The Hidden Cash Flow Crisis: Why Value-Based Care Providers Must Pivot from Prospective to Retrospective Risk Adjustment Excellence

Table of Contents

1. Abstract

2. Introduction: The Misaligned Focus in Value-Based Care

3. The Economics of Medicare Advantage Risk Adjustment Timing

4. Understanding the Cash Flow Implications of Prospective versus Retrospective Risk Adjustment

5. The Medicare Advantage Sweeps Period Reality

6. Technology Solutions for Retrospective Risk Adjustment Excellence

7. Datavant's Digital Infrastructure for Audit Relief

8. Strategic Partnership Opportunities in VBC Enablement

9. Conclusion: Rebalancing the Risk Adjustment Portfolio

Abstract

The value-based care industry has developed a concerning blind spot in its risk adjustment strategy. While providers and enablement companies have invested heavily in prospective risk adjustment capabilities at the point of care, they have systematically underinvested in the infrastructure required for efficient retrospective risk adjustment processes. This strategic misalignment creates significant cash flow challenges, as prospective HCC capture can take 18-24 months to translate into premium adjustments and an additional 12-24 months before providers see bonus payments. In contrast, efficient retrospective risk adjustment through automated medical record release can generate more immediate revenue impact for both Medicare Advantage plans and their provider partners. This essay examines the actuarial realities of Medicare Advantage risk adjustment timing, the cash flow implications of current industry practices, and presents a framework for leveraging digital infrastructure solutions to optimize retrospective risk adjustment processes. Through examination of companies like Datavant and their audit relief offerings, we explore how VBC enablement companies can better serve their provider partners by prioritizing release of information automation alongside traditional prospective coding initiatives.

Introduction: The Misaligned Focus in Value-Based Care

The value-based care ecosystem has reached an inflection point where the gap between strategic intention and operational execution has become a material impediment to sustainable growth. Across the industry, from venture-backed primary care platforms to established Medicare Advantage plans, organizations have poured resources into sophisticated prospective risk adjustment capabilities. These investments, while well-intentioned, reflect a fundamental misunderstanding of the cash flow dynamics that drive profitability in risk-based contracts.

The prevailing wisdom has been straightforward and seemingly logical: capture hierarchical condition categories at the point of care, ensure comprehensive documentation, and optimize coding practices to maximize risk adjustment revenue. This approach has spawned an entire cottage industry of clinical decision support tools, coding optimization platforms, and provider training programs. Yet despite these investments, many value-based care organizations continue to struggle with cash flow challenges and find themselves constantly chasing revenue that seems perpetually eighteen months away.

The root of this problem lies not in the quality of prospective risk adjustment efforts, but in the timing mismatch between when these efforts generate revenue and when organizations need cash flow to sustain operations. Meanwhile, a more immediate opportunity sits largely unaddressed: the retrospective risk adjustment process that could deliver revenue impact within quarters rather than years. This opportunity requires a different set of capabilities, centered around the efficient and automated release of medical records to payers conducting risk adjustment audits.

The Medicare Advantage industry processes billions of dollars in risk adjustment revenue annually, and the timing of when this revenue flows through the system has profound implications for every participant. Understanding these timing dynamics is not merely an academic exercise but a business imperative that separates successful value-based care organizations from those that struggle to achieve sustainable unit economics.

The Economics of Medicare Advantage Risk Adjustment Timing

To understand why retrospective risk adjustment deserves greater attention, one must first grasp the intricate timing mechanisms that govern Medicare Advantage risk adjustment revenue. The Centers for Medicare and Medicaid Services operates on a complex calendar that creates multiple lag periods between clinical encounters, risk score calculations, premium adjustments, and provider compensation.

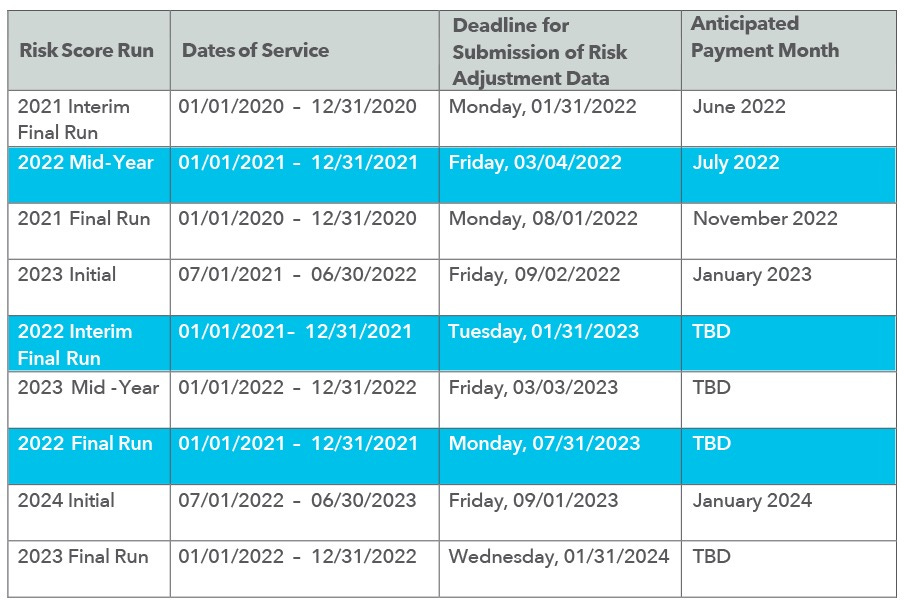

When a provider captures a hierarchical condition category during a patient encounter today, that diagnosis enters a process that unfolds over multiple calendar years. The encounter data must first be submitted to CMS through the Risk Adjustment Processing System, where it undergoes initial validation and processing. This submission occurs during specific reporting periods, with encounter data typically due to CMS by the end of January following the service year. However, the actual incorporation of this data into risk scores does not occur until CMS runs its annual risk adjustment model, which typically happens in the summer following the service year.

The calculated risk scores then feed into the premium payment process for the following year, creating a cascade of delays that can extend the time between diagnosis capture and revenue realization to eighteen months or more. For example, a diagnosis captured during a patient encounter in January 2024 would not begin generating premium revenue until January 2025, and depending on the specific timing of model runs and premium calculations, the full revenue impact might not be realized until well into 2025.

This timing challenge becomes even more complex when considering how Medicare Advantage plans share risk adjustment revenue with their provider partners. Most bonus payment programs operate on annual cycles, with performance periods that align with calendar years and payment calculations that occur months after the performance period ends. A provider capturing a diagnosis in early 2024 might not see bonus payments related to that diagnosis until late 2025 or early 2026, creating a cash flow delay that can span nearly three years.

These timing dynamics create a fundamental tension in value-based care economics. Organizations need positive cash flow to invest in care management, technology infrastructure, and provider compensation, but their prospective risk adjustment efforts generate revenue on a timeline that is poorly aligned with operational cash flow needs. This misalignment is particularly acute for venture-backed organizations that face pressure to demonstrate near-term progress toward profitability.

The retrospective risk adjustment process operates on an entirely different timeline that offers more immediate cash flow benefits. When Medicare Advantage plans conduct risk adjustment audits, they are typically reviewing encounters from previous years that are already incorporated into current premium payments. The ability to efficiently respond to these audits and provide supporting medical records can directly impact current-year revenue for both the plan and, through shared savings arrangements, the provider organization.

Understanding the Cash Flow Implications of Prospective versus Retrospective Risk Adjustment

The cash flow implications of this timing mismatch extend far beyond simple accounting considerations and strike at the heart of value-based care sustainability. Organizations that focus exclusively on prospective risk adjustment are essentially making multi-year investments with highly uncertain returns, while potentially ignoring more immediate revenue opportunities through retrospective risk adjustment excellence.

Consider the economic reality facing a typical value-based primary care organization. These companies often operate on thin margins while investing heavily in technology, care management staff, and provider compensation. The promise of risk adjustment revenue provides the foundation for these investments, but the extended timeline for revenue realization creates a working capital challenge that can persist for years.

A primary care group that successfully captures an additional fifty hierarchical condition categories per thousand patients might expect to generate several hundred thousand dollars in additional annual risk adjustment revenue. However, the cash flow profile of this revenue is heavily back-loaded, with minimal impact in year one, moderate impact in year two, and full impact not realized until year three or later. Meanwhile, the costs associated with generating this revenue, including technology investments, staff training, and care management resources, are front-loaded and must be funded from other sources.

This timing dynamic becomes particularly problematic when organizations attempt to scale rapidly or when they face unexpected operational challenges. The lag between investment and return means that organizations must maintain significant cash reserves or access to capital to bridge the gap between when they incur costs and when they realize the associated revenue benefits.

Retrospective risk adjustment processes offer a fundamentally different cash flow profile. When a Medicare Advantage plan initiates a risk adjustment audit, they are seeking medical records to support diagnoses that are already reflected in current premium payments. The plan's ability to retain these premium dollars depends on their success in the audit process, creating immediate financial incentives for both efficient record retrieval and comprehensive documentation.

Organizations that excel at retrospective risk adjustment can often see revenue impact within a single quarter. A well-designed release of information process can help plans successfully defend millions of dollars in current-year premium revenue, and the shared savings arrangements that govern most value-based care contracts mean that providers can see bonus payments related to this success within months rather than years.

The contrast in cash flow timing is stark and material. While prospective risk adjustment efforts might generate their first meaningful cash flow impact eighteen to twenty-four months after implementation, retrospective risk adjustment improvements can generate positive cash flow within ninety to one hundred twenty days. For organizations operating with limited working capital or facing pressure to demonstrate near-term profitability, this timing difference can be the determining factor in their long-term viability.

The Medicare Advantage Sweeps Period Reality

The Medicare Advantage risk adjustment audit process, commonly referred to as sweeps periods, operates according to a rigid calendar that creates both opportunities and obligations for participating organizations. Understanding the mechanics and timing of these sweeps periods is essential for any organization seeking to optimize their retrospective risk adjustment performance.

CMS conducts Risk Adjustment Data Validation audits on an annual basis, typically initiating the process in the spring following the service year under review. These audits involve the selection of a statistical sample of enrollees for each Medicare Advantage plan, with medical records requests covering diagnoses that were submitted for risk adjustment purposes. The audit timeline is compressed and unforgiving, with plans typically having thirty to sixty days to respond with comprehensive medical record documentation.

The financial stakes of these audits are enormous. CMS applies the audit results to the plan's entire membership through statistical extrapolation, meaning that a failed audit sample can result in recoupment demands that reach into the hundreds of millions of dollars for large plans. The audit failure rate across the industry has been increasing in recent years, with some estimates suggesting that plans fail to adequately support forty to sixty percent of the diagnoses included in audit samples.

The primary driver of audit failures is not clinical documentation quality but operational efficiency in the medical record retrieval and submission process. Plans and their provider partners often struggle to locate relevant medical records, extract the appropriate documentation, and submit comprehensive responses within the compressed audit timeline. These operational challenges are particularly acute for organizations that rely on manual processes or fragmented health information systems.

The sweeps period timeline creates a natural opportunity for organizations that can streamline the medical record release process. Rather than scrambling to locate and retrieve records during the compressed audit period, organizations that have invested in automated release of information capabilities can respond to audit requests with speed and comprehensiveness that directly translates to improved audit outcomes.

The revenue impact of improved audit performance is immediate and substantial. A Medicare Advantage plan that improves its audit success rate from sixty percent to eighty percent might retain tens of millions of dollars in premium revenue that would otherwise be subject to recoupment. Under typical shared savings arrangements, provider partners can see bonus payments related to this improved performance within the same fiscal year as the audit.

This immediate revenue impact stands in sharp contrast to the extended timeline associated with prospective risk adjustment efforts. Organizations that prioritize retrospective risk adjustment excellence can generate measurable improvements in cash flow within a single audit cycle, while organizations that focus exclusively on prospective efforts must wait multiple years to see comparable financial benefits.

The sweeps period reality also highlights the critical importance of operational excellence over clinical sophistication. While prospective risk adjustment often requires complex clinical decision support and provider behavior modification, retrospective risk adjustment success depends primarily on having robust systems and processes for medical record management and release. These operational capabilities are more predictable to implement and scale than clinical behavior changes.

Technology Solutions for Retrospective Risk Adjustment Excellence

The technology landscape for retrospective risk adjustment has evolved significantly in recent years, driven by the recognition that manual processes are inadequate for the scale and speed requirements of modern Medicare Advantage audit cycles. Leading organizations have moved beyond traditional health information management approaches to embrace API-driven, automated solutions that can handle high-volume medical record requests with minimal human intervention.

The core technical challenge in retrospective risk adjustment lies in the fragmentation of medical record systems and the complexity of extracting relevant documentation from diverse data sources. A typical Medicare Advantage member might receive care from multiple provider organizations, each using different electronic health record systems, with relevant clinical documentation scattered across inpatient, outpatient, laboratory, imaging, and pharmacy systems.

Traditional approaches to medical record retrieval rely heavily on manual processes, with health information management staff receiving audit requests, identifying relevant records, extracting appropriate documentation, and compiling comprehensive responses. This manual approach is not only time-intensive but also prone to errors and inconsistencies that can undermine audit success rates.

Modern technology solutions address these challenges through comprehensive automation that can integrate across diverse health information systems. These solutions typically feature API connectivity to major electronic health record platforms, automated record identification algorithms, and sophisticated document compilation workflows that can generate comprehensive audit responses with minimal human intervention.

The most advanced platforms go beyond simple record retrieval to incorporate intelligent document analysis that can identify specific clinical evidence required to support individual hierarchical condition categories. These systems can analyze clinical documentation to ensure that audit responses include all relevant evidence, reducing the risk of audit failures due to incomplete submissions.

The technical architecture for effective retrospective risk adjustment automation requires several key components. First, robust integration capabilities that can connect to diverse health information systems through standardized APIs or custom integration solutions. Second, intelligent record identification algorithms that can quickly locate relevant clinical documentation based on diagnosis codes, date ranges, and provider specifications. Third, automated document compilation workflows that can assemble comprehensive audit responses according to specific payer requirements and formatting standards.

The scalability advantages of automated solutions become particularly apparent during peak audit periods when plans might receive hundreds or thousands of medical record requests within compressed timeframes. Manual processes that might be adequate for routine operations quickly become overwhelmed during these high-volume periods, while automated solutions can maintain consistent performance regardless of request volume.

Security and compliance considerations are paramount in any retrospective risk adjustment technology solution. These systems must handle protected health information according to HIPAA requirements while maintaining audit trails and access controls that satisfy both regulatory requirements and payer specifications. The most sophisticated platforms incorporate advanced encryption, role-based access controls, and comprehensive logging capabilities that provide complete visibility into all system activities.

Datavant's Digital Infrastructure for Audit Relief

Datavant has emerged as a particularly compelling example of how purpose-built technology infrastructure can transform retrospective risk adjustment operations. Their audit relief and request automation offerings represent a fully digital approach to medical record release that addresses many of the operational challenges that have historically plagued the industry.

The core innovation in Datavant's approach lies in their comprehensive API-driven architecture that can integrate seamlessly with existing health information systems while providing sophisticated automation capabilities. Rather than requiring organizations to replace their existing electronic health record systems or health information management workflows, Datavant's platform can overlay these existing systems to provide enhanced automation and efficiency.

Their request automation capability addresses one of the most time-intensive aspects of traditional medical record release processes. When a payer initiates an audit request, the Datavant platform can automatically identify relevant medical records across multiple systems, extract appropriate documentation, and compile comprehensive responses according to specific payer requirements. This automation can reduce response times from weeks to days while improving the comprehensiveness and accuracy of audit submissions.

The audit relief offering goes beyond simple automation to provide intelligent analysis of audit requests and medical record content. The platform can analyze clinical documentation to identify potential gaps or inconsistencies that might lead to audit failures, allowing organizations to proactively address these issues before submitting their responses. This proactive approach can significantly improve audit success rates and reduce the risk of revenue recoupment.

Datavant's digital infrastructure also provides valuable analytics and reporting capabilities that can help organizations optimize their retrospective risk adjustment performance over time. The platform tracks audit response times, success rates, and failure patterns to identify opportunities for process improvement and system optimization. These insights can inform strategic decisions about technology investments, workflow redesign, and staff training priorities.

The scalability of Datavant's platform is particularly valuable for organizations managing large Medicare Advantage populations or complex provider networks. The platform can handle high-volume audit periods without degradation in performance, ensuring that organizations can maintain consistent response times and quality regardless of request volume. This scalability is essential for organizations seeking to grow their Medicare Advantage business without proportional increases in administrative overhead.

The integration capabilities of Datavant's platform extend beyond traditional electronic health record systems to encompass laboratory systems, imaging platforms, pharmacy databases, and other sources of clinical information. This comprehensive integration approach ensures that audit responses include all relevant clinical documentation, reducing the risk of failures due to incomplete submissions.

From a strategic perspective, Datavant's offerings represent a fundamental shift from viewing medical record release as a necessary administrative burden to viewing it as a core operational capability that directly impacts financial performance. Organizations that embrace this perspective and invest in appropriate technology infrastructure can transform retrospective risk adjustment from a cost center into a revenue driver.

Strategic Partnership Opportunities in VBC Enablement

The opportunity to integrate sophisticated retrospective risk adjustment capabilities into value-based care enablement platforms represents one of the most compelling partnership opportunities in the current healthcare technology landscape. As SVP of Provider Partnerships, I have observed firsthand how VBC enablement companies can differentiate themselves and deliver immediate value to their provider partners by prioritizing release of information automation alongside traditional prospective coding initiatives.

The strategic rationale for these partnerships extends beyond simple technology integration to encompass fundamental improvements in the value proposition that enablement companies can offer to their provider partners. Most VBC enablement platforms focus heavily on prospective risk adjustment capabilities, offering clinical decision support, coding optimization, and provider training programs. While these capabilities are valuable, they generate benefits on the extended timeline discussed earlier in this analysis.

By incorporating sophisticated retrospective risk adjustment capabilities, enablement companies can offer their provider partners more immediate cash flow benefits while also improving the long-term sustainability of their risk-based contracts. This dual benefit creates a more compelling value proposition that can accelerate provider adoption and improve contract retention rates.

The technical integration of retrospective risk adjustment capabilities into existing VBC enablement platforms requires careful consideration of workflow design and user experience optimization. Provider organizations are already managing complex workflows around prospective risk adjustment, care management, and quality reporting. Adding retrospective risk adjustment capabilities without careful integration can create workflow fragmentation and reduce overall system adoption.

The most successful integration approaches focus on creating unified workflows that seamlessly blend prospective and retrospective risk adjustment activities. For example, when a provider reviews a patient's risk adjustment profile for prospective coding opportunities, the platform can simultaneously display any pending retrospective audit requests related to that patient and provide streamlined workflows for addressing both requirements.

Data integration represents another critical success factor in these partnership initiatives. Retrospective risk adjustment automation requires access to comprehensive clinical data across multiple systems and time periods. VBC enablement platforms that have already invested in robust clinical data integration capabilities are well-positioned to extend these capabilities to support retrospective risk adjustment requirements.

The market opportunity for these integrated solutions is substantial and growing rapidly. The Medicare Advantage market continues to expand, with enrollment projected to reach forty million beneficiaries by 2030. As enrollment grows and CMS intensifies its audit activities, the demand for sophisticated retrospective risk adjustment capabilities will only increase.

Provider organizations are also becoming more sophisticated in their evaluation of VBC enablement solutions. Early adopters may have been satisfied with basic prospective risk adjustment capabilities, but mature organizations increasingly demand comprehensive solutions that address the full spectrum of risk-based contract requirements. Enablement companies that can demonstrate immediate cash flow benefits through retrospective risk adjustment excellence will have significant competitive advantages in this evolving market.

The partnership opportunity extends beyond technology integration to encompass comprehensive service delivery models. Many provider organizations lack the internal expertise to optimize their retrospective risk adjustment performance, creating opportunities for enablement companies to provide managed services that combine technology automation with expert oversight and optimization.

From my perspective as someone focused on expanding these capabilities across provider groups heavily involved in Medicare Advantage risk contracts, the key to successful partnerships lies in understanding the specific operational challenges and cash flow requirements of different provider organization types. Primary care groups, specialist practices, and health systems each face unique challenges in managing retrospective risk adjustment requirements, and successful enablement solutions must be flexible enough to address these diverse needs.

The most compelling partnership opportunities involve enablement companies that can demonstrate measurable improvements in both immediate cash flow and long-term contract performance. Organizations that can show providers how to generate positive returns within the first year of implementation while also building sustainable risk adjustment capabilities for the future will capture the largest market share in this evolving landscape.

Conclusion: Rebalancing the Risk Adjustment Portfolio

The value-based care industry stands at a critical juncture where strategic realignment is both necessary and urgent. The continued focus on prospective risk adjustment at the expense of retrospective capabilities represents a fundamental misunderstanding of cash flow dynamics and revenue optimization opportunities. Organizations that recognize this misalignment and take action to rebalance their risk adjustment portfolios will establish significant competitive advantages in an increasingly challenging market environment.

The evidence presented throughout this analysis demonstrates that retrospective risk adjustment excellence offers superior cash flow characteristics compared to prospective initiatives. While prospective risk adjustment remains important for long-term revenue optimization, the immediate financial benefits of improved retrospective performance make it the more pressing strategic priority for most organizations. The timing mismatch between prospective risk adjustment investments and revenue realization creates unsustainable cash flow pressures that can undermine organizational viability regardless of the quality of clinical operations.

The technology infrastructure required to achieve retrospective risk adjustment excellence has matured to the point where comprehensive automation is both technically feasible and economically attractive. Companies like Datavant have demonstrated that API-driven solutions can transform medical record release processes from manual, error-prone activities into streamlined, automated workflows that deliver measurable improvements in audit success rates and cash flow timing.

The strategic implications extend beyond individual organizational performance to encompass the entire value-based care ecosystem. Medicare Advantage plans that work with providers capable of excellent retrospective risk adjustment performance will achieve better audit outcomes and retain more premium revenue. This improved performance benefits all participants in the risk-sharing arrangement and creates positive feedback loops that support sustainable contract relationships.

For VBC enablement companies, the opportunity to integrate sophisticated retrospective risk adjustment capabilities represents a clear path to differentiation and improved provider value propositions. The organizations that move quickly to develop these capabilities and establish strategic partnerships with leading technology providers will capture disproportionate market share as the industry recognizes the importance of comprehensive risk adjustment excellence.

The Medicare Advantage market dynamics that drive these opportunities will only intensify over time. As CMS continues to refine its audit processes and increase oversight of risk adjustment practices, the premium placed on operational excellence in retrospective risk adjustment will continue to grow. Organizations that establish these capabilities early will benefit from first-mover advantages that compound over time.

From a broader industry perspective, the shift toward retrospective risk adjustment excellence represents a maturation of value-based care operations. Early industry participants focused primarily on clinical transformation and prospective risk capture because these activities were more intuitive and aligned with traditional healthcare delivery models. The recognition that administrative excellence and operational efficiency are equally important for sustainable success represents a natural evolution toward more sophisticated business practices.

The cash flow benefits of retrospective risk adjustment excellence also create opportunities for accelerated industry growth and innovation. Organizations that can generate positive cash flow more quickly can invest more aggressively in care management, technology infrastructure, and provider compensation. This accelerated investment cycle can drive improvements in clinical outcomes and patient satisfaction that support long-term contract sustainability and market expansion.

The competitive landscape will increasingly reward organizations that demonstrate comprehensive risk adjustment capabilities spanning both prospective and retrospective activities. The organizations that recognize this trend early and make appropriate investments will establish sustainable competitive advantages, while those that continue to focus exclusively on prospective activities will find themselves at increasing disadvantage in both contract negotiations and operational performance.

The path forward requires thoughtful integration of retrospective risk adjustment capabilities into existing operational workflows and technology platforms. Organizations should prioritize automation investments that can deliver immediate cash flow benefits while building toward more comprehensive risk adjustment excellence over time. The key is to view retrospective risk adjustment not as a compliance burden but as a strategic capability that directly impacts financial performance and competitive positioning.

As the industry continues to evolve, the organizations that achieve the optimal balance between prospective and retrospective risk adjustment excellence will emerge as the sustainable leaders in value-based care. The window of opportunity for establishing these capabilities remains open, but it will not remain so indefinitely. The time for strategic realignment is now, and the organizations that act decisively will reap the benefits for years to come.