI platforms that goes beyond traditional software testing. Healthcare AI tools must demonstrate not just technical functionality but clinical utility, safety, and improved patient outcomes. This validation process typically requires clinical studies, peer review, and often collaboration with academic medical centers. The time and cost associated with rigorous clinical validation can be substantial and often determines long-term market acceptance more than technical capabilities.

User support in healthcare requires specialized expertise that differs significantly from typical software support. Healthcare professionals using clinical AI tools need support from individuals who understand medical terminology, clinical workflows, and the specific challenges of integrating AI into patient care. This support requirement affects both operational costs and hiring requirements for healthcare AI companies.

The compliance and quality assurance challenges scale exponentially with user growth. While early-stage platforms may operate with minimal oversight, successful healthcare AI companies must implement comprehensive quality control systems, maintain detailed audit trails, and demonstrate ongoing compliance with evolving regulatory requirements. These operational requirements represent significant ongoing costs and complexity.

Sales and marketing in healthcare require specialized approaches that differ from typical software markets. Healthcare professionals respond to different messaging, require different validation processes, and often require peer endorsement before adopting new technologies. Building effective healthcare sales and marketing capabilities requires substantial investment in specialized talent and often takes years to develop fully.

Partnership development in healthcare involves complex negotiations with medical publishers, professional societies, healthcare institutions, and regulatory bodies. These partnerships are often essential for credibility and market access but require specialized business development capabilities and often involve complex revenue sharing or licensing arrangements.

The international expansion challenges are particularly acute for healthcare AI platforms. Different countries have varying medical standards, regulatory requirements, and professional practices. Successful international expansion often requires separate partnerships, localized content, and navigation of different regulatory approval processes.

Financial management for healthcare AI companies involves unique challenges related to the long sales cycles, complex pricing models, and regulatory requirements typical of healthcare markets. The revenue recognition challenges associated with enterprise healthcare contracts, the compliance costs associated with healthcare data management, and the liability considerations specific to clinical decision support create financial complexity that requires specialized expertise.

The talent acquisition challenge for healthcare AI companies is particularly acute. Successful teams require combination of AI expertise, clinical knowledge, healthcare industry experience, and regulatory understanding. This talent combination is rare and expensive, affecting both scaling timelines and operational costs.

Strategic Assessment: Which Approach Will Prevail?

Evaluating the competitive prospects of DeepEvidentia versus OpenEvidence requires analysis across multiple dimensions that extend far beyond technical capabilities. While technical excellence is necessary for success in clinical AI, it is not sufficient to overcome the complex execution challenges that determine long-term market success.

From a pure technical perspective, DeepEvidentia's dual-layer O3 reasoning architecture appears superior to OpenEvidence's retrieval-based approach. The ability to engage in genuine clinical reasoning rather than simple information retrieval represents a fundamental advancement that could provide superior clinical utility. If the technical claims prove accurate in clinical testing, DeepEvidentia could offer meaningful advantages in clinical decision-making quality and physician satisfaction.

However, technical superiority alone is insufficient to overcome OpenEvidence's substantial advantages in market positioning, user adoption, and business execution. OpenEvidence's achievement of 440,000+ physician users represents a network effect and market penetration that would be extremely difficult for any competitor to replicate quickly. The viral adoption pattern and high engagement metrics suggest that the platform provides genuine clinical value that translates into strong user loyalty.

The content partnership advantage represents another significant barrier for potential competitors. OpenEvidence's relationship with NEJM and its ability to attract additional content partners create credibility and clinical utility that pure technical approaches cannot easily replicate. Healthcare professionals value information credibility as much as technical sophistication, and established medical authorities carry weight that new platforms struggle to achieve.

The funding and operational scale advantages also favor OpenEvidence in the short to medium term. The ability to invest $100+ million in user acquisition, content partnerships, enterprise sales, and international expansion creates substantial competitive advantages that are difficult to overcome through technical excellence alone. Healthcare market penetration requires sustained investment over extended periods, and well-funded platforms have significant advantages in this competition.

However, the rapid pace of AI technology development and the changing economics of AI application development create opportunities for disruptive entry. If DeepEvidentia can demonstrate meaningful clinical advantages through superior reasoning capabilities, it could potentially overcome some traditional competitive barriers. Healthcare professionals are ultimately pragmatic and will adopt tools that demonstrably improve clinical outcomes and workflow efficiency.

The capital efficiency demonstrated by DeepEvidentia also creates strategic advantages in terms of iteration speed and risk management. The ability to develop and test new approaches quickly and cheaply enables more experimental approaches and potentially faster adaptation to changing market needs. This agility could be particularly valuable in the rapidly evolving AI landscape.

The international market dynamics also create opportunities for platforms that can better address local market needs or regulatory requirements. OpenEvidence's U.S.-focused approach may create opportunities for competitors that prioritize international markets or develop more flexible approaches to regulatory compliance.

My assessment is that OpenEvidence will likely maintain its market leadership position in the near term due to its substantial advantages in user adoption, content partnerships, and operational scale. However, DeepEvidentia's technical approach represents a genuine advancement that could capture market share if it can demonstrate superior clinical utility and overcome the execution challenges associated with scaling healthcare AI businesses.

The ultimate winner in clinical AI will likely be determined not by technical capabilities alone but by the ability to execute across the full spectrum of healthcare business challenges while maintaining technical excellence. This suggests that the most successful approach may involve combination of superior technical capabilities with sophisticated healthcare business execution.

Conclusion: The Real Battle Ahead

The competition between DeepEvidentia and OpenEvidence represents more than a technical rivalry—it illuminates fundamental questions about the future of healthcare AI and the factors that will determine success in this transformative industry. While the immediate comparison focuses on reasoning capabilities versus information retrieval, the deeper contest involves different philosophies about how to build sustainable healthcare AI businesses in an industry characterized by complex stakeholder dynamics, regulatory uncertainty, and deeply entrenched workflow patterns.

From a technical standpoint, DeepEvidentia's dual-layer O3 reasoning architecture represents a genuine advancement over traditional retrieval-based systems. The ability to engage in clinical reasoning rather than simple information lookup addresses a fundamental limitation of current clinical decision support tools and could provide meaningful improvements in clinical utility and physician satisfaction. If the technical claims prove accurate, DeepEvidentia offers a superior approach to the core challenge of clinical AI: helping healthcare professionals synthesize complex medical information into actionable clinical insights.

However, the broader analysis reveals that technical excellence, while necessary, is insufficient for building successful healthcare AI companies. OpenEvidence's remarkable achievement of 440,000+ physician users, $1 billion valuation, and viral adoption patterns demonstrates that success in healthcare AI requires execution across multiple dimensions that extend far beyond the sophistication of the underlying language model.

The business model complexity analysis reveals that monetizing clinical AI requires navigation of unique healthcare industry dynamics involving conservative adoption patterns, complex purchasing processes, regulatory requirements, and stakeholder alignment challenges that differ significantly from typical software markets. OpenEvidence's comprehensive approach to these challenges—including content partnerships, enterprise sales strategy, and regulatory positioning—represents a sophisticated understanding of healthcare market realities that pure technical approaches cannot easily replicate.

The capital efficiency comparison, while striking, may be misleading when considering the full scope of building successful healthcare AI businesses. DeepEvidentia's $4,000 development cost represents impressive technical achievement, but sustainable healthcare AI companies require substantial ongoing investment in content partnerships, clinical validation, regulatory compliance, user acquisition, and operational scaling that can dwarf initial development costs.

The competitive dynamics analysis suggests that sustainable advantages in healthcare AI emerge from combination of technical capabilities, network effects, content partnerships, regulatory positioning, and workflow integration. While technical innovation creates opportunities for disruptive entry, established platforms with large user bases and sophisticated business execution capabilities possess significant competitive advantages that are difficult to overcome through technical superiority alone.

My ultimate assessment is that the winner in clinical AI will be determined by the ability to combine technical excellence with sophisticated healthcare business execution. This suggests that neither pure technical innovation nor business execution alone will be sufficient—successful healthcare AI companies must excel across both dimensions simultaneously.

For healthcare technology entrepreneurs, this analysis provides several important insights. First, technical innovation remains crucial for creating differentiated value propositions in clinical AI. DeepEvidentia's reasoning-based approach demonstrates that meaningful technical advancement is possible and can create competitive advantages. Second, technical innovation must be combined with deep understanding of healthcare industry dynamics and sophisticated business execution to achieve sustainable success. Third, the changing economics of AI development create opportunities for smaller teams to compete with well-funded incumbents, but success still requires navigation of complex healthcare business challenges.