The Hidden Infrastructure Arbitrage: How Real-Time Eligibility APIs and Machine-Readable Files Are Creating New Digital Health Business Models

Disclaimer: The thoughts and opinions expressed in this essay are my own and do not reflect the views of my employer.

Abstract

The healthcare technology landscape is experiencing a fundamental shift as previously opaque data streams become accessible through modern APIs and regulatory transparency requirements. This essay examines how the convergence of real-time eligibility verification systems, comprehensive provider directories, and payer machine-readable files creates unprecedented opportunities for digital health entrepreneurs. By treating these compliance artifacts as infrastructure layers rather than mere regulatory requirements, technical leaders can architect novel business models that address market inefficiencies in healthcare pricing, coverage verification, and risk assessment. The analysis presents seven distinct business model archetypes, providing technical implementation guidance using Stedi's real-time eligibility API, Purple Lab's provider directory, and payer MRF data as foundational infrastructure components.

Table of Contents

The Infrastructure Renaissance in Healthcare Data

Technical Architecture Foundations

Seven Business Model Archetypes

Dynamic Benefits Marketplace

Real-Time Eligibility as Credit Underwriting Signal

Provider Growth Hacking via Payer MRF Mining

Micro-Insurance and Episodic Coverage Bundles

Employer Plan Optimization SaaS

Fraud and Abuse Analytics Platform

Network-as-a-Service

Implementation Strategies and Technical Considerations

Market Dynamics and Competitive Positioning

Regulatory Considerations and Risk Mitigation

Future Infrastructure Evolution

---

The healthcare technology sector stands at an inflection point where compliance requirements are inadvertently creating some of the most valuable infrastructure layers in the industry. While most organizations view EDI transactions and machine-readable files as regulatory burdens, a growing cohort of technical leaders recognizes these data streams as the foundation for entirely new business models. The convergence of real-time eligibility APIs, comprehensive provider directories, and payer transparency data represents more than incremental improvement in healthcare administration—it constitutes a fundamental restructuring of how healthcare commerce operates at the infrastructure level.

The traditional healthcare technology stack has long suffered from information asymmetries that create inefficiencies throughout the care delivery process. Patients navigate complex benefit structures without understanding their financial exposure. Providers struggle to verify coverage and estimate costs before delivering services. Payers maintain pricing opacity that prevents meaningful competition. These inefficiencies persist not because of technical limitations, but because the underlying data infrastructure has remained fragmented and inaccessible to innovation.

Recent regulatory developments have begun to dismantle these information silos. The CMS price transparency rules require payers to publish machine-readable files containing negotiated rates and historical claims data. The 21st Century Cures Act mandates API access to patient data. The No Surprises Act creates new requirements for cost estimation and balance billing protection. While these regulations emerged from policy objectives around transparency and patient rights, their technical implementation creates infrastructure primitives that enable sophisticated new business models.

The most compelling opportunities emerge when these regulatory data streams are combined with modern API infrastructure. Stedi's real-time eligibility API transforms the traditional EDI 270/271 transaction flow into a developer-friendly interface that enables real-time coverage verification at scale. Purple Lab's provider directory aggregates and normalizes provider network data across multiple sources. When these components are combined with payer MRF data parsing capabilities, the result is a comprehensive healthcare commerce infrastructure stack that enables business models previously impossible to implement.

The technical architecture required to capitalize on these opportunities differs significantly from traditional healthcare IT approaches. Rather than building monolithic applications that handle specific use cases, successful implementations treat eligibility verification, provider directories, and pricing data as composable infrastructure services. This architectural pattern enables rapid experimentation with new business models while maintaining the reliability and compliance requirements essential in healthcare.

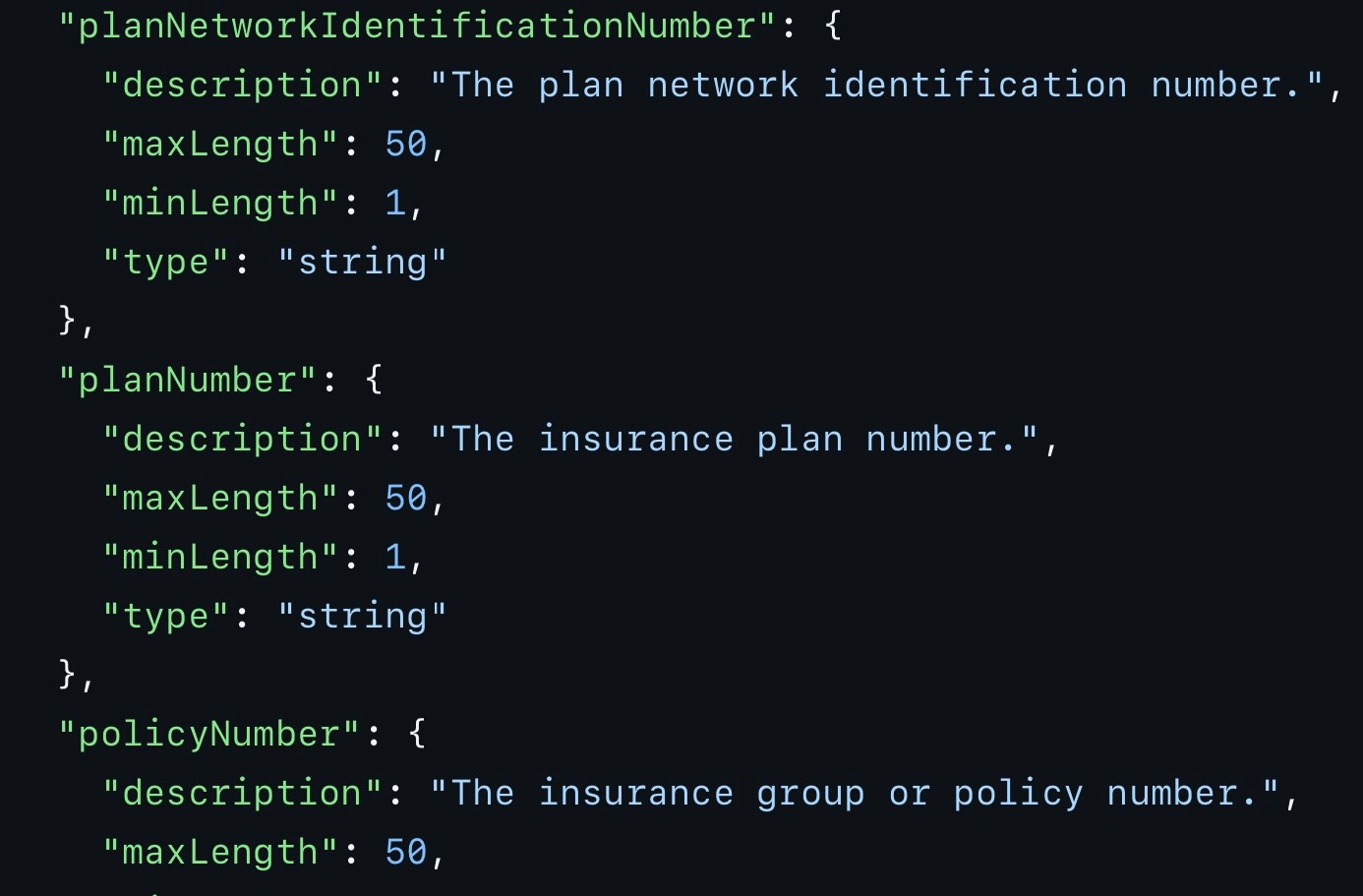

Understanding the technical implementation details becomes crucial for CTOs evaluating these opportunities. Stedi's eligibility API abstracts the complexity of EDI transaction processing while maintaining the real-time performance characteristics essential for point-of-care applications. The API accepts standard eligibility inquiry parameters including member information, provider details, and service type codes, returning structured responses that include coverage status, benefit limitations, copayment amounts, and deductible information. The service handles the underlying EDI formatting, transmission protocols, and payer routing requirements that traditionally required specialized healthcare IT expertise.

The integration process begins with authentication through Stedi's OAuth 2.0 implementation, followed by API key provisioning for production environments. Eligibility inquiries are submitted via RESTful endpoints that accept JSON payloads containing member demographics and service-specific parameters. Response times typically range from 200 milliseconds to 2 seconds depending on payer system performance, enabling real-time integration into clinical workflows and patient-facing applications.

Purple Lab's provider directory API provides normalized access to provider network information across multiple payers and geographic regions. The service aggregates data from payer provider directories, CMS databases, and proprietary sources to create a comprehensive view of provider network participation, specialty classifications, and practice location details. This aggregation becomes particularly valuable when combined with eligibility verification, as it enables applications to determine not only whether a patient has coverage, but whether specific providers are in-network for their particular plan.

Machine-readable files from payers represent the third critical infrastructure component. These files, required by CMS transparency rules, contain detailed negotiated rate information for covered services. The technical challenge lies in parsing and normalizing data across hundreds of payer files, each with slightly different schemas and formatting conventions. Successful implementations typically involve automated ETL pipelines that can process MRF updates on a regular schedule while handling schema variations and data quality issues.

The convergence of these infrastructure components enables several distinct business model archetypes, each addressing specific market inefficiencies through novel applications of the underlying data streams.

The Dynamic Benefits Marketplace represents perhaps the most consumer-facing application of this infrastructure stack. The concept leverages real-time eligibility verification to determine a patient's current coverage status and benefit structure, then overlays MRF data to provide accurate cost estimates for specific services across multiple providers. The technical implementation requires sophisticated data integration to match service codes across eligibility responses and MRF pricing structures, while accounting for patient-specific factors like deductible status and copayment requirements.

The business model potential becomes apparent when considering the current state of healthcare price transparency. Patients routinely receive surprise bills because they lack access to accurate cost information before receiving services. Providers struggle to collect payment because patients cannot budget for healthcare expenses. A marketplace that provides real-time, personalized cost estimates addresses both problems while creating new revenue opportunities through provider advertising, patient financing integration, and data insights monetization.

Technical implementation requires careful attention to data freshness and accuracy. Eligibility information changes frequently as patients switch plans or exhaust benefits. MRF data updates monthly or quarterly depending on payer policies. The application architecture must handle these update cycles while providing users with appropriate data freshness indicators. Caching strategies become critical for performance, but must balance speed with accuracy requirements in healthcare contexts where stale data can have significant financial consequences.

The Real-Time Eligibility as Credit Underwriting Signal business model explores an entirely different application of the same infrastructure. Healthcare coverage status provides valuable signals about individual financial stability and creditworthiness that traditional underwriting models often miss. Active health insurance coverage, deductible status, and coordination of benefits information can serve as proxy indicators for employment status, income stability, and financial responsibility.

This approach becomes particularly relevant in healthcare financing contexts where traditional credit scores may not accurately reflect ability to pay for medical services. High-deductible health plan members may have excellent credit scores but struggle to pay large medical bills. Conversely, individuals with limited credit history may have comprehensive health coverage that indicates stable employment and financial planning capability.

The technical implementation requires careful handling of HIPAA and fair credit reporting requirements while extracting meaningful signals from eligibility data. Machine learning models can identify patterns in coverage types, benefit utilization, and coordination of benefits that correlate with payment behavior. The resulting risk scores can be integrated into healthcare-specific lending products, payment plan eligibility determination, or prior authorization processes.

Provider Growth Hacking via Payer MRF Mining represents a more targeted application focused on provider revenue optimization. By analyzing MRF data for pricing variations across similar services and geographic markets, providers can identify opportunities to optimize their service mix and pricing strategies. The technical challenge involves processing large volumes of MRF data to identify statistical outliers and arbitrage opportunities while accounting for legitimate differences in service complexity and market conditions.

Implementation typically involves data science workflows that parse MRF files across multiple payers to identify services with unusually high reimbursement variance. These opportunities are then cross-referenced with eligibility data to determine whether the provider's existing patient population could support expansion into high-margin service lines. The analysis might reveal that certain diagnostic procedures are reimbursed at significantly higher rates by specific payers, suggesting opportunities to target marketing efforts or adjust service capacity.

Micro-Insurance and Episodic Coverage Bundles address the growing prevalence of high-deductible health plans and coverage gaps in traditional insurance products. Real-time eligibility verification enables instant identification of coverage limitations or exclusions at the point of service. When combined with MRF pricing data, this creates opportunities to offer targeted, episodic insurance products that fill specific coverage gaps for individual encounters.

The technical architecture requires integration with point-of-care systems to trigger coverage analysis at the appropriate moments in clinical workflows. When eligibility verification identifies a coverage gap or high patient responsibility amount, the system can instantly price and offer supplemental coverage options. Payment processing, underwriting automation, and claims administration must all operate within the timeframe of a typical clinical encounter.

Employer Plan Optimization SaaS applies these data streams to the group insurance market, where employers struggle to evaluate plan performance and optimize benefit designs. By combining MRF data analysis with simulated eligibility scenarios based on employee demographics and utilization patterns, the platform can provide continuous optimization recommendations for employer-sponsored health plans.

Implementation requires sophisticated modeling capabilities that can simulate different plan designs against actual utilization patterns derived from eligibility verification patterns and claims cost estimates from MRF data. The platform might identify opportunities to modify network configurations, adjust benefit structures, or implement targeted wellness programs based on quantitative analysis of plan performance metrics.

Fraud and Abuse Analytics Platform leverages the combination of eligibility verification patterns and MRF pricing anomalies to identify potentially fraudulent billing practices. Providers who consistently bill at statistical outliers from MRF negotiated rates while targeting patients with specific coverage characteristics may indicate coordination of benefits abuse or upcoding schemes.

The technical implementation involves pattern recognition algorithms that can identify suspicious correlations between eligibility verification requests, billing patterns, and pricing anomalies across multiple data sources. Machine learning models can flag unusual combinations of patient coverage profiles and provider billing patterns for further investigation by payer fraud departments or regulatory authorities.

Network-as-a-Service represents the most infrastructure-focused business model, positioning eligibility verification and pricing data as utility services for other digital health applications. Rather than building specific use case applications, this approach provides developer-friendly APIs that abstract the complexity of healthcare data integration for other companies building patient-facing or provider-facing applications.

The technical architecture requires high availability, low latency, and extensive monitoring capabilities to support other applications' reliability requirements. Documentation, SDKs, and developer tools become critical success factors. The business model typically involves usage-based pricing that scales with customer application growth while maintaining predictable cost structures for customers during development phases.

Successful implementation of these business models requires careful attention to several technical and operational considerations. Healthcare data integration involves significantly more complexity than typical API integrations due to regulatory compliance requirements, data quality variability, and the high stakes of accuracy in healthcare contexts. Error handling strategies must account for scenarios where incorrect eligibility or pricing information could result in patient financial harm or regulatory violations.

Data privacy and security requirements in healthcare exceed those in most other industries. HIPAA compliance affects not only data storage and transmission practices, but also logging, monitoring, and debugging processes. Business associate agreements become essential for any service handling protected health information. Security architectures must protect against both external threats and unauthorized internal access while maintaining audit trails for regulatory compliance.

Performance requirements in healthcare often involve real-time constraints that affect user experience and clinical workflows. Eligibility verification delays can disrupt patient check-in processes. Pricing estimate delays can interrupt clinical decision-making. The technical architecture must prioritize availability and performance while maintaining data accuracy and security requirements.

Scalability considerations become particularly important as healthcare applications often experience unpredictable usage patterns driven by seasonal variations, public health events, or changes in insurance plan designs. The infrastructure must handle traffic spikes during open enrollment periods while maintaining cost efficiency during lower usage periods.

Market dynamics in healthcare technology differ significantly from consumer technology markets. Sales cycles are longer, decision-making involves multiple stakeholders, and regulatory considerations affect adoption timelines. Technical leaders must balance architectural flexibility with the stability and compliance requirements that healthcare organizations demand.

Competitive positioning often depends more on regulatory expertise and healthcare domain knowledge than pure technical capabilities. Understanding the nuances of EDI transaction flows, payer business models, and clinical workflows becomes essential for successful product development. Technical teams benefit from healthcare industry experience or strong partnerships with healthcare domain experts.

Customer acquisition strategies must account for the conservative nature of healthcare organizations and the importance of compliance documentation in purchasing decisions. Technical demonstrations must address not only functional capabilities, but also security, compliance, and reliability considerations that healthcare buyers prioritize.

Revenue model selection affects both technical architecture decisions and go-to-market strategies. Transaction-based pricing aligns with usage patterns but requires careful cost management. Subscription models provide predictable revenue but must demonstrate ongoing value. Platform models require significant investment in developer tools and ecosystem development.

Regulatory considerations permeate every aspect of healthcare technology development. HIPAA privacy and security rules affect technical architecture decisions. State insurance regulations may limit certain business models. Federal transparency requirements create opportunities but also compliance obligations. Anti-kickback statutes and Stark law provisions may restrict certain revenue sharing arrangements with healthcare providers.

Technical teams must develop expertise in healthcare regulatory frameworks or establish strong relationships with healthcare attorneys and compliance professionals. Regulatory change management processes become essential as healthcare regulations evolve frequently. The technical architecture must accommodate regulatory changes without requiring major system redesigns.

Risk mitigation strategies must address both technical and business risks specific to healthcare contexts. Data breach incidents carry significantly higher costs and regulatory consequences than in other industries. Accuracy errors can result in patient financial harm and regulatory penalties. Service availability issues can disrupt patient care and provider operations.

Insurance coverage for technology errors and omissions becomes particularly important in healthcare contexts. Professional liability considerations may apply to certain applications that provide clinical decision support or financial recommendations. Business continuity planning must account for healthcare organizations' 24/7 operational requirements.

Looking toward future infrastructure evolution, several trends suggest expanding opportunities for these business models. Interoperability requirements continue to expand the scope of data available through standardized APIs. Price transparency regulations are likely to become more comprehensive and include additional healthcare sectors. Consumer expectations for digital healthcare experiences continue to rise, creating demand for more sophisticated applications of healthcare data.

Artificial intelligence and machine learning capabilities will likely enhance the value of healthcare data infrastructure by enabling more sophisticated pattern recognition, predictive analytics, and automated decision-making. Natural language processing advances may enable better extraction of insights from unstructured healthcare data. Computer vision capabilities could extend these business models into medical imaging and diagnostic contexts.

The regulatory environment continues to evolve in directions that generally favor increased transparency and interoperability. The CMS Interoperability and Patient Access final rule expands API requirements for Medicare Advantage and Medicaid managed care plans. The 21st Century Cures Act implementation continues to drive adoption of standardized APIs across healthcare organizations. State-level price transparency initiatives are expanding beyond federal requirements.

Technical standards evolution affects infrastructure development priorities. FHIR adoption continues to accelerate across healthcare organizations. SMART on FHIR enables more sophisticated healthcare application integration. HL7 standards development incorporates modern API design principles while maintaining healthcare-specific functionality.

The convergence of real-time eligibility APIs, provider directories, and machine-readable files represents more than incremental improvement in healthcare data access. These infrastructure components enable fundamental changes in how healthcare commerce operates by eliminating information asymmetries that have long created inefficiencies in the healthcare market. Technical leaders who recognize the strategic value of these infrastructure layers can build businesses that capture value from market inefficiencies while improving healthcare accessibility and affordability.

Success in this space requires balancing technical innovation with deep understanding of healthcare regulatory requirements, business models, and operational constraints. The most promising opportunities emerge when technical capabilities are applied to address specific healthcare market failures rather than attempting to replicate consumer technology models in healthcare contexts.

The business models outlined in this analysis represent just the beginning of what becomes possible when healthcare data infrastructure reaches sufficient maturity and accessibility. As API coverage expands and data quality improves, additional opportunities will emerge for technical teams willing to invest in understanding both the technology and the healthcare domain expertise required for successful implementation.

For CTOs evaluating these opportunities, the key strategic decision involves determining whether to build healthcare data integration capabilities internally or leverage specialized infrastructure services like Stedi's eligibility API and Purple Lab's provider directory. The technical complexity and regulatory requirements favor specialized services for most organizations, allowing technical teams to focus on application logic and user experience rather than healthcare data integration challenges.

The infrastructure renaissance in healthcare data creates unprecedented opportunities for digital health innovation. Technical leaders who understand both the capabilities and constraints of this emerging infrastructure landscape are positioned to build the next generation of healthcare technology companies. The organizations that succeed will be those that treat compliance requirements as infrastructure opportunities rather than regulatory burdens, unlocking new business models that improve healthcare outcomes while capturing value from market inefficiencies that have persisted for decades.