The Reverse-Acquihire Revolution: How Zuckerberg's AI Talent Strategy Could Transform Healthcare M&A

A narrative essay examining the implications of Meta's unprecedented talent acquisition strategy for healthcare industry consolidation

Disclaimer: The thoughts and opinions expressed in this essay are my own and do not reflect those of my employer.

Table of Contents

Abstract

Introduction: Decoding the LinkedIn Intelligence

The Scale AI Gambit: Rewriting the Rules of Talent Acquisition

The Reverse-Acquihire Revolution: A New Corporate Finance Paradigm

Legal Engineering: License vs Acquire as Regulatory Arbitrage

Winners and Losers in the New Deal Structure

Healthcare's Regulatory Maze: The Perfect Testing Ground

UnitedHealth and the Art of Creative Consolidation

Implementation Scenarios: How Healthcare Could Adapt

The Employee Experience: What Happens to the Rank and File

Conclusion: The Future of Strategic Talent Consolidation

Abstract

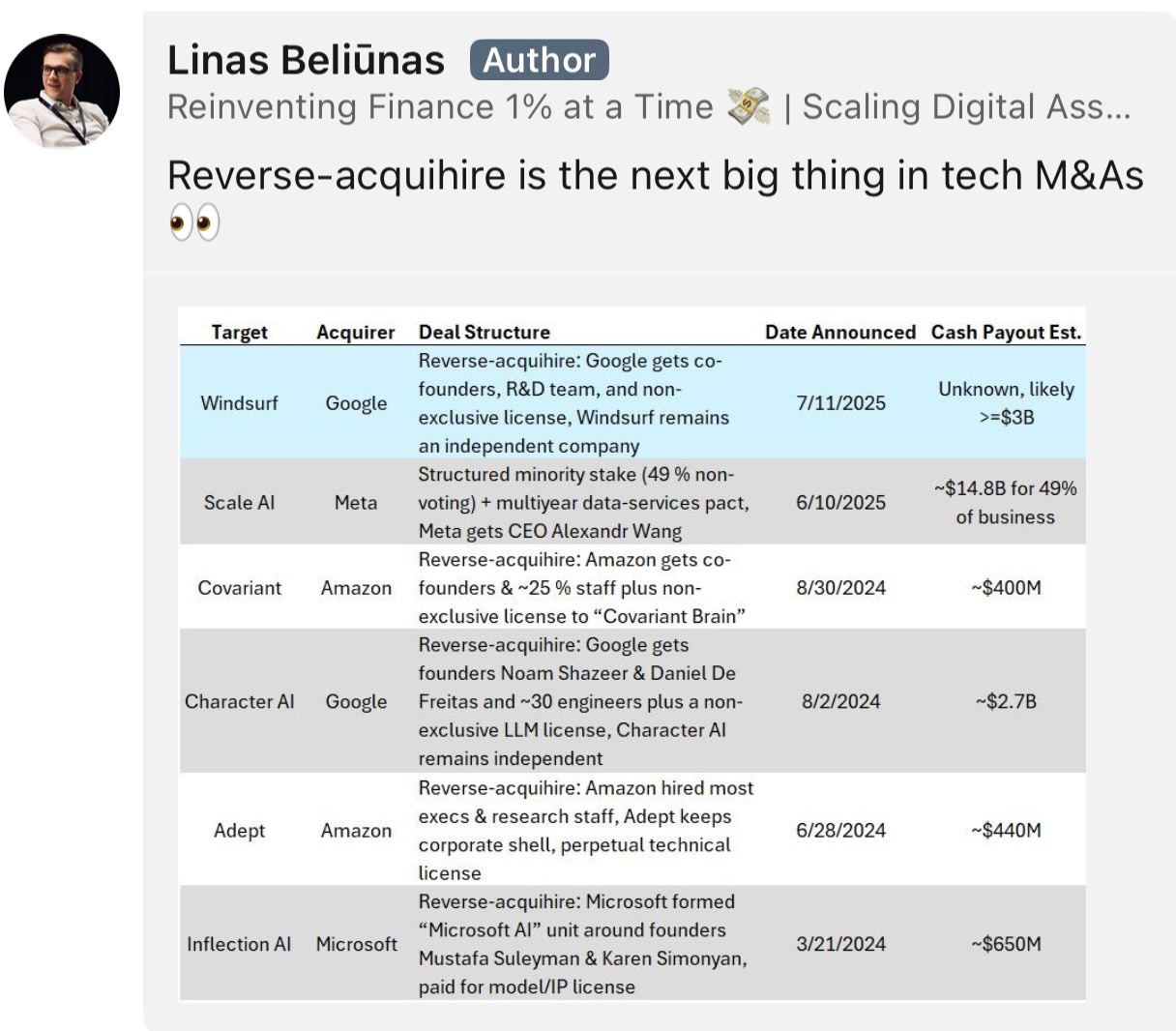

Analysis Source: LinkedIn posts by Linas Beliūnas and Peter Walker documenting Meta's unprecedented AI talent acquisition strategy and Google's reverse-acquihire of Windsurf

Scale: Meta offering $200 million to poach Apple's AI chief—3x more than Apple CEO Tim Cook's annual compensation—as part of a broader $14.3 billion talent consolidation strategy

Innovation: Reverse-acquihire model using licensing structures to avoid traditional M&A regulatory scrutiny while achieving talent acquisition objectives

Healthcare Implications: Strategy could revolutionize healthcare consolidation by enabling companies like UnitedHealth to circumvent DOJ antitrust blocking through creative deal structures

Key Insight: The licensing-versus-acquisition model represents regulatory arbitrage that could fundamentally reshape how talent moves in heavily regulated industries

---

Introduction: Decoding the LinkedIn Intelligence

The cascade of LinkedIn posts from Linas Beliūnas and Peter Walker that emerged in July 2025 captured something unprecedented unfolding in Silicon Valley's approach to talent acquisition. Beliūnas, who describes himself as "Reinventing Finance 1% at a Time" and focuses on scaling digital assets, documented what he called "absolutely insane" behavior from Mark Zuckerberg in pursuing AI talent. His posts reveal Meta CEO offering two hundred million dollars to poach Apple's AI Chief Ruoming Pang, representing three times more than Apple CEO Tim Cook made in total compensation the previous year. The sheer audacity of this number demands examination not merely as Silicon Valley excess, but as a fundamental shift in how technology companies approach existential competition.

Peter Walker, Head of Insights at Carta and a respected data storyteller in the venture capital ecosystem, provided crucial context about the mechanics of what he terms "reverse-acquihires." His analysis of Google's $2.4 billion licensing deal for Windsurf reveals a sophisticated legal structure designed to acquire talent and intellectual property while avoiding the regulatory scrutiny that comes with traditional mergers and acquisitions. Walker's question about whether rank-and-file employees get compensated in these licensing dividends highlights the human cost of these new deal structures.

The documentation from both sources reveals something that extends far beyond typical technology sector competition. Beliūnas notes that Meta's superintelligence unit is "literally writing checks bigger than Wall Street CEO jobs" and characterizes Zuckerberg's recruiting spree as "unprecedented and has never been seen in the history of tech and business." The specificity of his breakdown shows $100 million in signing bonuses, $100 million in base salary, plus massive Meta stock grants tied to loyalty and performance, representing a compensation structure that fundamentally breaks traditional technology industry frameworks.

What emerges from this LinkedIn intelligence is not merely documentation of aggressive recruiting, but evidence of a new corporate finance paradigm that could reshape how talent moves across industries. The reverse-acquihire model that Walker identifies represents a form of regulatory arbitrage that maintains the appearance of partnership while achieving the substance of acquisition. For healthcare entrepreneurs operating within an industry that faces even more stringent regulatory oversight than technology, understanding these mechanisms becomes critical for anticipating how consolidation strategies might evolve.

The Scale AI Gambit: Rewriting the Rules of Talent Acquisition

The centerpiece of Zuckerberg's strategy involves the $14.3 billion investment to bring Scale AI's Alexandr Wang and his team into Meta's newly formed superintelligence division. This transaction represents something qualitatively different from traditional acquihires in both scale and structure. Where historical technology acquihires followed a formula of approximately one to two million dollars per top engineer vesting over four years, Meta's approach involves paying orders of magnitude more for individual executives while restructuring entire teams around them.

Wang's personal compensation package reportedly includes the $200 million poaching premium that Beliūnas documented, positioning him to lead Meta's response to competitive threats from OpenAI, Google DeepMind, and Anthropic. The strategic logic reflects Zuckerberg's assessment that artificial general intelligence represents an existential competitive dynamic where traditional hiring and organic development cannot match the pace of external innovation. Rather than competing for individual engineers in a constrained talent market, Meta chose to acquire entire capability sets through systematic talent consolidation.

The broader team assembly that Beliūnas documents reveals the systematic nature of this approach. Meta's superintelligence group now includes former Apple, OpenAI, Google, and Anthropic talent, including Nat Friedman, Daniel Gross, and over ten OpenAI researchers including those who built Colossus. This represents not just individual recruitment but the reconstruction of competing research teams within Meta's organizational structure. The compensation premiums required to achieve this level of talent mobility suggest that traditional employment contracts and retention mechanisms proved insufficient to maintain talent stability across the AI ecosystem.

The timing of this strategy coincides with what Zuckerberg reportedly characterized as frustration with Meta's ability to keep pace with rival AI laboratories. Despite success in creating the open-source Llama model family, Meta struggled to maintain leadership positions as innovations emerged from competitors. The superintelligence lab represents an attempt to internalize the entire innovation cycle rather than competing for outputs in the broader ecosystem. This strategic shift from external competition to internal consolidation reflects a fundamental change in how technology companies approach research and development in rapidly evolving fields.

The financial scale involved deserves particular attention from healthcare entrepreneurs. At $200 million for a single executive and $14.3 billion for comprehensive team acquisition, Meta's investment represents approximately one-third of the entire digital health investment volume for the decade spanning 2014-2024. The willingness to deploy this level of capital for talent acquisition alone suggests that technology companies have concluded that human capital represents the primary constraint on competitive advantage in artificial intelligence applications.

The Reverse-Acquihire Revolution: A New Corporate Finance Paradigm

Peter Walker's analysis introduces the concept of "reverse-acquihire" as a distinct transaction structure that achieves talent acquisition objectives while avoiding traditional merger and acquisition regulatory frameworks. The Google-Windsurf transaction that Walker documents provides the clearest example of how this mechanism operates in practice. Rather than acquiring Windsurf as a corporate entity, Google paid $2.4 billion to license the company's technology while hiring the founders and key technical staff directly.

The structure that Walker outlines involves three distinct components that work in concert to achieve acquisition-like outcomes. First, Google pays Windsurf a substantial licensing fee that gets distributed to shareholders as a dividend. Second, the company hires Windsurf's CEO, co-founder, and top AI researchers to work directly for Google DeepMind. Third, Windsurf remains an independent company maintaining its corporate structure while losing its core talent and intellectual property to the licensing arrangement.

Walker's insight about regulatory avoidance proves particularly astute when examined against the backdrop of traditional technology mergers. The licensing structure allows Google to achieve the practical benefits of acquiring Windsurf's capabilities without triggering the Hart-Scott-Rodino Antitrust Improvements Act requirements that govern merger review. By maintaining Windsurf's independent corporate existence while effectively hollowing out its operational capabilities, Google circumvents the regulatory scrutiny that might have blocked a direct acquisition.

The mechanics that Walker describes reveal sophisticated legal engineering designed to optimize for talent acquisition while minimizing regulatory friction. The licensing payment provides immediate liquidity to Windsurf shareholders, potentially including early employees with equity stakes, while the talent migration ensures that Google captures the human capital that created the underlying intellectual property. This dual-track approach allows both companies to claim that no traditional acquisition occurred while achieving substantially similar economic outcomes.

The precedent that this structure establishes extends far beyond the immediate Google-Windsurf transaction. Walker notes that OpenAI's original $3 billion deal with Microsoft fell through specifically because Microsoft's ownership of OpenAI intellectual property created insurmountable conflicts. The reverse-acquihire model provides a mechanism for resolving such conflicts by separating intellectual property licensing from talent acquisition, allowing both to proceed independently while achieving coordinated strategic objectives.

Legal Engineering: License vs Acquire as Regulatory Arbitrage

The distinction between licensing intellectual property and acquiring corporate entities represents more than semantic precision in the regulatory environment that governs major technology transactions. The legal framework that has evolved around merger and acquisition activity creates specific triggers for government review based on transaction size, market concentration, and competitive impact. The reverse-acquihire model that Walker identifies exploits gaps in this framework by structuring talent and intellectual property transfers in ways that avoid traditional acquisition classifications.

The Hart-Scott-Rodino Act requires premerger notification to federal antitrust agencies for transactions exceeding specific dollar thresholds, currently $111.4 million for most transactions. However, these requirements apply specifically to acquisitions of voting securities or assets that confer control over business operations. Licensing arrangements, even those involving substantial payments, typically fall outside these notification requirements provided they maintain the licensor's independent corporate existence and operational control.

The Google-Windsurf structure that Walker analyzes exploits this regulatory gap by creating economic outcomes similar to acquisition while maintaining legal independence that avoids merger review. Google achieves access to Windsurf's intellectual property through licensing while separately hiring the talent responsible for creating and developing that property. The licensing payment provides financial compensation to Windsurf shareholders while the talent migration ensures that Google captures the human capital necessary to utilize and advance the licensed technology.

The sophistication of this approach suggests coordinated legal and strategic planning designed specifically to achieve regulatory arbitrage. Rather than attempting to structure a transaction that might survive antitrust review, the reverse-acquihire model avoids that review entirely by disaggregating traditional acquisition components into separate transactions that individually fall below regulatory thresholds or outside regulatory scope.

The precedent implications extend well beyond immediate technology sector applications. Industries that face more stringent regulatory oversight, particularly healthcare, financial services, and telecommunications, could potentially adapt similar structures to achieve consolidation objectives while avoiding the regulatory friction that has historically constrained merger activity. The key insight involves recognizing that regulatory frameworks designed around traditional corporate combinations may not adequately address more sophisticated approaches to talent and intellectual property consolidation.

However, the sustainability of this regulatory arbitrage depends on maintaining legal fiction that licensing arrangements represent genuine partnerships rather than disguised acquisitions. The departure of key talent immediately following licensing agreements could potentially trigger regulatory investigation if patterns suggest coordinated schemes to circumvent merger review requirements. The success of reverse-acquihire strategies may ultimately depend on their ability to maintain plausible independence while achieving practical consolidation.

Winners and Losers in the New Deal Structure

The reverse-acquihire model creates a complex landscape of winners and losers that differs significantly from traditional merger and acquisition outcomes. Understanding these distributional effects becomes crucial for healthcare entrepreneurs considering how similar strategies might apply within more regulated industry contexts.

The most obvious winners in the reverse-acquihire structure include the acquired talent, particularly senior executives and founders who receive substantial compensation premiums for joining the acquiring organization. Alexandr Wang's reported $200 million package and the broader compensation increases that Beliūnas documents represent unprecedented transfers of value to individual contributors. This level of individual compensation reflects the acquiring company's assessment that specific talent cannot be replicated through traditional hiring or organic development processes.

Shareholders of the target company also benefit substantially from the licensing dividend structure that Walker describes. The $2.4 billion licensing payment that Google made to Windsurf provided immediate liquidity to shareholders without requiring the extended timelines and regulatory uncertainty associated with traditional merger processes. This immediate liquidity proves particularly valuable for early investors and employees who might otherwise face years of illiquidity while merger processes unfold.

The acquiring companies achieve strategic objectives while avoiding regulatory friction that might delay or block traditional acquisitions. Google's ability to access Windsurf's capabilities without triggering antitrust review represents significant value creation relative to alternative approaches that might face regulatory challenge. Similarly, Meta's systematic talent consolidation allows the company to rebuild competitive capabilities without the integration challenges that typically accompany large-scale mergers.

However, the reverse-acquihire structure creates significant losers that Walker identifies in his analysis. Rank-and-file employees of target companies face particular challenges because they typically do not benefit from the licensing dividends that compensate shareholders, nor do they receive the premium compensation packages offered to senior talent. Walker's concern about whether "regular employees ALSO get paid out by the licensing dividend" highlights this distributional inequity.

The broader competitive landscape also faces potential disruption as reverse-acquihire strategies concentrate talent within large technology companies that can afford to pay substantial premiums for strategic capabilities. Smaller companies and startups may find it increasingly difficult to retain key talent when faced with compensation packages that exceed traditional venture capital resources. This dynamic could ultimately reduce innovation diversity by concentrating talent within a small number of well-capitalized technology giants.

Customers and partners of target companies represent another category of potential losers in reverse-acquihire transactions. Walker notes that "all of Windsurf's actual clients are probably looking for their next coding copilot as well" following the talent exodus to Google. The licensing structure may maintain the appearance of business continuity while undermining the operational capabilities that customers depend upon.

The regulatory system itself faces challenges from reverse-acquihire strategies that achieve practical consolidation while avoiding traditional merger review. If these structures become widespread, they could undermine the effectiveness of antitrust enforcement by allowing concentration to occur outside existing regulatory frameworks. This creates potential systemic risks if industry consolidation proceeds without appropriate oversight or competitive analysis.

Healthcare's Regulatory Maze: The Perfect Testing Ground

Healthcare represents perhaps the most promising sector for applying reverse-acquihire strategies because the industry faces regulatory constraints that make traditional merger and acquisition activity particularly challenging. The complex web of federal and state oversight, antitrust considerations, and stakeholder concerns that govern healthcare transactions creates exactly the type of friction that reverse-acquihire structures are designed to circumvent.

The regulatory environment in healthcare operates across multiple dimensions that create barriers to traditional consolidation. The Federal Trade Commission and Department of Justice review healthcare mergers under standard antitrust frameworks, but healthcare transactions also face scrutiny from state insurance commissioners, health departments, and specialized agencies like the Centers for Medicare and Medicaid Services. This multi-layered oversight creates extended timelines and substantial uncertainty for traditional merger processes.

Recent healthcare merger activity demonstrates the challenges that large organizations face when pursuing traditional acquisition strategies. The Department of Justice's decision to block UnitedHealth's $3.3 billion acquisition of Amedisys in 2024 illustrates how antitrust enforcement has become more aggressive in healthcare contexts. The DOJ cited concerns that eliminating competition would negatively impact patients, insurers, and healthcare workers, reflecting the broader stakeholder considerations that distinguish healthcare from other industries.

The complexity of healthcare delivery creates additional regulatory friction that reverse-acquihire strategies might help address. Healthcare organizations must maintain licenses, accreditations, and compliance with numerous federal and state requirements that can be disrupted by traditional merger processes. Provider networks, patient relationships, and clinical protocols represent assets that may be difficult to transfer through conventional acquisition structures but could potentially be accessed through licensing and talent migration approaches.

The talent concentration that characterizes healthcare markets makes the industry particularly suitable for reverse-acquihire applications. Key clinical specialties, administrative expertise, and technological capabilities are often concentrated within specific organizations or geographic regions. The ability to access these capabilities through talent acquisition rather than corporate merger could allow healthcare organizations to expand their footprint and capabilities without triggering the regulatory review that traditional expansion might require.

Digital health and health technology represent particularly promising applications for reverse-acquihire strategies because they often involve intellectual property and technical capabilities that can be cleanly separated from traditional healthcare delivery infrastructure. Software platforms, data analytics capabilities, and technological innovations can potentially be licensed while the talent responsible for their development migrates to acquiring organizations. This separation allows healthcare organizations to access technical capabilities while maintaining compliance with healthcare-specific regulatory requirements.

The financial dynamics of healthcare also create conditions favorable to reverse-acquihire applications. Healthcare organizations, particularly integrated systems like UnitedHealth, generate substantial cash flows that could support the licensing payments required for reverse-acquihire transactions. The ability to deploy this capital for strategic capability acquisition without triggering extended regulatory review could provide significant competitive advantages in rapidly evolving healthcare technology markets.

UnitedHealth and the Art of Creative Consolidation

UnitedHealth Group's historical approach to systematic expansion through acquisition provides the clearest healthcare parallel to Meta's aggressive talent consolidation strategy. However, the increasing regulatory resistance that UnitedHealth faces in traditional merger activity makes the company an ideal candidate for exploring reverse-acquihire alternatives that could achieve similar strategic objectives while avoiding regulatory friction.

UnitedHealth's transformation from traditional health insurer to vertically integrated healthcare conglomerate demonstrates both the potential and limitations of conventional acquisition strategies in healthcare. The company spent at least $33 billion on acquisitions during the 2010s, systematically building capabilities in provider networks, data analytics, pharmacy benefits, and care delivery. This expansion made UnitedHealth both the largest health insurer and the largest employer of doctors in the United States.

The $4.3 billion acquisition of DaVita Medical Group illustrates both UnitedHealth's strategic approach and the regulatory constraints that increasingly limit traditional expansion. The transaction required extensive Federal Trade Commission review, forced divestiture of Las Vegas operations to satisfy antitrust concerns, and took over a year to complete despite price reductions designed to expedite approval. The complexity and constraints of this process demonstrate why alternative approaches like reverse-acquihire might prove attractive.

The blocked Amedisys acquisition reveals how regulatory enforcement has evolved to constrain UnitedHealth's traditional expansion strategies. The Department of Justice's decision to challenge the $3.3 billion transaction reflects growing concern about UnitedHealth's market dominance and its impact on competition, patient access, and healthcare worker conditions. This regulatory stance suggests that future traditional acquisitions will face even greater scrutiny and potential blocking.

A reverse-acquihire approach could potentially allow UnitedHealth to access key capabilities from organizations like Amedisys without triggering the same regulatory response. Rather than acquiring Amedisys as a corporate entity, UnitedHealth could potentially license key intellectual property, care protocols, and operational capabilities while hiring senior management and clinical leadership. This approach might allow UnitedHealth to access Amedisys's home health and hospice expertise while maintaining the appearance of independent competition in relevant markets.

The specific capabilities that UnitedHealth typically seeks through acquisition align well with reverse-acquihire possibilities. Clinical expertise, care delivery protocols, provider relationships, and operational knowledge represent forms of intellectual property and human capital that can potentially be separated from corporate ownership structures. Technology platforms, data analytics capabilities, and care management systems could be licensed while the talent responsible for their development and implementation joins UnitedHealth's expanding workforce.

The financial scale required for reverse-acquihire strategies fits within UnitedHealth's resource capabilities. The company's annual revenue exceeding $350 billion provides the cash flow necessary to support substantial licensing payments while offering competitive compensation packages to attract key talent. The ability to deploy these resources for strategic capability acquisition without extended regulatory review could provide significant advantages over competitors constrained by traditional merger processes.

However, UnitedHealth's market dominance also creates risks for reverse-acquihire strategies if regulatory agencies conclude that such approaches represent disguised acquisitions designed to circumvent merger review. The company's visibility and market position make it likely that creative consolidation approaches would face scrutiny, particularly if patterns emerge suggesting systematic use of reverse-acquihire to achieve what traditional mergers could not accomplish.

The healthcare industry's interconnected relationships and regulatory oversight create additional complexity for reverse-acquihire applications. Provider networks, patient relationships, and clinical protocols may be more difficult to separate from corporate structures than the software and intellectual property that characterize technology sector applications. UnitedHealth would need to demonstrate that licensing arrangements represent genuine partnerships rather than disguised control relationships that effectively eliminate competition.

Implementation Scenarios: How Healthcare Could Adapt

The practical application of reverse-acquihire strategies in healthcare would likely evolve through several distinct scenarios that reflect the industry's diverse structure and regulatory constraints. Understanding these potential implementation paths provides insight into how creative consolidation might reshape healthcare competitive dynamics while avoiding traditional merger friction.

The most immediate applications would likely focus on health technology and digital health companies where intellectual property and technical capabilities can be cleanly separated from healthcare delivery infrastructure. Large healthcare systems could license software platforms, data analytics tools, and care management technologies while hiring the technical teams responsible for their development. This approach would allow rapid access to technological capabilities without the regulatory review required for acquiring healthcare technology companies that serve multiple competing systems.

A specific example might involve UnitedHealth licensing Epic's MyChart patient portal technology while hiring key Epic developers to enhance OptumCare's digital capabilities. Rather than attempting to acquire Epic, which would face insurmountable antitrust challenges, UnitedHealth could pay Epic substantial licensing fees for specific technology modules while separately hiring talent to implement and advance these capabilities within UnitedHealth's ecosystem. Epic would maintain its independent existence while UnitedHealth gained access to key digital health capabilities.

Clinical expertise and care delivery protocols represent another promising application area for healthcare reverse-acquihires. Academic medical centers, specialty practices, and clinical research organizations possess knowledge and capabilities that could be licensed while key clinical leaders migrate to larger healthcare systems. This approach could allow rapid expansion of specialized capabilities without the complex regulatory processes required for traditional academic affiliations or practice acquisitions.

Consider how UnitedHealth might access Mayo Clinic's expertise in personalized medicine and precision health through a reverse-acquihire structure. Rather than attempting a traditional affiliation that would require extensive regulatory review and stakeholder approval, UnitedHealth could license specific Mayo Clinic care protocols and diagnostic approaches while hiring key Mayo researchers and clinicians to implement these capabilities within OptumCare. Mayo Clinic would maintain its independent research and clinical mission while UnitedHealth gained access to world-class clinical expertise.

Pharmaceutical and biotechnology applications could involve licensing drug development platforms and research capabilities while acquiring the scientific talent responsible for their creation. Large pharmaceutical companies could access startup biotechnology innovations through licensing arrangements while hiring key researchers to continue development within larger organizational structures. This approach could accelerate drug development timelines while avoiding the regulatory complexity of traditional pharmaceutical mergers.

The nursing shortage and clinical workforce challenges that characterize healthcare create opportunities for reverse-acquihire approaches focused on workforce development and management. Healthcare systems could license workforce training programs and retention strategies from successful organizations while hiring key human resources and clinical leadership to implement these approaches across larger networks. This talent-focused consolidation could help address systemic workforce challenges while avoiding traditional merger constraints.

Regional healthcare consolidation represents perhaps the most complex application scenario because provider networks and patient relationships may be more difficult to separate from corporate structures. However, creative approaches might involve licensing care delivery protocols and operational systems while gradually migrating clinical and administrative leadership between organizations. This gradual talent consolidation could achieve practical integration while maintaining the appearance of independent competition that satisfies regulatory requirements.

International expansion provides another application scenario where reverse-acquihire strategies could help healthcare organizations access global markets without triggering domestic antitrust concerns. American healthcare systems could license care delivery approaches from international organizations while hiring key international leadership to implement these capabilities in U.S. markets. This approach could accelerate global expansion while avoiding the regulatory complexity of traditional international healthcare mergers.

The Employee Experience: What Happens to the Rank and File

Walker's pointed question about whether rank-and-file employees benefit from licensing dividends highlights one of the most significant equity concerns raised by reverse-acquihire strategies. The differential treatment of senior talent versus general employees creates potential for substantial distributional inequities that could reshape employment relationships across healthcare and technology sectors.

The compensation dynamics that emerge from reverse-acquihire structures fundamentally alter traditional employment value propositions. Senior executives and key technical talent receive unprecedented compensation packages that reflect their strategic importance to acquiring organizations, while general employees face uncertainty about their long-term prospects with organizations that have effectively lost their leadership and core capabilities. This creates a two-tier system where individual contribution value varies dramatically based on strategic importance to potential acquirers.

In healthcare contexts, these dynamics could prove particularly problematic because patient care depends on coordinated teams rather than individual star performers. Nursing staff, technicians, administrative personnel, and support workers represent essential components of care delivery that cannot easily be replaced or replicated. However, these employees typically lack the individual bargaining power to command premium compensation in reverse-acquihire scenarios, potentially creating retention challenges that could compromise care quality.

The Windsurf example that Walker analyzes illustrates these concerns in practice. While the CEO and key technical staff join Google with presumably enhanced compensation packages, the remaining Windsurf employees face working for what Walker characterizes as "mostly a shell of itself with the best talent plus management team gone." The licensing dividend may provide some compensation to employees with equity stakes, but those with only traditional employment relationships receive no additional benefit while facing substantially reduced organizational capabilities.

Healthcare organizations considering reverse-acquihire strategies would need to address these employee equity concerns both for ethical reasons and to maintain operational effectiveness. Patient care requires coordinated teams with deep institutional knowledge and established working relationships. The departure of senior leadership could undermine these capabilities even if licensing arrangements maintain access to protocols and systems. Creative approaches to employee retention and compensation would be necessary to maintain operational continuity during talent transitions.

One potential approach might involve extending licensing dividends to all employees based on tenure or contribution rather than limiting benefits to equity holders. This would help ensure that the financial benefits of reverse-acquihire transactions reach broader employee populations while maintaining incentives for organizational commitment during transition periods. However, such arrangements would add complexity and cost to transactions while potentially creating new regulatory considerations.

Professional licensing and credentialing requirements in healthcare create additional considerations for employee transitions in reverse-acquihire scenarios. Physicians, nurses, and other clinical professionals maintain individual licenses that cannot be transferred between organizations through corporate transactions. The ability of these professionals to continue practicing depends on maintaining appropriate organizational affiliations and meeting continuing education requirements that could be disrupted by major organizational changes.

The long-term career implications for employees in organizations subject to reverse-acquihire represent another significant concern. Professionals who remain with licensing organizations may find their career advancement limited by reduced organizational capabilities and resources. Those who do not receive offers to join acquiring organizations may face professional stagnation while the industry's most attractive opportunities concentrate within a smaller number of large organizations.

Union representation and collective bargaining agreements add further complexity to employee considerations in healthcare reverse-acquihire scenarios. Healthcare workers increasingly organize to address compensation and working condition concerns, and these collective agreements typically include protections against adverse changes in employment terms. Reverse-acquihire strategies would need to navigate these contractual obligations while achieving talent consolidation objectives.

Conclusion: The Future of Strategic Talent Consolidation

The reverse-acquihire revolution documented in the LinkedIn posts from Beliūnas and Walker represents more than tactical innovation in technology sector deal-making. The licensing-versus-acquisition model they describe constitutes a fundamental challenge to regulatory frameworks designed around traditional corporate combinations, with implications that extend far beyond Silicon Valley's competitive dynamics into the heavily regulated healthcare industry.

Zuckerberg's willingness to pay $200 million for individual executives and $14.3 billion for comprehensive talent consolidation demonstrates how artificial intelligence competition has created existential pressures that justify unprecedented resource deployment. The systematic nature of Meta's approach, acquiring talent from Apple, OpenAI, Google, and Anthropic to rebuild competitive capabilities, suggests that traditional hiring and organic development cannot match the pace of technological change in critical fields.

The legal sophistication of the reverse-acquihire model reveals how creative corporate finance can exploit regulatory gaps to achieve strategic objectives while avoiding traditional merger scrutiny. Google's $2.4 billion licensing payment to Windsurf while simultaneously hiring the company's key talent demonstrates that regulatory frameworks designed around corporate acquisitions may be inadequate for addressing more sophisticated approaches to capability consolidation.

For healthcare entrepreneurs and executives, these developments signal potential transformation in how consolidation might proceed despite increasing antitrust enforcement. UnitedHealth's challenges in pursuing traditional acquisitions like Amedisys suggest that alternative approaches may become necessary for strategic expansion. The reverse-acquihire model could provide mechanisms for accessing clinical expertise, care delivery capabilities, and technological innovations without triggering the regulatory friction that increasingly constrains traditional healthcare mergers.

However, the distributional inequities that Walker identifies in reverse-acquihire structures create significant risks for healthcare applications. The industry's dependence on coordinated care teams and the essential nature of healthcare services make employee retention and organizational continuity critical considerations that may not apply in technology contexts. Healthcare organizations would need to develop more equitable approaches to talent transition that recognize the broader workforce contributions necessary for effective care delivery.

The sustainability of reverse-acquihire strategies ultimately depends on their ability to maintain legal fiction that licensing arrangements represent genuine partnerships rather than disguised acquisitions. If patterns emerge suggesting systematic use of these structures to circumvent merger review, regulatory agencies may adapt their frameworks to address the underlying consolidation regardless of transaction structure. The healthcare industry's high visibility and public interest considerations make it particularly likely that creative consolidation approaches would face scrutiny if they appear to undermine competitive markets or patient access.

The future of strategic talent consolidation will likely involve continued innovation in transaction structures as organizations seek to achieve competitive objectives while navigating evolving regulatory constraints. Healthcare's complex regulatory environment and essential service mission create both opportunities and risks for applying reverse-acquihire approaches developed in technology contexts. The industry's ability to balance consolidation efficiencies with competitive markets and patient access will determine whether these innovative approaches ultimately serve broader public interests or simply enable creative circumvention of regulatory protections.

For health tech entrepreneurs, the message is clear: understanding these emerging transaction models becomes critical for strategic planning and competitive positioning. Whether as potential targets for reverse-acquihire or as organizations considering creative consolidation approaches, healthcare companies must prepare for a future where talent mobility and capability access may follow fundamentally different patterns than traditional merger and acquisition activity. The revolution in strategic talent consolidation has begun, and healthcare will inevitably be transformed by its implications.

Makes a lot of sense as a strategy once you realize its not just the regulatory burden. The integration cost, complications and politics scupper so many acquisitions from ever achieving full value.

Now, just waiting for the phone to ring with that 9 figure offer :-) (truth is 7 figure would probably do it!