The Trust Stack: Engineering Verifiable Healthcare Ledgers in the Post-Interoperability Era

Disclaimer: The views and opinions expressed in this essay are those of the author and do not necessarily reflect the official policy or position of my employer or any organization with which I am affiliated.

Abstract

Healthcare operates on a foundation of distributed trust across multiple parties who maintain separate ledgers yet must reconcile shared financial and clinical realities. This essay examines the technical architecture of trust across seven major healthcare ledger domains, analyzing where automation has succeeded, where manual reconciliation persists, and how distributed ledger technologies could reduce friction without compromising patient privacy. Through detailed examination of revenue cycle management, pharmacy operations, supply chain integrity, quality reporting, risk adjustment, value-based contracts, and patient financials, we map the current state of trust automation and propose concrete architectural patterns for hardening healthcare's financial and clinical ledgers. The analysis reveals that while healthcare has achieved high automation in deterministic matching scenarios, significant manual reconciliation burden remains in areas requiring clinical validation, multi-party settlement, and exception handling. Strategic deployment of distributed ledger technologies, focused on provenance rather than payload sharing, presents opportunities to reduce reconciliation friction while maintaining regulatory compliance and patient privacy protections.

Table of Contents

Introduction: The Healthcare Trust Problem

Mapping Trust Across Healthcare Ledgers

Revenue Cycle Management: Claims to Cash

Pharmacy and Controlled Substances: Perpetual Inventory

Supply Chain and Implants: Three-Way Matching

Clinical Quality Reporting: EHR Truth to Regulatory Acceptance

Risk Adjustment: Diagnosis Evidence to HCC Recognition

Value-Based Contracts: Multi-Party Settlement

Patient Financials: Estimates to True-Up

Architecture Patterns for Scalable Trust

The Distributed Ledger Opportunity

Implementation Playbooks

Conclusion: Building Healthcare's Trust Infrastructure

---

Healthcare's digital transformation has produced a paradox that few industries face at such scale. We have achieved remarkable automation in moving clinical and financial data between systems, yet the fundamental challenge of trust between parties has only intensified. Every day, hospitals process thousands of transactions across seven major ledger domains, each requiring different levels of trust verification and reconciliation. The complexity emerges not from any single relationship, but from the combinatorial explosion of trust requirements across multiple parties who must maintain separate ledgers while agreeing on shared realities.

Consider the seemingly simple act of a patient receiving care. This single episode generates trust relationships across at least seven different ledger systems: the provider's revenue cycle management system records charges and receivables, the pharmacy system tracks medication dispensing against perpetual inventory, the supply chain system reconciles implant usage to billing, the EHR captures quality metrics for regulatory reporting, the risk adjustment system validates diagnosis codes for capitation payments, any applicable value-based contracts require multi-party settlement calculations, and the patient financial system manages estimates versus actual costs. Each system maintains its own version of truth, yet they must ultimately reconcile to a consistent view of what happened, what was owed, and what was paid.

The healthcare industry has responded to this challenge with a combination of sophisticated automation for deterministic scenarios and expensive manual processes for everything else. Where data formats are standardized and business rules are clear, we have achieved impressive automation rates. Electronic data interchange processes millions of claims transactions daily with minimal human intervention. Pharmacy systems automatically post dispensing transactions to perpetual inventory ledgers. Supply chain systems perform three-way matching between purchase orders, receipts, and invoices within defined tolerance levels.

Yet beneath this veneer of automation lies a vast infrastructure of manual reconciliation work. Revenue cycle teams spend countless hours investigating underpayments and processing recoupments that span multiple claim periods. Pharmacy staff perform manual waste attestation and navigate complex 340B carve-in and carve-out scenarios. Supply chain managers reconcile vendor-managed consignment arrangements where standard three-way matching breaks down. Quality teams engage in chart abstraction to fill gaps in automated measure calculation. Risk adjustment specialists validate diagnosis specificity and clinical documentation. Value-based care analysts dispute member attribution methodologies and outlier exclusions. Patient financial counselors manage the gap between pre-service estimates and post-adjudication reality.

This manual work exists not because the industry lacks technological sophistication, but because these scenarios involve elements that resist pure automation: clinical judgment, policy interpretation, multi-party disputes, and exception handling. These are precisely the areas where distributed ledger technology could provide the most value, not by replacing human decision-making, but by creating verifiable audit trails that reduce the time and effort required to establish shared truth.

The opportunity lies in recognizing that most healthcare trust problems are not about sharing data, but about sharing evidence of data integrity. Providers and payers do not need to see each other's complete ledgers, but they do need confidence that their counterpart's calculations are based on the same source of truth and applied consistently. Suppliers and hospitals do not need complete visibility into each other's inventory systems, but they do need verifiable consumption events for consignment settlement. Quality reporting organizations do not need access to complete medical records, but they do need assurance that submitted measures are calculated against authentic clinical facts.

This distinction between sharing payloads and sharing proofs represents a fundamental shift in how we approach healthcare interoperability. Rather than continuing the decades-long effort to standardize data formats and force convergence on shared systems, we can create trust infrastructure that allows parties to maintain their existing systems while providing cryptographic evidence of their integrity.

The technical architecture required to support this vision builds on proven patterns from financial services and supply chain management, adapted for healthcare's unique regulatory and privacy requirements. Event-sourced ledgers provide immutable audit trails. Hash-based provenance tracking creates tamper-evident records without exposing sensitive data. Deterministic reconciliation jobs enforce invariant conditions that must always hold. Smart contracts automate settlement calculations while maintaining transparency about the rules being applied.

Perhaps most importantly, this approach recognizes that trust in healthcare is not binary but exists on a spectrum. Some transactions require real-time verification, while others can be settled periodically. Some relationships are adversarial enough to justify the overhead of consensus mechanisms, while others benefit more from simple append-only audit logs. The art lies in matching the trust mechanism to the specific requirements of each ledger domain and relationship type.

The seven major healthcare ledger domains each present distinct trust challenges and automation opportunities. Revenue cycle management has achieved high automation for standard claim processing but struggles with clinical validation disputes and complex recoupment scenarios. Pharmacy operations excel at transaction-level inventory tracking but require manual intervention for controlled substance attestation and regulatory compliance. Supply chain management automates standard procurement workflows but depends on human oversight for consignment arrangements and recall management. Quality reporting has standardized measure calculation but relies on manual chart abstraction for complex clinical scenarios. Risk adjustment has automated diagnosis mapping but requires human validation of clinical specificity. Value-based contracts provide deterministic settlement calculations but depend on manual resolution of attribution disputes. Patient financial management has automated eligibility verification but struggles with post-adjudication balance reconciliation.

In each domain, the pattern is consistent: automation succeeds where business rules are deterministic and data formats are standardized, but manual processes persist where clinical judgment, policy interpretation, or multi-party coordination is required. The opportunity for distributed ledger technology lies precisely in these manual areas, not by eliminating human decision-making, but by creating shared infrastructure for tracking decisions and their consequences.

The revenue cycle management domain illustrates both the potential and the limitations of current trust automation. Modern revenue cycle systems can process hundreds of thousands of claim transactions daily with minimal human intervention. Electronic data interchange standards provide reliable message formats for eligibility verification, prior authorization, claim submission, acknowledgment, status inquiry, and remittance advice. Automated posting rules can match remittance line items to specific claim charges with high accuracy. Double-entry accounting principles ensure that debits and credits balance across accounts receivable, cash, and contractual adjustment accounts.

Yet significant manual work remains in areas that require clinical validation or involve complex multi-period reconciliations. When a payer downgrades a diagnosis-related group assignment, revenue cycle staff must review clinical documentation to determine whether the change is appropriate or represents an underpayment that should be appealed. When recoupment notices arrive months or years after the original claim, analysts must trace complex webs of related transactions to determine the correct financial impact. When coordination of benefits scenarios involve multiple payers with different policy periods and benefit structures, manual investigation becomes necessary to establish the correct payment responsibility.

These scenarios resist pure automation not because the underlying business logic is unknowable, but because they require access to information that spans multiple systems and time periods, along with judgment calls about policy interpretation and clinical appropriateness. Distributed ledger technology could address these challenges by creating shared audit trails that track not just transactions, but the evidence and rules used to justify them.

Consider the underpayment detection scenario that consumes significant revenue cycle resources. Today, when a provider suspects that a payer has incorrectly applied contract terms or clinical policies, the dispute resolution process involves manual gathering of evidence from multiple systems: the original claim submission, the remittance advice, the applicable contract provisions, the clinical policies in effect at the time of service, and any relevant prior authorization decisions. This evidence gathering is time-consuming and error-prone, particularly when dealing with retroactive policy changes or complex modifier interactions.

A distributed ledger approach could transform this process by requiring both parties to commit cryptographic hashes of key evidence at the time of initial adjudication. The provider would hash the claim submission, clinical documentation, and applicable contract provisions. The payer would hash the adjudication decision, policy versions, and fee schedules used. These hashes would be stored on a shared ledger without exposing the underlying patient health information or proprietary contract details. When disputes arise, both parties could quickly verify that their calculations were based on the same source evidence, dramatically reducing the time required to identify the root cause of payment variances.

The pharmacy and controlled substances domain presents similar opportunities for trust automation, complicated by additional regulatory requirements around drug tracking and diversion prevention. Modern pharmacy systems excel at transaction-level inventory management, automatically updating perpetual inventory records as medications are dispensed from automated dispensing cabinets or central pharmacy locations. Cycle counting procedures and exception reporting can identify variances quickly and route them for investigation. Integration with electronic health records enables automatic posting of charges based on medication administration records.

However, significant manual processes remain around controlled substance attestation, waste documentation, compounding yield reconciliation, and regulatory compliance reporting. Federal regulations require witness signatures for controlled substance waste, creating bottlenecks in high-volume settings. Complex 340B drug pricing program requirements force manual tracking of eligible versus ineligible dispensing to ensure compliance with covered entity restrictions. Compounding operations require manual yield calculations and waste attestation that resist standardization due to the variability in formulations and preparation techniques.

Distributed ledger technology could address these challenges by creating tamper-evident attestation records that multiple parties can verify without requiring constant human oversight. Controlled substance waste events could be recorded with cryptographic timestamps and digital signatures that provide stronger evidence of compliance than paper-based log books. 340B accumulator systems could use shared ledgers to track eligible dispensing across multiple covered entity locations, reducing the manual effort required for quarterly true-up processes. Compounding yield calculations could be recorded with hash-based provenance tracking that links final product quantities to source ingredient lots and preparation protocols.

The supply chain and implant tracking domain faces unique challenges around consignment inventory management and recall response that highlight the limitations of traditional three-way matching approaches. Standard procurement processes work well for purchased inventory where ownership transfers at the point of delivery, enabling automated matching between purchase orders, receiving documents, and vendor invoices. However, an increasing percentage of high-value medical devices and implants are managed through consignment arrangements where ownership transfers only at the point of patient use.

These consignment scenarios require manual reconciliation between usage events captured in clinical systems and billing events recorded in revenue cycle systems. Vendors must track inventory placement across multiple hospital locations while maintaining ownership until consumption. Hospitals must ensure that charged items correspond to actual patient usage and that unused items are properly credited. When recalls occur, both parties must quickly identify affected lots and trace them to specific patients, a process that today requires manual correlation across multiple tracking systems.

Distributed ledger approaches could streamline these processes by creating shared consumption ledgers that automatically trigger settlement calculations when usage events are recorded. Hospital systems would hash usage events with case identifiers and device unique identifiers, while vendor systems would hash corresponding invoice line items. Smart contracts could automatically calculate monthly settlement amounts based on recorded consumption, reducing the manual effort required for consignment reconciliation. Recall scenarios could be addressed through shared lot tracking that enables rapid identification of affected devices without exposing proprietary inventory or patient information.

The clinical quality reporting domain represents perhaps the most complex trust challenge in healthcare, requiring reconciliation between clinical reality as captured in electronic health records and regulatory requirements as defined by quality measure specifications. Modern clinical quality measurement systems can automatically calculate hundreds of measures from structured data in electronic health records, providing real-time feedback to clinicians and administrators about performance against various quality benchmarks.

Yet significant gaps remain in areas that require clinical abstraction, cross-organizational data sharing, and resolution of measure specification ambiguities. Many quality measures cannot be calculated entirely from structured data, requiring manual chart review to identify relevant clinical facts. Multi-institutional quality initiatives require data sharing arrangements that are often limited by privacy concerns and technical interoperability challenges. Measure specification updates can create retroactive calculation changes that require expensive reprocessing of historical data.

Distributed ledger approaches could address these challenges by creating shared evidence ledgers that track quality-relevant facts without exposing complete medical records. Clinical systems could hash relevant data elements along with temporal and provenance metadata, enabling quality organizations to verify measure calculations without accessing underlying patient information. Multi-institutional initiatives could use federated calculation approaches where each organization calculates measures against local data and commits cryptographic proofs of their results to shared ledgers.

The risk adjustment domain faces similar challenges around clinical evidence validation and retroactive audit requirements. Health plans participating in Medicare Advantage and other capitated payment programs must submit encounter data that supports hierarchical condition category assignments used for payment calculations. The accuracy of these submissions is critical, as payment rates are adjusted based on the documented severity of enrolled member conditions.

Current risk adjustment processes involve significant manual work around diagnosis validation, clinical documentation improvement, and audit response. Clinical staff must review documentation to ensure that recorded diagnoses meet medical necessity criteria and include sufficient clinical detail to support payment claims. When retrospective audits occur, health plans must manually gather supporting documentation across multiple providers and time periods, a process that is both expensive and prone to error.

Distributed ledger approaches could streamline these processes by creating shared evidence repositories that track clinical documentation without exposing complete medical records. Provider systems could hash relevant clinical notes and diagnostic evidence along with cryptographic signatures from reviewing clinicians. Health plans could submit encounter data that references these evidence hashes, enabling auditors to verify that reported conditions are supported by authentic clinical documentation without requiring access to complete medical records.

The value-based contract domain presents the most complex multi-party trust challenges in healthcare, requiring settlement calculations that span multiple organizations and incorporate diverse data sources including claims, quality metrics, patient attribution, and risk adjustment factors. These contracts often involve shared savings arrangements where multiple parties must agree on complex calculations involving total cost of care, quality performance, and patient attribution methodologies.

Current value-based contract settlement processes are heavily manual, requiring extensive data exchange, calculation validation, and dispute resolution. Participating organizations must share claims data, member rosters, and quality results while protecting proprietary information and patient privacy. Settlement calculations must be performed using agreed-upon methodologies, but differences in data definitions, exclusion criteria, and calculation timing can lead to disputed results. When disputes occur, resolution requires manual investigation across multiple data sources and time periods.

Distributed ledger approaches could transform these processes by implementing contract-as-code methodologies where settlement calculations are performed using shared, deterministic algorithms operating on hash-verified input data. Each participating organization would commit cryptographic hashes of their input data including member rosters, claims extracts, and quality results. Settlement calculations would be performed using smart contracts that implement agreed-upon methodologies, producing identical results for all parties. Disputes would be limited to input data quality rather than calculation methodology, dramatically reducing the time and effort required for settlement reconciliation.

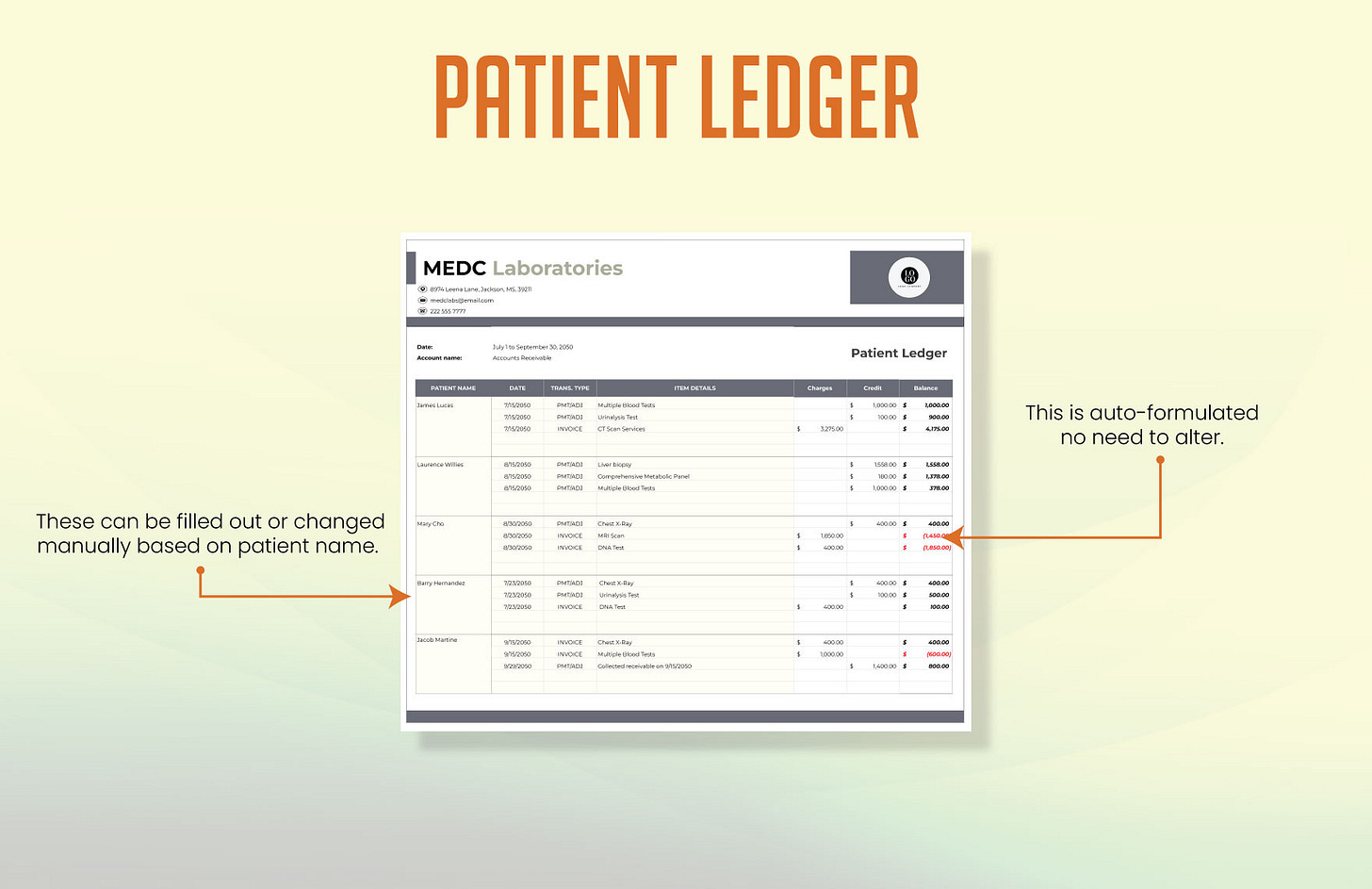

The patient financial management domain faces unique challenges around price transparency and post-adjudication balance reconciliation that reflect the complexity of healthcare payment systems. Patients increasingly demand accurate cost estimates before receiving care, but providing reliable estimates requires integration across multiple systems including eligibility verification, benefit determination, provider contracting, and prior authorization status. Even when accurate estimates are provided, post-adjudication reality often differs due to changes in patient benefits, coordination of benefits scenarios, or clinical modifications to originally planned services.

Current patient financial processes involve significant manual work around estimate refinement, balance explanation, and payment plan management. Financial counselors must manually research complex benefit structures and coordinate with multiple payers to provide accurate estimates. When post-service balances differ from estimates, staff must manually investigate the reasons and communicate explanations to patients. Payment plan arrangements require ongoing manual monitoring and adjustment based on changing patient circumstances.

Distributed ledger approaches could improve these processes by creating shared estimate repositories that track the evidence and assumptions used in cost projections. Provider systems could hash estimate calculations along with the benefit information, contract terms, and clinical assumptions used. Payer systems could commit to estimated adjudication parameters that would be used for settlement. When actual results differ from estimates, both parties could quickly identify whether variances are due to changed clinical circumstances, benefit updates, or calculation errors.

These domain-specific challenges highlight the need for architectural patterns that can scale trust across multiple types of relationships and transaction volumes. The most successful healthcare organizations have converged on several key design principles that provide a foundation for distributed ledger implementation.

Event-sourced double-entry accounting provides the foundation for trustworthy financial ledgers by ensuring that every transaction creates balanced entries across clearly defined accounts. Rather than updating account balances in place, all changes are recorded as immutable events that can be replayed to reconstruct current state. This approach provides natural audit trails and supports complex reconciliation scenarios where transactions must be traced across multiple time periods and account categories.

Provenance-first design ensures that every ledger entry carries sufficient metadata to support verification and audit requirements. Each entry includes not just transaction amounts and accounts, but also references to source artifacts, applicable business rules, responsible actors, and temporal context. This metadata is essential for dispute resolution and regulatory compliance, but it must be designed carefully to avoid exposing sensitive information in multi-party scenarios.

Deterministic reconciliation jobs enforce invariant conditions that must always hold across different ledger domains. These invariants provide early detection of data quality issues and prevent silent drift between related systems. For example, the sum of claim line payments, adjustments, and patient liability must always equal the sum of submitted charges for each line item. Inventory ledgers must always balance between receipts, dispensing, waste, and on-hand quantities. Value-based contract settlements must always allocate total savings or losses across participating parties without remainder.

Idempotence and exactly-once processing prevent duplicate transactions and ensure consistent results across system restarts and retry scenarios. Each transaction carries sufficient identifying information to enable deduplication across multiple processing attempts. This is particularly important in healthcare environments where network interruptions, system maintenance, and error recovery can result in repeated message transmission.

Tamper evidence provides assurance that ledger entries have not been modified after initial commitment. This can be achieved through various mechanisms ranging from simple append-only storage to sophisticated cryptographic hash chains. The appropriate level of tamper evidence depends on the specific trust requirements and threat models of each relationship and transaction type.

The distributed ledger opportunity in healthcare lies not in replacing existing systems, but in providing shared infrastructure for trust verification that complements current automation while addressing its limitations. Most healthcare trust problems stem not from inability to share data, but from difficulty in establishing confidence that shared calculations are based on consistent source evidence and applied using agreed-upon rules.

Distributed ledger technology can address these challenges through several key mechanisms. Hash-based provenance tracking creates tamper-evident records of source documents and business rules without exposing sensitive content. Smart contracts enable deterministic settlement calculations that all parties can verify independently. Consensus mechanisms provide shared agreement on transaction ordering and validation rules for scenarios where parties have adversarial incentives. Cryptographic proofs enable verification of calculations without exposing underlying data.

The key insight is that healthcare rarely requires full decentralization, but it desperately needs verifiable audit trails and deterministic dispute resolution. Most healthcare relationships involve known parties operating under established regulatory frameworks rather than anonymous participants in trustless environments. This enables hybrid approaches that combine the auditability benefits of distributed ledgers with the performance and privacy characteristics of traditional systems.

Practical implementation of these concepts requires careful attention to data minimization, regulatory compliance, and integration complexity. Patient health information must remain protected according to HIPAA requirements, which generally prohibit sharing identifiable information on shared ledgers. However, cryptographic hashes and zero-knowledge proofs can provide verification capabilities without exposing underlying data. Regulatory reporting requirements must be preserved, which often requires maintaining parallel traditional systems during transition periods. Integration complexity must be managed through phased implementations that demonstrate value before requiring significant changes to existing workflows.

The most promising near-term opportunities involve scenarios where manual reconciliation currently consumes significant resources and where relationships between parties are adversarial enough to justify additional infrastructure overhead. Revenue cycle underpayment disputes, pharmacy 340B compliance tracking, consignment inventory settlement, value-based contract reconciliation, and risk adjustment audit response all meet these criteria.

Implementation playbooks for these scenarios follow similar patterns: identify the source artifacts and business rules that drive current manual processes, design hash-based provenance tracking that preserves verification capabilities without exposing sensitive data, implement deterministic calculation engines that can operate on hash-verified inputs, and create shared audit trails that enable rapid dispute resolution.

Consider the specific example of payer-provider underpayment resolution, which currently consumes enormous resources across the healthcare industry. Today, when providers suspect that claims have been underpaid, they must manually gather evidence including original claim submissions, remittance advice details, applicable contract provisions, clinical policies in effect at the time of service, and any relevant prior authorization decisions. This evidence must then be compiled into dispute packages that are submitted to payers for manual review. The entire process often takes weeks or months and requires significant effort from both parties.

A distributed ledger implementation could streamline this process by requiring both parties to commit cryptographic evidence at the time of initial adjudication. When providers submit claims, they would also commit hashes of the clinical documentation, contract provisions, and prior authorization decisions that support their charges. When payers process claims, they would commit hashes of the adjudication rules, policy versions, and fee schedules used in their payment calculations. These hashes would be stored on a shared ledger without exposing underlying patient information or proprietary contract details.

When payment disputes arise, both parties could quickly verify whether their calculations were based on the same source evidence by comparing hash values stored on the shared ledger. If hash values match, the dispute involves rule interpretation rather than data consistency, enabling faster resolution through automated rule engines or expedited manual review. If hash values differ, the dispute involves data consistency issues that can be resolved through systematic comparison of the referenced source documents.

This approach transforms underpayment dispute resolution from a manual evidence-gathering exercise into a systematic verification process that can largely be automated. Providers can automatically flag payments where their expected calculations differ from actual payments by more than defined tolerance levels. Payers can automatically identify systematic issues with contract interpretation or policy application by analyzing patterns in dispute submissions. Both parties can focus their manual effort on genuine policy interpretation questions rather than data consistency verification.

Similar patterns apply across other healthcare ledger domains. Pharmacy 340B compliance tracking could use shared ledgers to record eligible dispensing events across multiple covered entity locations, enabling automated accumulator management and reducing manual effort required for quarterly true-up processes. Consignment inventory settlement could use shared consumption ledgers that automatically trigger settlement calculations when usage events are recorded by hospital systems and matched with vendor billing systems. Value-based contract reconciliation could use contract-as-code implementations that perform identical calculations for all parties based on hash-verified input data.

Risk adjustment audit response could use shared evidence repositories that enable rapid verification of clinical documentation without exposing complete medical records. Patient financial estimate reconciliation could use shared estimate repositories that track the assumptions and evidence used in pre-service cost projections, enabling rapid identification of variance causes when post-service balances differ from expectations.

The common thread across these implementations is the focus on provenance rather than payload sharing. Rather than attempting to create shared databases of healthcare information, these approaches create shared audit trails of information processing that enable verification without exposure. This distinction is critical for maintaining regulatory compliance while achieving the trust benefits of distributed ledger technology.

The technical infrastructure required to support these implementations builds on established patterns from other industries while addressing healthcare's unique requirements. Event-sourced architectures provide immutable audit trails that support complex reconciliation scenarios. Hash-based content addressing enables verification of document integrity without sharing document contents. Smart contract platforms provide deterministic calculation engines that all parties can verify independently. Cryptographic proof systems enable verification of complex calculations without exposing underlying data.

However, successful implementation requires careful attention to several healthcare-specific considerations. Patient privacy must be protected through appropriate data minimization and access controls. Regulatory reporting requirements must be preserved through parallel traditional systems during transition periods. Clinical workflow integration must be achieved without disrupting existing care processes. Performance requirements must be met for high-volume transaction processing scenarios.

Perhaps most importantly, implementation must be driven by clear value propositions that justify the additional complexity and infrastructure costs. Distributed ledger technology is not inherently valuable in healthcare, but becomes valuable when it enables automation of currently manual processes, reduces dispute resolution time and cost, or provides regulatory compliance benefits that justify the investment.

The future of healthcare trust infrastructure will likely involve hybrid approaches that combine distributed ledger capabilities with traditional systems optimized for specific use cases. High-volume, low-dispute transactions like standard claim processing will continue to benefit from centralized systems optimized for throughput and latency. High-stakes, high-dispute scenarios like value-based contract settlement will increasingly benefit from distributed ledger approaches that provide verifiable audit trails and deterministic dispute resolution.

The key to success will be matching trust mechanisms to specific relationship types and transaction characteristics. Not every healthcare transaction requires blockchain-level verification, but every healthcare relationship could benefit from better audit trails and more systematic dispute resolution processes. The organizations that master this matching process will gain significant competitive advantages through reduced operational costs, faster dispute resolution, and improved regulatory compliance.

The healthcare industry stands at an inflection point in its approach to trust and verification. The foundational investments in electronic health records, claims processing systems, and clinical data exchange have created a digital substrate capable of supporting more sophisticated trust mechanisms. The regulatory environment increasingly demands transparency and auditability that distributed ledger technologies are uniquely positioned to provide. The economic incentives around value-based care create natural demand for multi-party settlement mechanisms that traditional systems struggle to address.

The opportunity lies not in revolutionary replacement of existing systems, but in evolutionary enhancement of trust verification capabilities that address the most expensive and error-prone aspects of current manual processes. By focusing on provenance rather than payload sharing, healthcare organizations can achieve the audit trail and dispute resolution benefits of distributed ledger technology while maintaining the privacy protections and regulatory compliance requirements that define their operating environment.

The technical architecture described in this analysis provides a roadmap for organizations seeking to implement these capabilities in a systematic and value-driven manner. The domain-specific playbooks offer concrete starting points for addressing the highest-impact use cases in revenue cycle management, pharmacy operations, supply chain integrity, quality reporting, risk adjustment, value-based contracts, and patient financial management.

Success will require careful coordination between technical implementation teams, clinical workflow specialists, regulatory compliance experts, and business stakeholders who understand the economics of current manual processes. The organizations that achieve this coordination will create sustainable competitive advantages through reduced operational costs, improved regulatory compliance, and enhanced ability to participate in sophisticated value-based care arrangements that require high levels of trust and verification across multiple parties.

The healthcare industry's journey toward trustworthy, verifiable ledger infrastructure has already begun through the foundational investments in electronic systems and data standardization that enable today's automation. The next phase will extend this automation into the complex, multi-party scenarios that currently require expensive manual intervention. Distributed ledger technology provides the tools necessary for this extension, but realizing its benefits will require thoughtful application guided by deep understanding of healthcare's unique operational, regulatory, and economic requirements.

The trust stack that emerges from this evolution will provide the foundation for new forms of healthcare organization and payment that are simply not feasible with current manual reconciliation approaches. Value-based care arrangements involving dozens of providers and spanning multiple years of performance measurement will become operationally manageable through automated settlement mechanisms. Quality reporting initiatives involving hundreds of healthcare organizations will achieve new levels of accuracy and efficiency through shared evidence repositories. Pharmaceutical supply chains will achieve end-to-end traceability without compromising competitive information through privacy-preserving provenance tracking.

Most importantly, patients will benefit from healthcare systems that can focus more resources on care delivery and innovation rather than back-office reconciliation and dispute resolution. The manual effort currently consumed by trust verification across healthcare's ledger domains represents a significant opportunity cost in terms of clinical resources and innovation investment. Distributed ledger technology offers a path to reclaim these resources while improving the accuracy, transparency, and accountability of healthcare's financial and clinical systems.

The healthcare organizations that recognize and act on this opportunity will shape the industry's evolution toward more trustworthy, efficient, and patient-focused operations. The technical roadmap exists, the regulatory environment is supportive, and the economic incentives are aligned. The remaining challenge is execution guided by deep understanding of healthcare's operational realities and commitment to patient-centered outcomes.

In this context, the detailed technical analysis provided here serves not as a comprehensive solution, but as a framework for systematic evaluation and implementation of trust infrastructure improvements. Each healthcare organization will face unique combinations of ledger domains, relationship types, and regulatory requirements that will shape their optimal approach to distributed ledger implementation. The patterns and playbooks described provide starting points for this analysis, but successful implementation will require careful customization based on specific operational contexts and strategic objectives.

The future healthcare system will be characterized not by the absence of trust requirements, but by their systematic automation through verifiable infrastructure that enables new forms of organization and payment while maintaining the privacy and security protections that patients rightfully expect. Building this infrastructure represents both a significant technical challenge and an unprecedented opportunity to improve healthcare delivery through better alignment of incentives, reduced operational friction, and enhanced accountability across all participants in the healthcare ecosystem.