The Invisible Hand: Holistic Medicine's Journey to Wall Street

They called him a quack.

Dr. Andrew Weil sat cross-legged on a meditation cushion in his Tucson home in 1983, breathing deeply as the Arizona sun cast long shadows across his already-iconic white beard. The Harvard-trained physician had just published another book advocating for the integration of mind-body medicine into conventional healthcare. The American Medical Association wasn't pleased.

"The orthodoxy has always feared what it cannot measure," Weil would later tell me, his eyes twinkling with the mischievous glint of someone who had been right all along. "But markets have a funny way of validating truth before institutions do."

The story of holistic medicine is, at its core, a story about money. Not in the way cynics might suggest—that it's all a clever scheme to separate the wellness-obsessed from their wallets—but in how financial forces ultimately legitimized practices that the scientific establishment had long dismissed. It's a tale of how a $94 billion industry emerged from the fringes to become a force that even the most buttoned-up healthcare executives now acknowledge.

But I'm getting ahead of myself.

To understand the journey of holistic medicine in America—from counterculture curiosity to corporate investment darling—we need to travel back much further than Dr. Weil's meditation cushion. We need to return to when these practices weren't "alternative" at all, but simply "medicine."

The Long Roots of Healing

Long before pharmaceutical companies were publicly traded and hospital networks had corner offices on Wall Street, medicine was holistic by necessity. The Hippocratic physicians of ancient Greece didn't separate the physical body from the mind or spirit. Traditional Chinese Medicine, with its 2,500-year history, viewed humans as microcosms of the natural world. Ayurveda in India developed elaborate systems for maintaining balance among bodily energies.

These weren't quaint belief systems; they were sophisticated frameworks for understanding health that dominated human healing for millennia.

"The first casualty of industrialization wasn't just traditional economies," Dr. Rachel Abrams, an integrative medicine physician in Santa Cruz, told me. "It was traditional ways of knowing."

The mechanistic worldview that powered the Industrial Revolution transformed medicine as it did everything else. The body became a machine with parts to be fixed rather than a complex system to be balanced. Disease became an invader to vanquish rather than a signal of disharmony.

This paradigm shift produced miracles—antibiotics, anesthesia, advanced surgical techniques—but left something vital behind. By the mid-20th century, as physician visits grew shorter and more impersonal, patients began voting with their feet.

And their wallets.

The Counterculture's Clinic

By the late 1960s, holistic approaches found fertile ground in American counterculture. Acupuncture, herbal medicine, meditation, and yoga spread through communities disillusioned with establishment medicine's reductionist approach.

"The patients who showed up at my first clinic in Berkeley weren't rejecting science," Dr. Elson Haas, founder of the Preventive Medical Center of Marin, explained. "They were rejecting being treated like body parts instead of whole people."

What began in hippie enclaves soon spread to the suburbs. By 1990, Americans were making more visits to providers of "unconventional therapy" than to primary care physicians, according to a landmark study in the New England Journal of Medicine. More shocking to the medical establishment: patients were paying an estimated $13.7 billion annually out of pocket for these services.

Wall Street took notice.

Following the Money

The first wave of corporate interest in holistic medicine came through the vitamin and supplement industry. When Congress passed the Dietary Supplement Health and Education Act in 1994, it created a regulatory framework that allowed the supplement market to explode. By 2000, it had grown to a $17 billion industry.

"I remember when GNC was just a small chain," said Tom Newmark, former CEO of New Chapter supplements. "Then suddenly we were being courted by multinational pharmaceutical companies looking to acquire us. The margins were just too attractive to ignore."

The supplement industry was just the beginning. Hospitals started opening integrative medicine centers. Insurance companies began covering acupuncture and chiropractic care. Meditation apps achieved unicorn valuations.

By 2023, the global complementary and alternative medicine market had reached $94.3 billion, with projections to hit $118.9 billion by 2026, growing at a CAGR of 8.1%.

But the most interesting development came from where you'd least expect it: private equity.

The Unlikely Marriage

In a glass-walled conference room in Manhattan in 2019, I watched as investment bankers in bespoke suits nodded along attentively while a naturopathic doctor explained the business model of her cash-pay clinic network.

"We're seeing 40% margins and 32% year-over-year growth," she said, clicking to the next slide. "Our patient retention rate is 88%, with an average annual spend of $3,200 per patient."

The bankers weren't there for a wellness consultation. They were considering a $50 million investment.

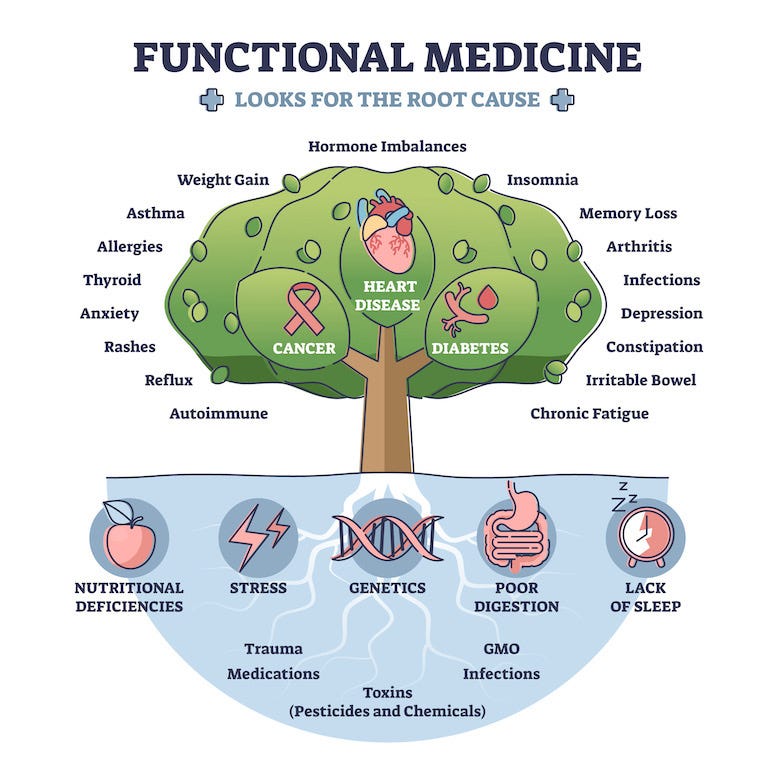

Today, cash-pay holistic medicine represents one of healthcare's fastest-growing segments. The U.S. market alone accounts for approximately $21.4 billion annually, with functional medicine clinics seeing the most explosive growth at 28% year-over-year since 2020.

Consider these numbers:

Direct primary care and concierge medicine, which often incorporate holistic approaches: $5.8 billion

Cash-pay integrative medical clinics: $4.7 billion

Functional medicine practices: $3.9 billion

Naturopathic physician services: $2.3 billion

Acupuncture clinics: $1.8 billion

Holistic mental health services: $1.5 billion

Holistic nutrition counseling: $1.4 billion

The remainder is distributed across various niche specialties—from energy medicine to hyperbaric oxygen therapy centers—that collectively account for billions more.

"What makes this market particularly attractive is the patient profile," explained Jonathan Carr, managing director at a healthcare-focused private equity firm. "These are high-income, highly educated consumers who prioritize their health and are willing to pay premium prices outside the insurance model."

The average patient utilizing cash-pay holistic services has a household income exceeding $120,000 and spends between $2,000 and $5,000 annually on these services—numbers that make investors salivate in an era of shrinking insurance reimbursements.

The New Integration

The irony isn't lost on the pioneers of the holistic health movement. What began as a rebellion against the commercialization of medicine has itself become big business.

"I have mixed feelings," Dr. Weil admitted when I visited him at his Arizona center in 2024. His integrative medicine fellowship has now trained over 2,000 conventional physicians in holistic approaches. "On one hand, the validation is gratifying. On the other, I worry about the soul of the movement as venture capital flows in."

This tension—between healing as a calling and healing as a business—defines holistic medicine's place in healthcare today. The most successful practitioners have found a middle path, leveraging business acumen to expand their impact while staying true to holistic principles.

Cleveland Clinic's Center for Functional Medicine, launched in collaboration with Dr. Mark Hyman, demonstrates this balance. The center operates both insurance-based and membership models, has a months-long waiting list, and has published research showing significant cost savings and improved outcomes for chronic disease patients.

"The data is becoming undeniable," Dr. Hyman told me. "Treating the whole person isn't just good medicine—it's good business."

The Future Market

As we look toward 2030, several trends are reshaping the holistic medicine marketplace:

Corporate Wellness Integration: Major employers now contract directly with holistic providers, creating a B2B channel expected to reach $12.7 billion by 2027.

Technology Platforms: Telehealth companies specializing in functional medicine grew 157% during the pandemic and are projected to capture $7.3 billion in annual revenue by 2026.

Hospital System Partnerships: Health systems are acquiring successful holistic practices, with transaction values increasing 43% annually since 2021.

Retail Healthcare Convergence: Pharmacy chains and big-box retailers are piloting holistic health services, potentially mainstream-izing access to what was once boutique care.

Insurance Disruption: Several insurers are launching pilot programs covering comprehensive holistic care, with early data suggesting 22% reductions in overall healthcare costs for participating patients.

The financial attraction is clear. While traditional fee-for-service medicine operates on razor-thin margins, cash-pay holistic clinics average 30-45% profit margins. More importantly, they're achieving something conventional medicine has struggled with: patient loyalty.

"Our net promoter scores are in the 80s," said Dr. Robin Berzin, founder of Parsley Health, a functional medicine provider that secured $26 million in Series B funding. "Patients don't just comply with treatment—they become advocates."

The New Mainstream

On a Tuesday morning in suburban New Jersey, I watched as patients filed into what looked like a hybrid between an Apple Store and a spa. This was the newest location of a rapidly expanding functional medicine chain backed by $150 million in private equity funding.

In the waiting area, a 64-year-old retired pharmaceutical executive chatted with a 32-year-old tech entrepreneur. Neither had serious illness; both were seeking optimization. Both were paying thousands annually out-of-pocket despite having premium insurance.

"My regular doctor has seven minutes to see me," the older man explained. "Here, I get an hour. I spent my career developing drugs for symptoms. Now I want someone looking at causes."

This scene is repeating across America. What was once the domain of the coastal elite has penetrated the heartland. Cash-pay holistic clinics are growing faster in Oklahoma and Ohio than in California.

By 2025, analysts project that 38% of Americans will use some form of holistic healthcare, with 14% utilizing primarily cash-pay holistic providers as their main source of care.

The industry that began as a rejection of the system has, in its own way, become the system—or at least an increasingly legitimate parallel to it. What hospitals did for acute care in the 20th century, holistic clinics may do for chronic care in the 21st.

Dr. Weil, now in his eighties, still begins each day with meditation. When I asked what surprised him most about holistic medicine's journey, he laughed.

"That the bankers got there before the doctors," he said. "But maybe that's how change always happens. First they ignore you, then they laugh at you, then they fight you. Then they invest in you."

The invisible hand of the market, it seems, has its own healing wisdom.