The Hidden Infrastructure: Claims Adjudication Interoperability in Healthcare

Disclaimer: The thoughts and opinions expressed in this essay are my own and do not reflect the views or positions of my employer.

Table of Contents

Abstract

Introduction

The Current State of Claims Adjudication Platforms

Technical Architecture of Core Adjudication Systems

Interoperability Challenges in Claims Processing

Use Cases for Claims Adjudication Interoperability

Economic and Strategic Implications

Technical Solutions and Implementation Pathways

Market Dynamics and Competitive Landscape

Future Outlook and Emerging Opportunities

Conclusion

Abstract

While Electronic Health Record interoperability dominates healthcare technology discourse, the equally critical infrastructure of claims adjudication platforms remains largely siloed and fragmented. This essay examines the current state of interoperability among core adjudication platforms, analyzing technical barriers, economic incentives, and strategic opportunities for creating seamless claim processing ecosystems. Through detailed analysis of platform architectures, data standards, and market dynamics, we explore compelling use cases for claims adjudication interoperability that could unlock significant value for payers, providers, and technology vendors. The analysis reveals that while technical solutions exist, market incentives and competitive dynamics present more formidable barriers to achieving meaningful interoperability than previously recognized.

Introduction

In the grand theater of healthcare technology transformation, Electronic Health Records have commanded center stage for over a decade, with interoperability serving as both the holy grail and the perpetual challenge that keeps entrepreneurs and investors captivated. Yet beneath this well-lit stage lies a vast and equally complex infrastructure that processes over four billion healthcare claims annually in the United States alone, representing more than four trillion dollars in healthcare spending. This hidden infrastructure, composed of core adjudication platforms and claims processing systems, operates with a level of fragmentation and isolation that would make even the most cynical Electronic Health Record interoperability skeptic blush.

The irony is palpable. While we obsess over whether a patient's allergy information can seamlessly flow from one hospital system to another, we largely ignore the fact that the financial backbone of healthcare operates through a patchwork of proprietary systems that communicate about as effectively as diplomats during a Cold War standoff. This disconnect becomes even more striking when we consider that claims data represents one of the most standardized, structured, and economically motivated datasets in all of healthcare, yet remains trapped in organizational silos that would make medieval guild systems seem progressive.

The stakes of this fragmentation extend far beyond mere technical elegance. In an era where value-based care models demand sophisticated risk adjustment, where alternative payment models require real-time financial transparency, and where artificial intelligence promises to revolutionize everything from fraud detection to clinical decision support, the inability of core adjudication platforms to communicate effectively represents a fundamental constraint on innovation. It is as if we were trying to build a modern financial services ecosystem on top of a banking infrastructure where Chase and Wells Fargo could not process transfers between each other.

This essay ventures into the underexplored territory of claims adjudication interoperability, examining not just the technical dimensions of the challenge, but the economic incentives, competitive dynamics, and strategic opportunities that shape this critical infrastructure. For the health tech entrepreneur and investor, understanding these dynamics represents more than academic curiosity. It offers a lens through which to identify potentially transformative opportunities in a market segment that processes more financial transactions than the New York Stock Exchange, yet operates with technology architectures that would be considered antiquated in virtually any other industry processing similar volumes and values.

The complexity of claims adjudication interoperability cannot be understated. Unlike clinical data, which deals primarily with information sharing and care coordination, claims data involves real-time financial transactions, complex business rules, and regulatory compliance requirements that create unique technical and operational challenges. The systems that process these claims have evolved over decades to optimize for performance, accuracy, and regulatory compliance, often at the expense of flexibility and interoperability. Understanding why these trade-offs were made, and how they might be reconsidered in light of changing market dynamics, provides crucial insight into both the challenges and opportunities in this space.

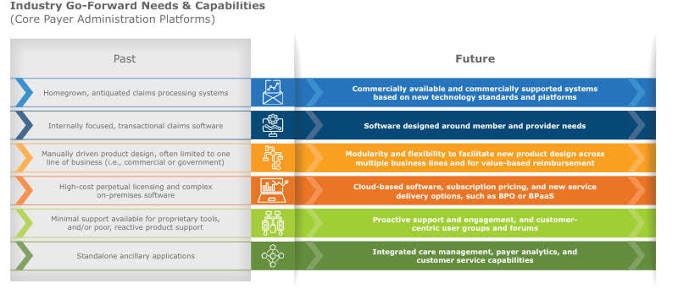

The Current State of Claims Adjudication Platforms

To understand the interoperability challenges facing claims adjudication, one must first appreciate the Byzantine complexity of the current ecosystem. The landscape is dominated by a handful of major platform providers, each serving different segments of the market with architectures that evolved during the mainframe era and have been incrementally modernized through decades of patches, upgrades, and bolt-on solutions. This evolutionary approach has created systems that are simultaneously sophisticated in their business logic and primitive in their ability to communicate with external systems.

The enterprise claims adjudication market is largely controlled by four major players, each with distinct architectural philosophies and market positioning strategies. TriZetto, now part of Cognizant, commands significant market share with its QNXT platform, which processes claims for health plans covering over one hundred million lives. The platform's strength lies in its comprehensive rule engine and configurability, allowing health plans to implement complex coverage policies and prior authorization workflows. However, this flexibility comes at the cost of standardization, as each implementation tends to become a unique snowflake of customized business rules and data structures.

Change Healthcare's FacetsCore represents another major architectural approach, built around a service-oriented architecture that theoretically enables greater modularity and integration capabilities. The platform processes claims for some of the largest health plans in the country, handling peak loads that exceed one million claims per day during busy periods. Yet despite its modern architectural foundations, FacetsCore implementations typically require extensive customization and integration work to communicate effectively with external systems, even other FacetsCore installations.

The legacy systems landscape includes platforms like Unisys and IBM, which continue to power significant portions of the Medicaid and Medicare Advantage markets despite architectures that date back to the 1980s. These systems process claims with remarkable reliability and efficiency, often handling complex government program requirements that newer platforms struggle to replicate. However, their integration capabilities are limited to batch file transfers and rudimentary web services that require significant middleware to achieve anything approaching real-time interoperability.

More recent entrants like Apixio and Waystar have attempted to modernize the claims processing landscape with cloud-native architectures and API-first designs. These platforms promise greater interoperability and easier integration, yet they face the challenge of competing against incumbent systems that have decades of business rule refinement and regulatory compliance built into their core functionality. The result is often a hybrid environment where modern platforms handle specific functions while legacy systems continue to process the bulk of claims volume.

The technical architecture of these platforms reveals why interoperability remains so challenging. Most core adjudication systems were designed as monolithic applications with tightly coupled components, making it difficult to expose specific functions or data elements without compromising system integrity. The business logic for claims processing is often embedded directly in stored procedures and application code, rather than being exposed through standardized APIs that external systems could easily consume.

Database architectures vary significantly across platforms, with some using proprietary data models optimized for high-volume transaction processing, while others have adopted more standard relational structures. This diversity in underlying data architecture makes it challenging to create universal translation layers or common data models that could facilitate interoperability. Even basic concepts like member identification, provider taxonomy, and service coding can vary significantly in how they are represented and stored across different platforms.

The situation becomes even more complex when considering the customization layer that sits on top of these core platforms. Health plans typically invest millions of dollars and years of effort in configuring these systems to meet their specific business requirements, regulatory obligations, and operational workflows. This customization creates a unique fingerprint for each implementation that makes standardized integration approaches nearly impossible. What works for integrating with one health plan's claims system may be completely incompatible with another plan using the same underlying platform.

Security and compliance requirements add another layer of complexity to the interoperability challenge. Claims adjudication platforms must comply with HIPAA privacy and security requirements, state insurance regulations, and various federal oversight mandates. These compliance requirements often drive architectural decisions that prioritize data isolation and access controls over interoperability and data sharing. The result is systems that are designed to be impermeable fortresses rather than interconnected nodes in a broader ecosystem.

The performance requirements of claims adjudication also influence architectural decisions in ways that limit interoperability. These systems must process enormous volumes of claims data with sub-second response times while maintaining perfect accuracy in financial calculations. This performance imperative often leads to architectural optimizations that sacrifice flexibility and standardization in favor of raw processing speed and reliability. Adding interoperability layers or external API calls can introduce latency and potential failure points that system architects are reluctant to accept.

Technical Architecture of Core Adjudication Systems

The technical foundations of claims adjudication platforms reveal a fascinating tension between the need for high-performance transaction processing and the desire for modern, interoperable system design. Understanding these architectural choices provides crucial insight into why interoperability remains so challenging and where the most promising opportunities for improvement might lie.

At the core of most enterprise claims adjudication platforms lies a sophisticated rules engine that evaluates each claim against thousands of coverage policies, prior authorization requirements, medical necessity criteria, and fraud detection algorithms. These rule engines represent decades of accumulated business logic, encoding everything from basic coverage determinations to complex value-based care contract calculations. The TriZetto QNXT platform, for example, can evaluate a single claim against over ten thousand different rules in less than two hundred milliseconds, a performance feat that requires careful architectural optimization and years of rule engine refinement.

The data architecture underlying these rules engines typically involves highly normalized relational database structures optimized for read performance rather than analytical querying. Claims data flows through multiple staging tables where it is validated, enriched, and transformed before reaching the core adjudication logic. This multi-stage processing approach allows for complex data validation and business rule application, but creates challenges for external systems that need real-time access to claims status or adjudication results.

Most platforms employ a messaging architecture for internal communication between system components, but these messaging systems are typically proprietary and not designed for external consumption. The FacetsCore platform, for instance, uses an internal messaging bus that can handle over one million messages per hour during peak processing periods, but this messaging system is not exposed through standardized APIs that external systems could easily consume. Instead, external integration typically requires custom middleware that translates between the internal messaging format and whatever protocol the external system expects.

The batch processing orientation of most claims adjudication platforms reflects their mainframe heritage and the reality that most claims processing has historically been performed in large overnight batch runs. While modern platforms have added real-time processing capabilities for functions like eligibility verification and prior authorization, the core adjudication logic still operates primarily in batch mode. This batch orientation creates challenges for use cases that require real-time interoperability, such as point-of-service claims adjudication or real-time benefit verification.

Database performance optimization in claims adjudication platforms often involves trade-offs that impact interoperability capabilities. Many platforms use specialized indexing strategies, materialized views, and denormalized summary tables to achieve the sub-second query response times required for high-volume claims processing. These optimizations can make it difficult to expose data through standardized query interfaces, as the underlying data structures may be too specialized or complex for external systems to navigate effectively.

The security architecture of claims adjudication platforms adds another layer of technical complexity that impacts interoperability. Most platforms implement multiple layers of security controls, including network-level access restrictions, application-level authentication and authorization, and data-level encryption and masking. While these security measures are essential for protecting sensitive health information and financial data, they can make it challenging to create the streamlined, standardized interfaces that would enable easy interoperability.

API development in the claims adjudication space has been hampered by the complexity of the underlying business logic and data models. Creating APIs that accurately represent the full functionality of a claims adjudication system requires exposing thousands of different business rules, data validation criteria, and processing options. The resulting API specifications tend to be extremely complex and difficult for external developers to implement correctly. Moreover, the high-performance requirements of claims processing mean that APIs must be designed to handle enormous call volumes without introducing unacceptable latency or system instability.

The challenge of maintaining data consistency across multiple interoperating systems presents another significant technical hurdle. Claims adjudication involves complex financial calculations and state management that must remain perfectly consistent across all system components. Introducing external systems into this ecosystem creates the possibility of data synchronization issues, race conditions, and consistency conflicts that could result in incorrect claim payments or financial discrepancies. The technical solutions for managing distributed transaction consistency at the scale required for claims processing are complex and not well-suited to the loose coupling typically associated with interoperable systems.

Platform vendors have experimented with various approaches to improving interoperability while maintaining system performance and reliability. Some have developed API layers that sit on top of their core processing engines, providing standardized interfaces for common functions like eligibility verification, claims status inquiry, and basic adjudication results. However, these APIs typically expose only a fraction of the full system functionality and often require extensive customization to meet the specific needs of different health plans or external systems.

The emergence of cloud-native claims processing platforms has introduced new architectural possibilities for interoperability, but also new challenges. While cloud platforms can more easily expose APIs and integrate with other cloud-based systems, they must still implement the same complex business logic and performance requirements as their on-premises predecessors. The result is often cloud platforms that are more interoperable in theory but still require significant customization and integration work to achieve meaningful connectivity with external systems.

Interoperability Challenges in Claims Processing

The barriers to achieving meaningful interoperability in claims adjudication extend far beyond mere technical incompatibility, encompassing a complex web of business, regulatory, and competitive factors that create powerful incentives for maintaining the status quo. Understanding these multi-dimensional challenges is essential for anyone seeking to navigate or disrupt this market.

The most fundamental challenge stems from the sheer diversity of business models and operational approaches across different types of health plans. A Medicare Advantage plan operates under fundamentally different regulatory requirements and business logic than a commercial employer-sponsored plan or a Medicaid managed care organization. These differences are not merely superficial variations in terminology or procedure codes, but represent entirely different approaches to benefits administration, provider network management, and financial risk management. Creating interoperability solutions that can accommodate this diversity without sacrificing the specialized functionality that each plan type requires represents a formidable technical and business challenge.

Data standardization presents another layer of complexity that extends well beyond the widely discussed challenges of clinical data interoperability. While clinical data standards like HL7 FHIR have gained significant traction in the provider space, claims adjudication involves dozens of different data elements that have no standardized representation across platforms. Consider something as basic as provider identification, which might be represented using National Provider Identifiers, internal plan-specific provider IDs, Tax Identification Numbers, or various combinations of these identifiers depending on the platform and use case. Creating mapping and translation services that can accurately reconcile these different identification schemes across multiple platforms and health plans requires extensive ongoing maintenance and validation.

The temporal aspects of claims data present unique interoperability challenges that are often underestimated by those approaching the problem from other healthcare domains. A single claim may undergo multiple adjudication cycles, appeals processes, and adjustment transactions over a period of months or even years. Each platform may represent this complex claim lifecycle differently, making it difficult to create synchronized views of claim status across multiple systems. Moreover, the financial implications of any inconsistency in claim status or payment amounts are immediate and significant, creating a low tolerance for the eventual consistency models that work well in other interoperability contexts.

Regulatory compliance requirements create additional barriers to interoperability that are both complex and constantly evolving. Health plans must comply with state insurance regulations, federal oversight requirements, and various industry standards, many of which specify particular approaches to data handling, audit trails, and system controls that may conflict with interoperability initiatives. The regulatory environment also varies significantly across different states and market segments, making it difficult to create standardized interoperability solutions that can be deployed broadly without extensive customization for local regulatory requirements.

The business incentives surrounding claims adjudication create perhaps the most significant barrier to interoperability. For health plans, claims processing represents a core competitive advantage and a closely guarded operational capability. The specific business rules, prior authorization criteria, and provider network management strategies implemented in their adjudication systems are often considered trade secrets that provide competitive differentiation in the market. Creating interoperability with external systems necessarily involves exposing some of this proprietary business logic, which many health plans view as commercially dangerous.

Platform vendors face their own set of conflicting incentives around interoperability. While there is clear market demand for more interoperable solutions, the complexity and customization required for most interoperability projects create lucrative consulting and professional services opportunities that might be reduced if true plug-and-play interoperability were achieved. Moreover, the high switching costs associated with claims adjudication platforms create powerful customer lock-in effects that vendors are reluctant to diminish through easier integration with competing systems.

The challenge of managing system performance while supporting interoperability creates another significant barrier. Claims adjudication platforms are optimized for high-volume, low-latency transaction processing, typically handling peak loads that exceed hundreds of thousands of claims per hour with response times measured in milliseconds. Adding interoperability layers, external API calls, or real-time synchronization requirements can introduce performance overhead that may be unacceptable for production workloads. The technical solutions for maintaining performance while supporting interoperability are complex and expensive, often requiring specialized infrastructure and significant ongoing operational overhead.

Security and privacy concerns add another dimension to the interoperability challenge. Claims data includes not only protected health information but also sensitive financial and commercial information that must be carefully controlled and audited. Creating interoperability solutions that maintain appropriate security controls while enabling meaningful data sharing requires sophisticated approaches to authentication, authorization, and data encryption that are both technically complex and operationally burdensome. The risk tolerance for security vulnerabilities in claims processing is extremely low, as any breach could result in significant financial losses and regulatory penalties.

Use Cases for Claims Adjudication Interoperability

Despite the formidable challenges, compelling use cases for claims adjudication interoperability continue to emerge, driven by evolving market dynamics, regulatory requirements, and technological capabilities. These use cases represent significant opportunities for entrepreneurs and investors willing to tackle the complex technical and business challenges involved in creating meaningful interoperability solutions.

The most immediately compelling use case involves multi-payer care management scenarios, particularly for patients with complex chronic conditions who receive care from multiple providers and may have coverage through multiple health plans. Consider a diabetes patient who has primary coverage through an employer-sponsored plan and secondary coverage through a spouse's plan, while also receiving some services through a direct-pay specialty provider network. Currently, coordinating benefits and managing prior authorizations across these multiple coverage sources requires extensive manual intervention, phone calls, and paper-based processes that create delays, administrative burden, and opportunities for errors.

An interoperable claims adjudication system could enable real-time coordination of benefits calculations, automated secondary payer billing, and coordinated prior authorization workflows that would dramatically improve both the patient experience and administrative efficiency. The technical requirements for such a system would include standardized APIs for eligibility verification, real-time adjudication results sharing, and coordinated prior authorization status updates across multiple platforms. While complex, the potential value creation from eliminating manual coordination of benefits processes could justify significant investment in interoperability infrastructure.

Value-based care contract management represents another high-value use case that is driving interest in claims adjudication interoperability. As health plans and provider organizations enter into increasingly sophisticated risk-sharing arrangements, they need the ability to track patient outcomes, utilization patterns, and cost trends across multiple care settings and payer relationships. Currently, these analyses require extensive data extraction, transformation, and reconciliation processes that are both time-consuming and error-prone.

Interoperable claims adjudication systems could enable real-time tracking of value-based care metrics, automated quality measure calculations, and dynamic risk adjustment processes that would make these contracts more feasible and effective. The technical architecture would need to support standardized reporting of quality metrics, utilization patterns, and financial outcomes across multiple platforms, while maintaining the data security and audit trails required for contract compliance and regulatory oversight.

Fraud detection and prevention represents a particularly compelling use case given the enormous financial stakes involved and the network effects that could be achieved through interoperability. Healthcare fraud schemes often span multiple payers and providers, making them difficult to detect when each health plan is analyzing claims data in isolation. An interoperable fraud detection system could enable real-time sharing of fraud indicators, suspicious provider patterns, and coordinated investigation workflows across multiple health plans and claims processing platforms.

The technical requirements for such a system would be substantial, requiring sophisticated privacy-preserving analytics capabilities, real-time scoring and alerting systems, and standardized protocols for sharing sensitive investigative information. However, the potential return on investment from reduced fraud losses could easily justify the development costs, particularly given that healthcare fraud is estimated to cost the industry over one hundred billion dollars annually.

Provider network management and credentialing represents another area where interoperability could create significant value. Currently, healthcare providers must complete separate credentialing processes, maintain separate provider profiles, and manage separate network participation agreements with each health plan they want to contract with. This fragmentation creates significant administrative burden for providers and makes it difficult for health plans to maintain accurate, up-to-date provider information.

An interoperable provider credentialing and network management system could enable standardized provider profiles, shared credentialing workflows, and real-time updates to provider information across multiple health plans and claims processing platforms. The technical architecture would need to support standardized provider data models, secure sharing of credentialing documents and background check results, and coordinated workflows for network participation decisions.

Real-time benefit verification and cost transparency represents a use case that has gained significant attention in recent years, driven by patient demand for upfront cost information and regulatory requirements for price transparency. Currently, providing accurate benefit and cost information at the point of service requires multiple system queries and manual calculations that are often incomplete or inaccurate.

Interoperable claims adjudication systems could enable real-time benefit verification that takes into account multiple coverage sources, accurate deductible and out-of-pocket calculations, and precise provider network status verification. The technical requirements would include high-performance APIs capable of handling point-of-service query volumes, standardized benefit calculation logic, and real-time synchronization of member eligibility and utilization information.

Alternative payment model administration represents an emerging use case that could drive significant demand for interoperability solutions. As the healthcare industry moves toward more sophisticated payment models, including episode-based payments, bundled payments, and capitation arrangements, health plans need the ability to track and manage payments across multiple providers, care episodes, and time periods.

An interoperable alternative payment model administration system could enable automated episode grouping, real-time budget tracking, and coordinated payment calculations across multiple providers and care settings. The technical architecture would need to support complex payment model logic, real-time utilization tracking, and standardized reporting capabilities that could work across different claims processing platforms and provider systems.

Population health management represents another high-value use case that is driving interest in claims adjudication interoperability. Health plans and provider organizations need the ability to analyze population health trends, identify high-risk patients, and coordinate care interventions across multiple care settings and payer relationships. Currently, these analyses are limited by the fragmentation of claims data across multiple systems and the lack of standardized approaches to data sharing and analysis.

Interoperable population health management systems could enable real-time identification of care gaps, automated outreach for preventive services, and coordinated care management across multiple providers and health plans. The technical requirements would include sophisticated analytics capabilities, standardized clinical data models, and privacy-preserving approaches to sharing sensitive health information across organizational boundaries.

Economic and Strategic Implications

The economic implications of achieving meaningful claims adjudication interoperability extend far beyond the immediate technical benefits, potentially reshaping competitive dynamics across the entire healthcare industry and creating new opportunities for value creation and capture. Understanding these broader economic effects is crucial for assessing the strategic importance of interoperability initiatives and the potential returns on investment in this space.

The direct cost savings from improved interoperability could be substantial, though precisely quantifying these benefits remains challenging due to the complexity of current manual processes and the lack of comprehensive data on administrative costs. Industry estimates suggest that administrative costs account for approximately thirty percent of total healthcare spending in the United States, with claims processing representing a significant portion of these costs. Even modest improvements in processing efficiency, error reduction, and manual intervention could generate billions of dollars in annual savings across the industry.

Consider the coordination of benefits process, which currently requires extensive manual intervention when patients have multiple coverage sources. Industry data suggests that coordination of benefits affects approximately fifteen percent of all healthcare claims, with each coordination event requiring an average of forty-five minutes of manual processing time across all stakeholders involved. Automating these processes through interoperable systems could eliminate millions of hours of manual work annually, generating direct cost savings that could justify significant investment in interoperability infrastructure.

The indirect economic benefits of interoperability may be even more significant than the direct cost savings. Improved data sharing and coordination could enable more sophisticated risk management, better fraud detection, and more effective population health management programs that generate value through improved health outcomes rather than just administrative efficiency. These indirect benefits are harder to quantify but could represent multiples of the direct cost savings in terms of overall economic value creation.

The strategic implications for health plans are particularly complex, as interoperability could simultaneously create competitive advantages and reduce barriers to entry in ways that reshape the entire industry structure. Health plans that successfully implement interoperable systems could gain significant operational advantages through reduced administrative costs, improved member satisfaction, and better provider relationships. However, these same interoperability capabilities could make it easier for new entrants to compete effectively, potentially reducing the value of existing operational advantages and customer relationships.

The impact on platform vendors presents a similar double-edged dynamic. Vendors that successfully develop interoperable solutions could capture significant market share by offering capabilities that their competitors cannot match. However, true interoperability could also reduce customer lock-in effects and make it easier for health plans to switch between different platform vendors, potentially reducing the long-term value of customer relationships and the pricing power that comes from high switching costs.

The emergence of interoperability as a competitive factor could drive a wave of consolidation in both the health plan and platform vendor markets. Organizations that lack the resources to develop sophisticated interoperability capabilities may find themselves at a significant competitive disadvantage, creating acquisition opportunities for larger players with the technical and financial resources to invest in these capabilities. This consolidation dynamic could reshape the industry structure in ways that have broader implications for competition, innovation, and pricing.

The potential for new business models enabled by interoperability represents perhaps the most significant long-term economic implication. Interoperable claims adjudication systems could enable entirely new approaches to healthcare financing, including real-time payment models, dynamic pricing based on quality and outcomes, and sophisticated risk-sharing arrangements that are currently too complex to administer effectively. These new business models could create substantial value for patients, providers, and payers while also creating new opportunities for technology companies and other intermediaries.

Technical Solutions and Implementation Pathways

The path toward achieving meaningful claims adjudication interoperability requires sophisticated technical solutions that balance the competing demands of performance, security, flexibility, and maintainability. The most promising approaches combine proven integration patterns with emerging technologies in ways that can accommodate the unique requirements of claims processing while providing pathways for gradual migration from current systems.

API-first architecture represents the most fundamental technical pattern for enabling interoperability, but implementing this approach in claims adjudication requires careful consideration of performance, security, and complexity requirements that go well beyond typical web application APIs. Claims processing APIs must be designed to handle enormous call volumes with sub-second response times while maintaining perfect accuracy in financial calculations and comprehensive audit trails. The API specifications themselves must be complex enough to accurately represent the full range of claims processing functionality while remaining simple enough for external developers to implement correctly.

Modern API design patterns like GraphQL offer potential solutions to some of these challenges by enabling more flexible and efficient data queries that can reduce the number of API calls required for complex operations. However, the financial accuracy requirements of claims processing make it difficult to implement the eventual consistency models that typically underlie GraphQL architectures. The solution may involve hybrid approaches that use GraphQL for complex queries while maintaining traditional REST APIs for transactional operations that require immediate consistency.

Event-driven architecture patterns offer another promising approach to claims adjudication interoperability, particularly for use cases that require real-time coordination across multiple systems. By publishing standardized events for key claims processing milestones like adjudication completion, payment generation, and appeal initiation, different systems could maintain synchronized views of claim status without requiring direct API integration. The technical challenge lies in defining event schemas that are both comprehensive enough to support meaningful coordination and standardized enough to work across different platform architectures.

The implementation of event-driven patterns in claims processing must carefully address ordering, durability, and exactly-once delivery guarantees that are essential for financial transaction processing. Message queuing systems like Apache Kafka offer the performance and reliability characteristics required for claims processing volumes, but require sophisticated operational expertise and infrastructure investment that may be beyond the reach of smaller health plans or technology vendors.

Data transformation and mapping represent perhaps the most technically challenging aspect of claims adjudication interoperability. Each platform uses different data models, coding systems, and business rule representations that must be accurately translated when sharing information with external systems. The transformation logic required for this translation is often complex and business-specific, making it difficult to create generic solutions that work across different health plan configurations and use cases.

Machine learning approaches to data mapping and transformation offer potential solutions to some of these challenges by automatically learning transformation rules from examples rather than requiring manual specification of mapping logic. However, the accuracy requirements of claims processing make it difficult to rely on probabilistic transformation approaches that might be acceptable in other domains. The solution may involve hybrid approaches that use machine learning to suggest transformation rules that are then validated and refined by human experts.

Cloud-native architecture patterns offer significant advantages for interoperability by providing standardized infrastructure services, APIs, and integration capabilities that can reduce the complexity and cost of implementing interoperable systems. Container orchestration platforms like Kubernetes enable more flexible deployment and scaling models that can accommodate the variable workloads typical of claims processing while providing better isolation and resource management than traditional virtualization approaches.

However, migrating claims adjudication workloads to cloud platforms presents significant challenges around data sovereignty, regulatory compliance, and performance predictability that must be carefully addressed. Many health plans have invested heavily in on-premises infrastructure and operational processes that are not easily replicated in cloud environments. The solution may involve hybrid cloud approaches that maintain sensitive processing on-premises while leveraging cloud services for interoperability and integration functions.

Market Dynamics and Competitive Landscape

The competitive landscape surrounding claims adjudication interoperability is characterized by complex relationships between established platform vendors, emerging technology companies, health plans, and various intermediaries, each with different strategic objectives and competitive advantages. Understanding these market dynamics is essential for assessing investment opportunities and developing successful market entry strategies in this space.

The incumbent platform vendors occupy a unique position in the interoperability ecosystem, simultaneously representing the biggest obstacles to change and the most likely sources of comprehensive solutions. Companies like Cognizant with their TriZetto and QNXT platforms, and Change Healthcare with their extensive claims processing infrastructure, possess both the technical capabilities and customer relationships necessary to drive broad adoption of interoperability standards. However, their business models are built around proprietary systems and professional services engagements that might be disrupted by true plug-and-play interoperability.

The strategic responses of these incumbent vendors to the interoperability challenge have been varied and revealing. Some have invested heavily in developing API layers and cloud-native versions of their platforms that promise better integration capabilities, while maintaining the core business logic and customer lock-in effects that drive their profitability. Others have pursued acquisition strategies, buying smaller companies with specialized interoperability capabilities and integrating their technologies into broader platform offerings.

The emergence of specialized interoperability vendors represents another important dynamic in the competitive landscape. Companies like Redox, which focuses specifically on healthcare data integration, and Mulesoft, which provides general-purpose integration platforms adapted for healthcare use cases, offer alternatives to the comprehensive platform approach favored by traditional vendors. These companies compete primarily on ease of integration and speed of implementation, positioning themselves as solutions that can bridge the gap between existing systems without requiring wholesale platform replacement.

However, the specialized interoperability vendors face significant challenges in addressing the full complexity of claims adjudication workflows and business rules. Their solutions often work well for straightforward data sharing use cases but struggle with the sophisticated business logic and performance requirements that characterize enterprise claims processing. This limitation creates opportunities for hybrid approaches that combine specialized interoperability tools with traditional platform capabilities.

Health plans themselves represent another category of market participant with significant influence over the direction of interoperability initiatives. Large health plans with substantial technical resources and market power can drive adoption of specific standards or technologies through their vendor selection decisions and contract requirements. Some plans have invested in developing internal interoperability capabilities or have partnered with technology vendors to create custom solutions that meet their specific needs.

The role of regulatory agencies and industry organizations in shaping the competitive landscape cannot be understated. While there are currently no comprehensive regulatory mandates for claims adjudication interoperability similar to those that have driven Electronic Health Record adoption, various regulatory initiatives and industry standards efforts could significantly influence market dynamics. The Centers for Medicare and Medicaid Services has expressed interest in improving data sharing and coordination across the healthcare system, which could translate into specific requirements or incentives for interoperability in claims processing.

Future Outlook and Emerging Opportunities

The future of claims adjudication interoperability will be shaped by several converging trends that are creating both new opportunities and new challenges for market participants. Understanding these emerging dynamics is crucial for identifying the most promising areas for investment and innovation in this space.

The continued growth of value-based care models will create increasing pressure for more sophisticated data sharing and coordination capabilities across the healthcare ecosystem. As health plans and provider organizations enter into more complex risk-sharing arrangements, they will need interoperable systems that can track patient outcomes, utilization patterns, and financial performance across multiple care settings and payer relationships. This trend will drive demand for more comprehensive interoperability solutions that go beyond simple data sharing to include sophisticated analytics and reporting capabilities.

The advancement of artificial intelligence and machine learning technologies presents significant opportunities for improving both the technical feasibility and business value of claims adjudication interoperability. AI-powered systems could automate many of the complex data mapping and transformation tasks that currently require extensive manual effort, making it more cost-effective to implement interoperable solutions. Additionally, the ability to apply machine learning algorithms to combined datasets from multiple payers could unlock new insights for fraud detection, population health management, and clinical decision support.

The emergence of new payment models and healthcare delivery approaches, including direct primary care, telemedicine, and digital therapeutics, will create demand for more flexible and interoperable claims processing capabilities. These new models often involve payment structures and care delivery mechanisms that do not fit well within traditional claims processing frameworks, creating opportunities for innovative interoperability solutions that can bridge the gap between emerging healthcare models and existing financial infrastructure.

The increasing focus on patient experience and transparency will drive demand for real-time benefit verification, cost estimation, and claims status tracking capabilities that require sophisticated interoperability between claims processing systems and patient-facing applications. This trend will create opportunities for companies that can develop consumer-friendly interfaces that aggregate data from multiple payers and providers to provide comprehensive, real-time information about healthcare costs and coverage.

The potential for blockchain and distributed ledger technologies to address some of the trust and coordination challenges in claims adjudication interoperability continues to evolve, though practical implementations remain limited by performance and scalability constraints. As these technologies mature, they may offer solutions to some of the most difficult problems in multi-payer coordination and data sharing, particularly around audit trails, data integrity, and decentralized governance.

Conclusion

The challenge of claims adjudication interoperability represents one of the most significant untapped opportunities in healthcare technology, combining enormous market size with technical complexity and competitive dynamics that have preserved the status quo for decades. Unlike the well-explored territory of clinical data interoperability, the claims processing ecosystem remains largely fragmented and proprietary, creating both barriers to innovation and opportunities for those capable of navigating the complex technical, regulatory, and business challenges involved.

The analysis presented in this essay reveals that while technical solutions for claims adjudication interoperability are achievable, the greatest barriers are not technological but rather economic and competitive. The incumbent platform vendors, health plans, and other market participants have developed business models and operational processes that are optimized for the current fragmented environment, creating powerful incentives to maintain existing approaches even when more efficient alternatives are available.

However, the convergence of several market trends, including the growth of value-based care, increasing demand for price transparency, and the emergence of new healthcare delivery models, is creating pressure for change that may overcome these traditional barriers. The organizations that can successfully develop comprehensive interoperability solutions that address both the technical and business challenges will be well-positioned to capture significant value as the market evolves.

For health tech entrepreneurs and investors, the claims adjudication interoperability space represents both a significant challenge and an enormous opportunity. The most successful approaches will likely involve incremental solutions that address specific high-value use cases while building toward more comprehensive interoperability over time. Companies that can navigate the complex web of technical, regulatory, and competitive constraints while delivering immediate value to market participants will be best positioned to succeed in this evolving landscape.

The key to success in this market will be understanding that claims adjudication interoperability is not simply a technical problem to be solved, but rather a complex ecosystem challenge that requires sophisticated approaches to business model innovation, stakeholder alignment, and value creation. The organizations that can develop solutions that create value for all participants while addressing the legitimate concerns about competitive differentiation, data security, and operational risk will ultimately drive the transformation of this critical healthcare infrastructure.

The stakes of this transformation extend far beyond the immediate participants in claims processing. As healthcare continues to evolve toward more sophisticated payment models, greater price transparency, and improved care coordination, the ability to share and coordinate claims data effectively will become increasingly critical to the overall performance of the healthcare system. The entrepreneurs and investors who recognize this opportunity and develop the capabilities to address it will play a crucial role in shaping the future of healthcare finance and operations.

The window of opportunity for disrupting claims adjudication interoperability may be narrowing as incumbent players begin to recognize the strategic importance of this capability and invest in developing their own solutions. However, the complexity of the challenge and the diversity of stakeholder needs suggest that there will continue to be opportunities for innovative companies that can identify underserved market segments or develop novel approaches to addressing the fundamental barriers to interoperability.

Ultimately, the success of claims adjudication interoperability initiatives will depend not just on technical excellence, but on the ability to create sustainable business models that align the incentives of all stakeholders while delivering measurable value improvements. The companies that can achieve this alignment while navigating the complex regulatory and competitive landscape will be well-positioned to capture significant value as the healthcare industry continues its digital transformation journey.